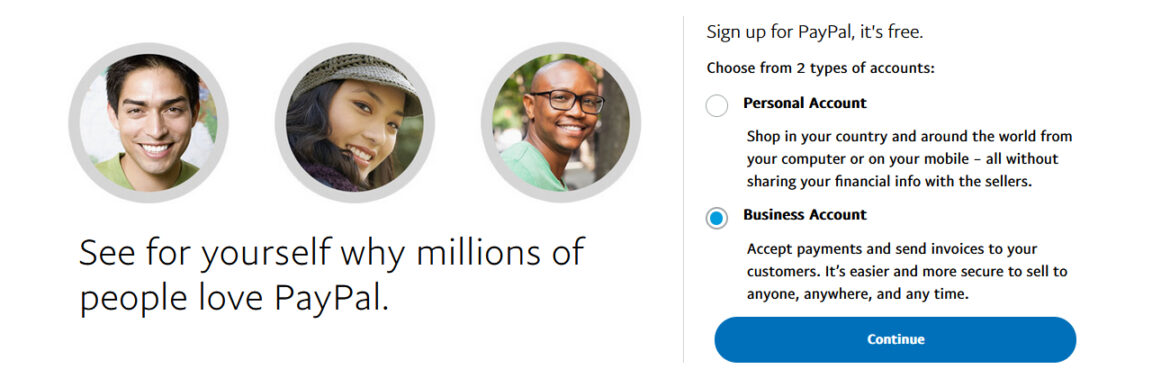

The primary reason individuals opt for a Business PayPal account over a Personal PayPal account is the ability to conduct transactions under a company or organization name instead of personal names.

With a Business PayPal account, users can leverage the credibility and professionalism associated with their business entity. When receiving payments or donations, the sender sees the designated business name rather than individual personal names. This feature not only enhances the professional appearance of transactions but also reinforces the legitimacy of the business entity.

By displaying the business name during transactions, businesses can establish brand recognition and reinforce their identity with customers, clients, and donors. This branding opportunity helps businesses build trust and credibility, which are essential for fostering long-term relationships and attracting repeat business.

Furthermore, using a business name in PayPal transactions offers a level of privacy and discretion for business owners. It allows them to maintain separation between their personal and business identities, enhancing security and protecting personal information.

Additionally, having a Business PayPal account unlocks access to a range of advanced features tailored to business needs. These include invoicing tools, multi-user access, integration with e-commerce platforms, and comprehensive reporting functionalities. Such features empower businesses to streamline financial management, track transactions, and scale operations effectively.

Tthe decision to choose a Business PayPal account over a Personal PayPal account is driven by the desire to represent the business entity professionally, establish brand identity, maintain privacy, and access advanced business-focused features. By leveraging the business name in transactions, businesses can project professionalism, enhance credibility, and foster trust with customers and clients.

Choosing a Business PayPal account is suitable for individuals or entities engaged in commercial activities, whether it’s selling products or services.

Here are more reasons for choosing to setup a Business PayPal account:

- Running a Business: If you’re operating a business, regardless of its size, a Business PayPal account offers features tailored to manage transactions, invoices, and customer payments efficiently.

- Accepting Payments Online: Businesses that conduct transactions online, such as e-commerce stores, freelancers, consultants, or service providers, benefit from the streamlined payment processing capabilities of a Business PayPal account.

- Enhanced Branding : As discussed at the start, a Business PayPal account allows you to customize your payment pages with your business name and logo, creating a more professional and branded payment experience for your customers.

- Access to Additional Features: Business PayPal accounts provide access to advanced features such as multi-user access, integration with e-commerce platforms, invoicing tools, and reporting functionalities, which are essential for managing and growing a business.

- Accepting International Payments: For businesses dealing with international customers or clients, a Business PayPal account offers the flexibility to accept payments in multiple currencies and provides tools to manage currency conversion and exchange rates.

- Legal and Financial Separation: Separating your personal finances from your business finances is crucial for accounting and taxation purposes. A Business PayPal account allows you to keep your business transactions separate from your personal ones, simplifying financial management and reporting.

- Compliance and Security: Business PayPal accounts come with additional security measures and fraud protection tools to safeguard your business and your customers’ sensitive information. They also offer compliance features to ensure adherence to regulatory requirements.

- Scalability and Growth: As your business expands, a Business PayPal account can accommodate higher transaction volumes and provides scalability to meet the evolving needs of your growing business.

