PayPal is widely recognized and extensively used in Kuwait as a digital payment platform. Many Kuwaiti individuals rely on PayPal for electronic money transfers, both sending and receiving. Here, we’ll delve into how to effectively utilize PayPal in Kuwait, including linking your bank ATM Card, withdrawing funds, and addressing common issues that users may encounter.

In Kuwait, PayPal extends its services to individuals, businesses, and freelancers alike. It facilitates various financial transactions such as online purchases, peer-to-peer money transfers, receiving payments for goods and services, as well as withdrawing funds directly to local bank accounts. Moreover, PayPal supports receiving money from abroad, making it a versatile solution for international transactions.

Kuwait is among the countries where PayPal permits direct bank transfers, providing users with convenient access to their funds,

Feel free to leave comments in section below incase of anything and don’t forget to Subscribe on our YouTube Channel https://youtube.com/webvator for latest updates

Using PayPal in Kuwait

- Account Creation: To start using PayPal in Kuwait, individuals need to sign up for an account on the PayPal website or through the mobile app. They’ll need to provide basic personal information and verify their email address.

- Linking Bank ATM Card: After creating an account, users can link their Kuwaiti bank ATM card to PayPal. This process involves adding the card details to their PayPal account, including the card number, expiration date, and CVV.

- Making Transactions: Once the bank ATM card is linked, users can make online purchases, send money to friends and family locally and internationally, receive payments for goods and services, and withdraw money to their bank account.

- Withdrawal Options: PayPal allows users in Kuwait to withdraw money directly to their linked bank account. Read below concerning best banks you can use in Kuwait.

How To Create a PayPal Account in Kuwait

Follow these steps:

1. Visit the Kuwait Official PayPal Website:

Go to the official PayPal website “https://www.paypal.com/kw/” signup and choose account type

PayPal typically offers options for personal and business accounts. Choose personal if your going to do Casual Transactions, Non-business-related Transactions, Selling Personal Items..

Choosing a Business PayPal account is suitable for individuals or entities engaged in commercial activities, whether it’s selling products or services or if you want enhanced Branding where your clients see your business name instead of your real names. For more details why you should consider using a business PayPal account, click here

