Unlocking PayPal’s Sending and Receiving Capabilities in Senegal

Let’s delve into the current state of PayPal in Senegal. If you’re considering using PayPal in Senegal, whether it’s for receiving payments from overseas employees, receiving payments from freelancing sites like upwork, TikTok cashouts in Senegal, Paypal integration on ecommerce , donations or any other purpose, this article aims to provide you with comprehensive insights into the world of PayPal in Senegal. Don’t forget to Subscribe on our Youtube Channel https://youtube.com/webvator

Learn how to set up your account in Senegal, receive payments, and efficiently withdraw funds to your bank account. Explore the step-by-step process and gain a clear understanding of navigating PayPal for your financial needs in Senegal.

Sending Money via PayPal in Senegal

Sending money through PayPal from Senegal to other countries where PayPal operates is indeed typically available. PayPal allows users to send money securely and conveniently to recipients with PayPal accounts in various countries around the world. This functionality enables individuals in Senegal to transfer funds internationally for various purposes, including personal payments, business transactions, and remittances.

Users in Senegal can initiate money transfers through PayPal by logging into their PayPal accounts, selecting the option to send money, entering the recipient’s email address associated with their PayPal account, specifying the amount to be sent, and completing the transaction. The recipient can then access the funds in their PayPal account and choose to withdraw them, make purchases online, or keep the balance for future use.

This feature facilitates international transactions and financial exchanges, enabling individuals in Senegal to conduct business, support family members abroad, or engage in online commerce with greater ease and convenience. However, it’s essential to be aware of any associated fees, currency conversion rates, and transaction limits that may apply when sending money through PayPal from Senegal to other countries.

Receiving and withdrawing Money via PayPal in Senegal

Receiving Money via PayPal in Senegal is possible but challenge is withdrawing it to a local bank in Senegal.

Banks are limited to only sending and Not receiving but the country Senegal is permitted to receive and send.

To withdraw from PayPal in Senegal to a local bank, many Senegalese PayPal users turn to alternative methods for accessing their funds. One popular solution involves utilizing third-party financial services such as Payoneer or online USA virtual banks. By linking their Senegal-based PayPal accounts with these external platforms, users gain the ability to withdraw funds from PayPal balances, effectively bridging the gap between digital and tangible assets.

The process typically involves setting up an account with the intermediary service, verifying identity and banking details, and linking the virtual account to the Senegal PayPal account. Once connected, users can initiate withdrawals from PayPal to the linked virtual bank or Payoneer account, facilitating the conversion of digital funds into usable currency.

As of now, Local banks in Senegal still have a problem withdrawing directly from PayPal, if anyone reading this has managed to withdraw to a local bank in Senegal, please leave us a comment below of the Senegal bank you used.

Bank in Senegal you can link to PayPal and withdraw money

You wondering Which banks in Senegal can you link to the PayPal account?

Do you want to know what banks in Senegal accept payments to debit cards via paypal?

In Senegal and many other countries, there’s a notable limitation when it comes to withdrawing funds directly from a local bank account linked to PayPal. However, an interesting workaround exists: while local bank accounts may not be supported for withdrawals, PayPal allows senegal users to add and withdraw funds to a US bank account, regardless of whether the PayPal account itself is US-based.

This unique feature stems from PayPal’s origins as a US-based company and its recognition of the needs of US expatriates and individuals with US-based financial ties. As such, individuals in Senegal and across Africa have leveraged this capability by adding US bank accounts to their PayPal profiles, enabling them to withdraw funds seamlessly.

This workaround offers a practical solution for those seeking to access their PayPal balances in regions where direct withdrawals to local banks are not feasible. By linking a US bank account to their PayPal accounts, users can effectively bridge the gap between their digital PayPal funds and tangible currency, facilitating smoother financial transactions and access to funds.