If you’re involved in commercial activities, selling products or services, and require features tailored to business needs, opting for a Business PayPal account is advisable. It offers enhanced functionality, branding opportunities, and tools for efficient financial management, making it an ideal choice for businesses of all sizes.

disadvantages of paypal business account

Here are the disadvantages of using a PayPal Business account

Disadvantages of PayPal Business Account:

- U can’t use Friends and Family PayPal Feature:In a PayPal Business account, users do not have access to the “Friends and Family” feature available in Personal accounts. The “Friends and Family” option allows users to send money to friends or family without incurring fees. Additionally, payments sent through the “Friends and Family” feature often bypass certain holds or restrictions that may apply to other types of PayPal transactions, especially for new or less active accounts.This limitation in Business accounts means that transactions made through a Business account will typically be subject to standard transaction fees, and they may also be subject to PayPal’s regular hold policies, which could impact the availability of funds for the recipient.

While Business accounts offer a range of features tailored for commercial use, such as invoicing tools and integration options, users should be aware that they won’t have access to the “Friends and Family” feature and its associated benefits when using a Business PayPal account.

- Higher Fees: PayPal Business accounts typically incur higher transaction fees compared to Personal accounts, especially for certain types of transactions like international payments or credit card processing.

- Chargebacks and Disputes: Business accounts may encounter more chargebacks and disputes, which can lead to financial losses and administrative burdens for the account holder.

- Complexity for Small Transactions: For businesses processing small transactions, PayPal fees can significantly impact profit margins, making it less cost-effective for microtransactions.

- Additional Verification Requirements: PayPal may require additional verification steps for Business accounts, such as providing business documentation or undergoing identity verification checks, which can delay account activation or transactions.

- Limited Use for Personal Transactions: While Business accounts are designed for commercial use, they may not be suitable or convenient for personal transactions or peer-to-peer payments.

- Compliance and Regulations: Businesses using PayPal for transactions must adhere to PayPal’s Acceptable Use Policy and other regulatory requirements, which may impose restrictions on certain types of businesses or transactions.

Is there a fee for PayPal business account?

Yes, PayPal charges fees for using its Business accounts. The fees vary depending on factors such as transaction volume, transaction type (domestic or international), currency conversion, and whether payments are received through PayPal or other methods like credit or debit cards. PayPal typically charges a transaction fee plus a fixed percentage of the transaction amount. Additionally, there may be fees for currency conversion, chargebacks, and other services.

On average expect 3.49% plus Fixed fee 0.49. Check out fees structure on Paypal website link; https://www.paypal.com/us/webapps/mpp/merchant-fees

How do I know if my PayPal is business or personal?

You can watch this video to know if your account is business or not, or click here

How do I avoid PayPal fees for my business account?

While it’s not possible to completely avoid PayPal fees for business transactions, there are strategies to minimize them:

- Choose the right PayPal account type: PayPal offers different types of business accounts, each with its own fee structure. Understanding your business needs and transaction volume can help you select the account type with the most cost-effective fees.

- Negotiate fees: High-volume businesses may have the opportunity to negotiate lower transaction fees with PayPal based on their transaction volume and other factors.

- Opt for bank transfers: PayPal charges lower fees for bank transfers compared to credit or debit card payments. Encouraging customers to use bank transfers can help reduce transaction fees.

- Set minimum payment thresholds: Consider setting minimum payment thresholds to avoid incurring fees on small transactions.

- Pass fees to customers: Some businesses choose to pass PayPal fees on to their customers by adding a surcharge to cover transaction costs. However, this approach may impact customer satisfaction and loyalty, so it’s essential to consider the potential consequences before implementing it.

Can I use a PayPal personal account for business?

While it’s possible to use a Personal PayPal account for occasional business transactions, it’s not recommended for long-term or substantial business activities. Personal accounts are designed for individual use and have limitations on receiving payments for goods and services. Using a Personal account for business purposes may violate PayPal’s terms of service and could result in restrictions or account suspension. Additionally, Personal accounts lack the features and tools available with Business accounts, such as invoicing, reporting, and customization options. To conduct business activities professionally and compliantly, it’s advisable to upgrade to a Business PayPal account tailored to business needs.

If this article has helped you in any way, leave us a comment below, you can also checkout and subscribe on our YouTube channel; http://www.youtube.com/webvator .