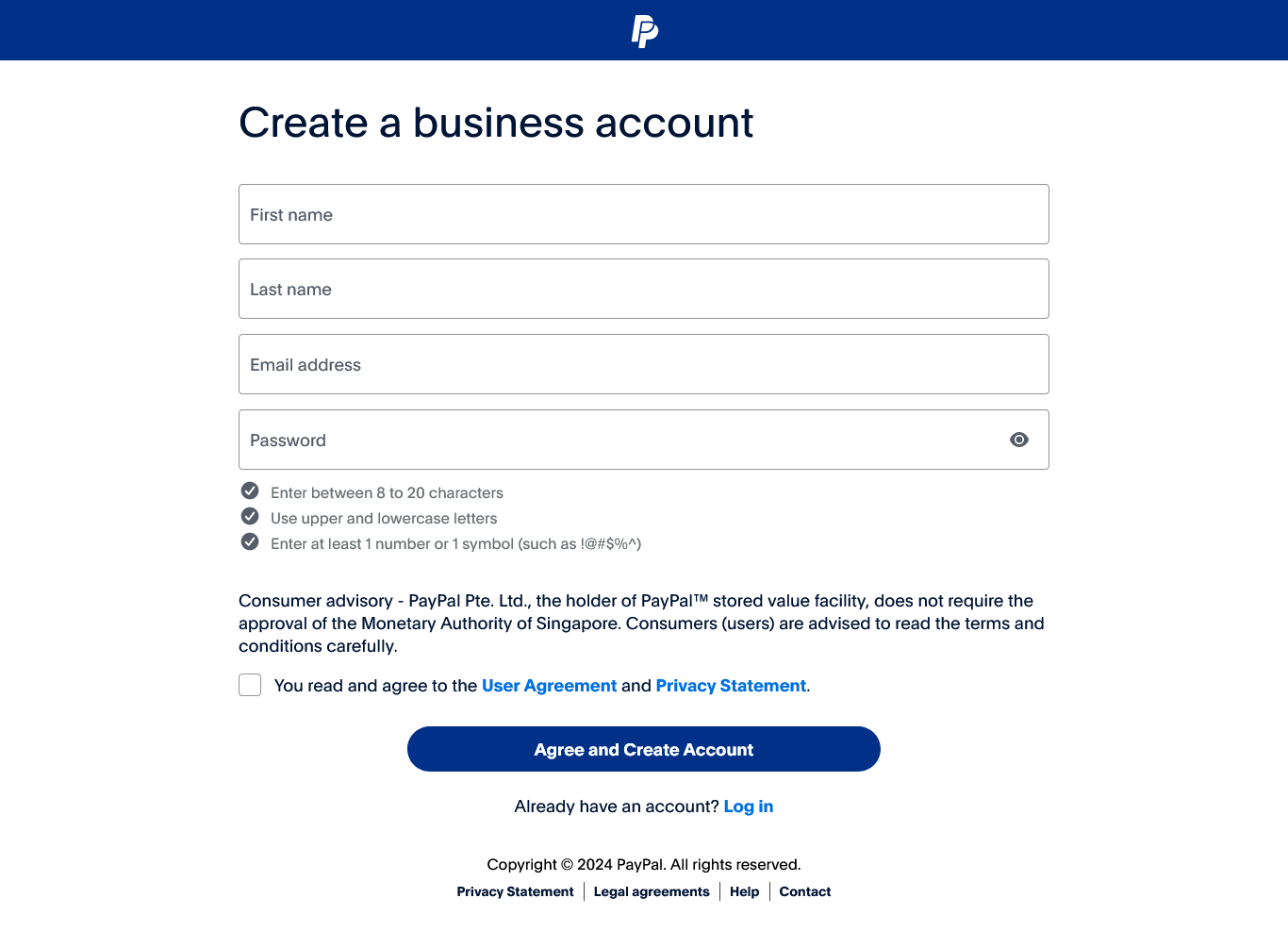

2. Fill in Personal Information

Provide Email Address, Names and Password

Enter a valid email address that you want to associate with your PayPal account. This will also serve as your username for logging in.

Create a Password:

Choose a strong and secure password for your PayPal account. It should include a mix of uppercase and lowercase letters, numbers, and special characters.

Fill in Data:

Complete the required fields with your personal information, including your name, address, and phone number.

3. Verify Your Email:

3. Verify Your Email:

– PayPal will send a verification email to the address you provided. Check your email inbox and follow the instructions to verify your email.

4. Link a Payment Method:

To fully utilize PayPal, link a payment method, such as a credit card or bank account. This allows you to fund your PayPal transactions.

5. Confirm Identity (if required):

Depending on your location and other factors, PayPal may request additional identity verification steps.

Add your debit card to your account, then withdraw to it.

How to withdraw money from PayPal in Kuwait

When withdrawing money from PayPal to your bank account in Kuwait, it’s advisable to link your bank ATM card rather than the bank account directly.

From my experience, withdrawals can be easily made to debit cards issued by Kuwait Finance House Bank (KFH), NBK, and Burgan Bank.

The withdrawal process typically takes around 3 business days to reach your bank account without incurring any charges. However, if you require immediate withdrawal, there may be a 1% fee applied.

During the process of connecting your bank card, you may receive verification codes on your mobile device to complete the verification process and activate the withdrawal option.

Once verified, there are usually no limits on how much you can withdraw from your PayPal account, provided your card is verified. To verify your bank card in PayPal, you can refer to instructional resources such as tutorial videos available online.

It’s worth noting that while linking your bank ATM card offers convenience and flexibility for withdrawals, users should always ensure the security of their financial information and adhere to PayPal’s verification procedures for a smooth transaction experience.

To withdraw money from PayPal in Kuwait, follow these general steps:

1. Log In to Your PayPal Account:

– Visit the PayPal website and log in to your account using your credentials.

2. Link Your Bank Account:

– Ensure your PayPal account is set up and verified.

– f you haven’t Linked your bank account to your PayPal account. Navigate to “Wallet” in your PayPal account, click on “Link a Bank” or “Link a Card,” and follow the prompts to add your bank details.

3. Confirm Bank Account:

– PayPal will deduct a small amount to your bank account for verification purposes. Check your bank statement for this amount and confirm it in your PayPal account to complete the linking process. This fee which ranges between 0.1$ – 1.8$ will be refunded after verification is done.