How To Create a PayPal Account in Senegal

Follow these steps:

1. Visit the Jordan Official PayPal Website:

Go to the official PayPal website by typing “https://www.paypal.com/sn/home” into your web browser.

2. Click on “Sign Up:

Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Choose Account Type:(Important)

PayPal typically offers options for personal and business accounts.

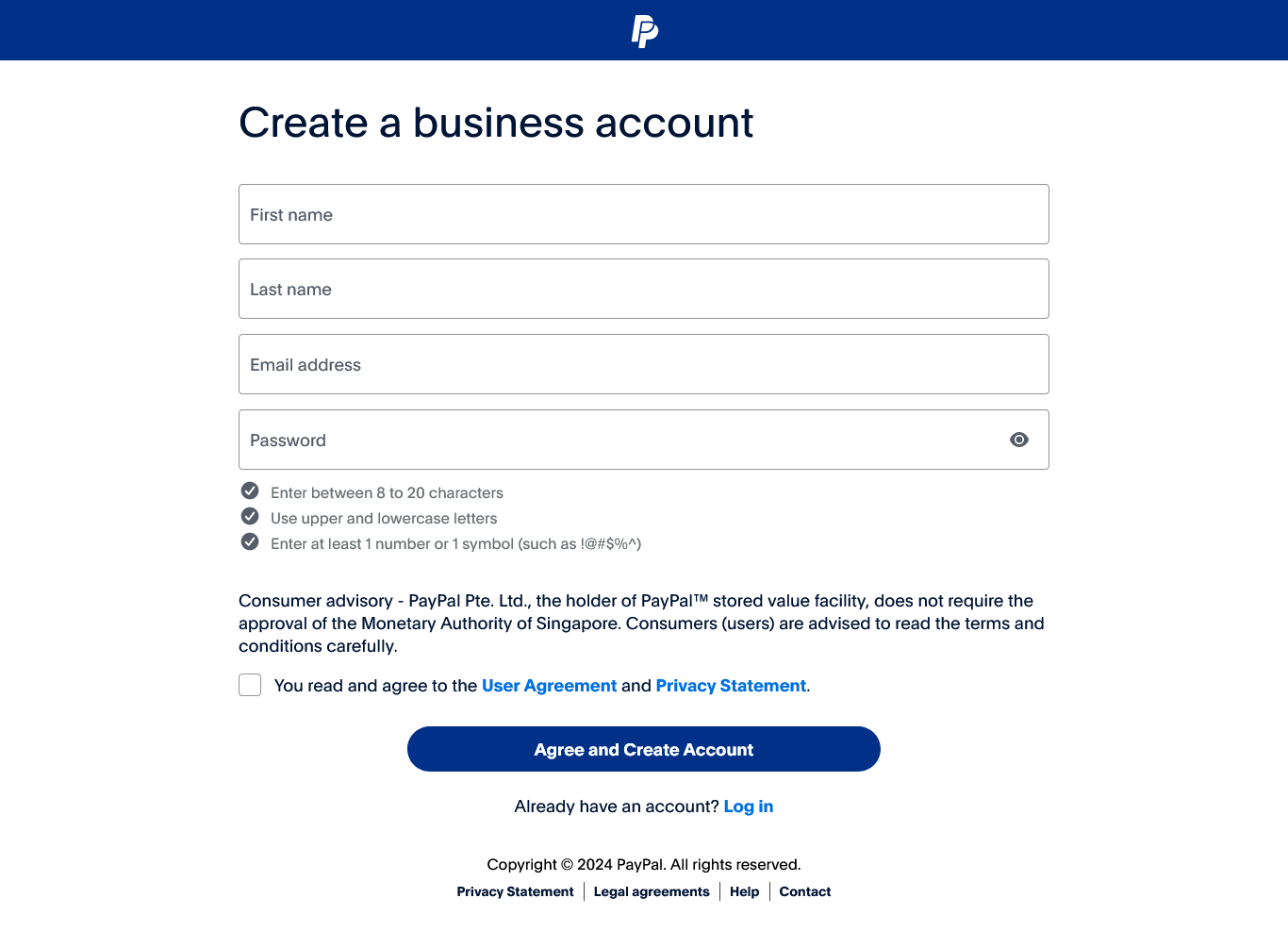

4. Provide Email Address:

Enter a valid email address that you want to associate with your PayPal account. This will also serve as your username for logging in.

5. Create a Password:

Choose a strong and secure password for your PayPal account. It should include a mix of uppercase and lowercase letters, numbers, and special characters.

6. Fill in Personal Information:

Complete the required fields with your personal information, including your name, address, and phone number.

7. Verify Your Email:

7. Verify Your Email:

– PayPal will send a verification email to the address you provided. Check your email inbox and follow the instructions to verify your email.

8. Link a Payment Method:

To fully utilize PayPal, link a payment method, such as a credit card or bank account. This allows you to fund your PayPal transactions.

9. Confirm Identity (if required):

Depending on your location and other factors, PayPal may request additional identity verification steps.

10. Complete the Setup:

Once you’ve filled in all the necessary information, your PayPal account should be set up. You can now log in and start using PayPal for online transactions.

How to withdraw money from PayPal in Senegal

To withdraw money from PayPal in Senegal, follow these general steps:

1. Link Your Bank Account:

– Ensure your PayPal account is set up and verified.

– Link your bank account to your PayPal account(If bank doesnt work, opt for a virtual USA account or Payoneer account). Navigate to “Wallet” in your PayPal account, click on “Link a Bank” or “Link a Card,” and follow the prompts to add your bank details.

2. Confirm Bank Account:

– PayPal may send a small amount to your bank account for verification purposes. Check your bank statement for this amount and confirm it in your PayPal account to complete the linking process.

3. Log In to Your PayPal Account:

– Visit the PayPal website and log in to your account using your credentials.

4. Navigate to Withdrawal Section:

– Locate the “Withdraw” or “Transfer” section on your PayPal dashboard.

5. Select Withdraw to Bank Account:

– Choose the option to withdraw funds to your linked bank account.

6. Enter Withdrawal Amount:

– Enter the amount you wish to withdraw.

7. Review and Confirm:

– Review the withdrawal details and confirm the transaction.

8. Wait for Processing:

– The withdrawal may take some time to process, usually a few business days.

9. Check Your Bank Account:

– Once the withdrawal is processed, check your Jordanian bank account for the credited funds.

Banking sector in Senegal

Which Banks support PayPal in Jordan?

How to Withdraw Money from PayPal with Payoneer in Senegal?

Here are the general steps to withdraw money from PayPal using Payoneer in Senegal:

1. Sign Up for Payoneer:

If you don’t have a Payoneer account, sign up for one on the Payoneer website.

2. Link Payoneer to PayPal:

In your PayPal account, link your Payoneer account. This may involve providing your Payoneer bank account details.

3. Verify Your Accounts:

Follow any verification steps required by both PayPal and Payoneer to ensure that the accounts are linked successfully.

4. Withdraw Funds:

Once linked, you should be able to select Payoneer as a withdrawal method in your PayPal account.

5. Confirm Withdrawal:

Enter the amount you want to withdraw and confirm the withdrawal transaction.

6. Wait for Processing:

The withdrawal process may take some time, typically 3-5 business days.

7. Check Your Payoneer Account:

After the withdrawal is processed, check your Payoneer account to ensure the funds have been received.

Note: Withdrawing money from PayPal to your Payoneer can cost you 14-16 USD

What are Alternatives to using PayPal in Senegal?

1. Wise

Wise is a UK-based foreign exchange financial technology company which specializes in cross-border payment transfers.

2. 2Checkout (now Verifone):

2Checkout, now part of Verifone, is a global payment platform that provides online payment processing services.

Click here to view up-to 12 alternatives to PayPal in Senegal

How can I link my Senegal bank account to PayPal?