4. Navigate to Withdrawal Section:

– Locate the “Withdraw” or “Transfer” section on your PayPal dashboard.

5. Select Withdraw to Bank Account:

– Choose the option to withdraw funds to your linked bank account.

6. Enter Withdrawal Amount:

– Enter the amount you wish to withdraw.

7. Review and Confirm:

– Review the withdrawal details and confirm the transaction.

8. Wait for Processing:

– The withdrawal may take some time to process, usually a few business days.

9. Check Your Bank Account:

– Once the withdrawal is processed, check your Kuwait bank account for the credited funds.

Banking sector in Kuwait

The banking sector in Kuwait plays a pivotal role in the country’s economy, providing essential financial services to individuals, businesses, and government entities. Here’s an overview of the banking sector in Kuwait:

Key Features:

Stability and Regulation: Kuwait’s banking sector is characterized by stability and robust regulatory oversight. The Central Bank of Kuwait (CBK) serves as the regulatory authority, overseeing the operations of banks and financial institutions to ensure compliance with regulations and maintain stability in the financial system.

Islamic Finance: Islamic banking is a significant component of Kuwait’s banking sector, with several Islamic banks offering Sharia-compliant products and services. Kuwait Finance House (KFH) is a notable Islamic bank in Kuwait, adhering to Islamic principles in its operations.

Conventional Banking: Alongside Islamic banks, conventional banks also operate in Kuwait, providing a wide range of banking services such as retail banking, corporate banking, investment banking, and wealth management. National Bank of Kuwait (NBK), Burgan Bank, and Gulf Bank are among the leading conventional banks in Kuwait.

Foreign Banks: Kuwait’s banking sector includes branches of international banks, contributing to the diversity and competitiveness of the financial landscape. These foreign banks offer specialized services and expertise to cater to the needs of multinational corporations, expatriates, and international investors operating in Kuwait.

Technological Advancements: Kuwait’s banking sector has embraced technological innovations to enhance service delivery and improve customer experience. Digital banking services, mobile banking apps, online transactions, and electronic payment systems are widely adopted by banks to meet the evolving needs of tech-savvy customers.

Government Support: The Kuwaiti government plays a crucial role in supporting the banking sector’s growth and development through favorable regulatory frameworks, incentives, and initiatives aimed at promoting financial inclusion, innovation, and economic diversification.

Challenges:

Competition: The banking sector in Kuwait is highly competitive, with numerous banks vying for market share. This competition puts pressure on banks to innovate, improve efficiency, and differentiate their offerings to attract and retain customers.

Regulatory Compliance: Banks operating in Kuwait must adhere to stringent regulatory requirements imposed by the Central Bank of Kuwait (CBK), which entails compliance with anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and other regulatory standards.

Economic Volatility: Kuwait’s economy is heavily reliant on oil revenues, making it susceptible to fluctuations in global oil prices. Economic volatility and geopolitical tensions in the region can impact the banking sector’s performance and profitability.

Cybersecurity Risks: With the increasing digitization of banking services, cybersecurity threats pose a significant risk to the banking sector. Banks must invest in robust cybersecurity measures to safeguard customer data, prevent cyber attacks, and maintain trust and confidence in the banking system.

Which Banks support PayPal in Kuwait?

In Kuwait, several prominent banks provide a range of financial services to individuals, businesses, and institutions.

Some of the notable banks in Kuwait include:

National Bank of Kuwait (NBK):

NBK is one of the largest and oldest banks in Kuwait, offering a comprehensive suite of banking products and services.

Services include retail banking, corporate banking, investment banking, and asset management.

NBK has a widespread network of branches and ATMs across Kuwait and operates internationally as well.

Kuwait Finance House (KFH):

KFH is a leading Islamic bank in Kuwait, adhering to Sharia principles in its operations.

Services encompass retail banking, commercial banking, investment products, and Islamic finance solutions.

KFH has a strong presence in Kuwait and operates internationally in several countries.

Burgan Bank:

Burgan Bank is another prominent financial institution in Kuwait, offering a diverse range of banking services.

Services include retail banking, corporate banking, private banking, and investment services.

Burgan Bank has a network of branches and ATMs across Kuwait and provides innovative financial solutions to its customers.