Here’s a general guide on how you can link Senegal bank account to PayPal

1. Log In to Your PayPal Account:

– Visit the official PayPal website and log in to your existing PayPal account. If you don’t have an account, you’ll need to sign up.

2. Navigate to “Wallet” or “Banks and Cards”:

– Once logged in, find the “Wallet” section on your PayPal account. In this section, you may see options like “Banks and Cards” or similar.

3. Add a Bank Account:

– Look for the option to add a bank account. This typically involves entering the required details, including your bank account number, branch details, and other relevant information.

4. Confirm Bank Account:

– PayPal may require you to confirm your bank account to ensure its validity. This often involves a small deposit or withdrawal that you’ll need to verify later.

5. Complete Verification Process:

– Check your bank statement for the small transaction made by PayPal. Once identified, log back into your PayPal account and confirm the amount to complete the verification process.

6. Linking Successful:

– After successful verification, your Senegal bank account should be linked to your PayPal account. You can now use it for various PayPal transactions, including withdrawals and payments.

7. Withdrawal to Senegal Bank:

– If you intend to withdraw funds from your PayPal account to your Senegal bank account, ensure that the linked bank account details are accurate. You can initiate a withdrawal from your PayPal account.

Note: Most Senegal bank accounts have a challenge receiving from PayPal, Incase withdraw fails, opt for USA virtual accounts or use Payoneer

Is PayPal accepted in Senegal?

Yes, PayPal is generally accepted in Senegal. Users can create PayPal accounts and use them for various online transactions, including sending and receiving money.

How do I get a PayPal account in Senegal?

To get a PayPal account in Senegal, you can follow these general steps:

- Visit the PayPal website or download the PayPal mobile app.

- Click on “Sign Up” to create a new account.

- Provide the required information, including your email address and personal details.

- Link a credit card, debit card, or bank account to your PayPal account.

- Verify your account through the confirmation email sent by PayPal.

- Once verified, your PayPal account is ready to use.

How long does a PayPal payment take to show up in my bank account in Senegal?

The time it takes for a PayPal payment to show up in your bank account can vary based on several factors, including the type of transfer, your location, and your bank’s processing times. Here are some general guidelines:

1. Standard Bank Transfer (Withdrawal):

– Standard transfers from your PayPal account to your bank typically take 3 to 5 business days to process. This duration may vary based on weekends, holidays, and your bank’s processing times.

2. Instant Transfer (if available):

– PayPal offers an Instant Transfer option in some regions, allowing you to move funds to your linked bank account almost immediately for a fee. This is faster than the standard transfer option.

3. eChecks or Unconfirmed Payments:

– If the payment you received is through an eCheck or is unconfirmed, it may take several days for the funds to clear. PayPal waits for the eCheck to be cleared by the sender’s bank before making the funds available to you.

4. Business Days vs. Weekends/Holidays:

– Business days (Monday to Friday) are typically considered when estimating transfer times. If you initiate a transfer on a weekend or during a holiday, the processing may start on the next business day.

5. Bank Processing Times:

– The speed of the transfer also depends on how quickly your bank processes incoming payments. Some banks may credit your account faster than others.

It’s essential to note that PayPal provides estimated arrival times for transfers, but these are not guarantees. Delays can occur due to various reasons, including technical issues, verification processes, or unexpected circumstances.

To get the most accurate and up-to-date information about your specific transfer, you can log in to your PayPal account, go to your transaction history, and check the details of the transfer. Additionally, your bank statement will reflect the deposit when the funds are available in your bank account.

Is PayPal available in Senegal?

Yes, PayPal is available in Senegal, and individuals can use it for various online transactions, including purchasing goods and services, as well as sending and receiving money.

If this article has helped you in any way, leave us a comment below, you can also checkout and subscribe on our YouTube channel; http://www.youtube.com/webvator .You can read more about how to create PayPal account in Uganda