Commercial Bank of Kuwait (CBK):

CBK is a well-established bank in Kuwait, catering to the banking needs of individuals, businesses, and government entities.

Services include retail banking, corporate banking, treasury services, and international banking.

CBK operates a network of branches and ATMs across Kuwait and offers a wide array of financial products and services.

Gulf Bank:

Gulf Bank is a leading commercial bank in Kuwait, offering a comprehensive range of banking and financial services.

Services include retail banking, corporate banking, investment banking, and wealth management.

Gulf Bank is known for its customer-centric approach and innovative banking solutions.

What are Alternatives to using PayPal in Kuwait?

1. Wise

Wise is a UK-based foreign exchange financial technology company which specializes in cross-border payment transfers.

2. Revolut

Revolut helps you spend, send, and save smarter. Welcome to your new favourite way to do all things money.

Click here to view up-to 12 alternatives to PayPal in Kuwait

What cards work well in Kuwait with Paypal?

Make sure your bank ATM Card has a seal of VISA, master-card. They are other types but most common compatible cards are these

My card is hesabi , can it work on Paypal?

“Hesabi” cards are debit cards issued by Kuwait Finance House (KFH), an Islamic bank in Kuwait. While PayPal generally accepts a wide range of debit cards, including Visa, Mastercard, and others, the acceptance of specific cards, such as Hesabi cards, can depend on various factors, including the card’s network and issuer policies.

To determine if your Hesabi card can be used with PayPal, you can follow these steps:

To determine if your Hesabi card can be used with PayPal, you can follow these steps:

1. Try Adding the Card: Log in to your PayPal account and navigate to the “Wallet” section. Then, select “Link a debit or credit card” and enter the details of your Hesabi card. PayPal will attempt to verify and add the card to your account. If successful, you can use the card for PayPal transactions.

2. Check with KFH: You can also reach out to Kuwait Finance House (KFH) to inquire about their policies regarding Hesabi card usage with online payment platforms like PayPal. They can provide insights into any restrictions or limitations associated with using Hesabi cards for online transactions.

3. Explore Alternative Payment Methods: If your Hesabi card is not compatible with PayPal or if you encounter difficulties, consider exploring alternative payment methods accepted by PayPal, such as bank transfers, PayPal balance, or other debit or credit cards.

While PayPal aims to accept a wide range of payment methods, including debit cards like Hesabi cards, the acceptance of specific cards can vary based on factors such as card network, issuer policies, and regional considerations. Therefore, it’s recommended to directly verify with PayPal and KFH to determine the compatibility and usage of your Hesabi card with PayPal.

How long does a PayPal payment take to show up in my bank account in Mexico?

The time it takes for a PayPal payment to show up in your bank account can vary based on several factors, including the type of transfer, your location, and your bank’s processing times. Here are some general guidelines:

1. Standard Bank Transfer (Withdrawal):

– Standard transfers from your PayPal account to your bank typically take 3 business days to process. This duration may vary based on weekends, holidays, and your bank’s processing times.

2. Instant Transfer (if available):

– PayPal offers an Instant Transfer option in some regions, allowing you to move funds to your linked bank account almost immediately for a fee. This is faster than the standard transfer option.

3. eChecks or Unconfirmed Payments:

– If the payment you received is through an eCheck or is unconfirmed, it may take several days for the funds to clear. PayPal waits for the eCheck to be cleared by the sender’s bank before making the funds available to you.

4. Business Days vs. Weekends/Holidays:

– Business days (Monday to Friday) are typically considered when estimating transfer times. If you initiate a transfer on a weekend or during a holiday, the processing may start on the next business day.

5. Bank Processing Times:

– The speed of the transfer also depends on how quickly your bank processes incoming payments. Some banks may credit your account faster than others.

It’s essential to note that PayPal provides estimated arrival times for transfers, but these are not guarantees. Delays can occur due to various reasons, including technical issues, verification processes, or unexpected circumstances.

Is PayPal available in Kuwait?

Yes, PayPal is available in Kuwait, and individuals can use it for various online transactions, including purchasing goods and services, as well as sending and receiving money.

If this article has helped you in any way, leave us a comment below, you can also checkout and subscribe on our YouTube channel;

You can read more about Website design Kuwait