Virtual PayPal Uganda Account Creation

When creating a Virtual PayPal account in Uganda, it is crucial to thoroughly understand and comply with Uganda PayPal’s terms and conditions. Many individuals have faced issues, including losing their funds, due to registering Uganda PayPal accounts with unverified or unverifiable details. To avoid such setbacks, ensure that all information provided during the registration process can be validated when PayPal requests supporting documents. If you’re unfamiliar with PayPal’s policies or need guidance through the setup process, don’t hesitate to reach out to us for assistance. We’re here to help you navigate the requirements smoothly.

With Virtual PayPal account, you can receive money from abroad, play online games and get paid, do surveys and get paid, withdraw payments from Upwork and other freelancing websites which pay to PayPal,Set up subscription billing for recurring payments, receive donations or your NGO, Accept payments from customers worldwide via Credit and Debit cards .. and so many other uses.

How do you create a Virtual PayPal account in Uganda & in Other restricted countries

The reason why someone would opt for a virtual PayPal account is mainly because you come from a country which doesn’t support receiving on PayPal, countries like Uganda, Zambia , Rwanda, Tanzania, south Sudan etc.

Creating a PayPal account in Uganda that can receive payments offers numerous advantages. With such an account, you can receive funds from abroad, particularly from developed countries where PayPal is widely recognized as one of the safest and quickest ways to transfer money.

This receiving PayPal account enables Ugandans to accept payments from various freelancing platforms like Upwork, Fiverr, Freelancer, Toptal , Guru, PeoplePerHour, 99designs, SimplyHired, TaskRabbit, Hubstaff Talent and others. By linking your Upwork account to your PayPal, you can effortlessly withdraw your earnings.

In Uganda, getting paid online can be challenging without a PayPal account, as alternative payment methods are often harder to access and less convenient. Therefore, having a PayPal account significantly simplifies the process of receiving international payments and enhances your ability to participate in the global digital economy.

This page contains steps on information on how to;

How To Create a Virtual PayPal Account in Uganda for Organizations

How To Create a Pay & Get Paid PayPal Account in Uganda

How To Create a Virtual PayPal Account in Uganda for personal use

How To Create a Virtual PayPal Account in Uganda for Online Games & Tiktok

How To Create a Virtual PayPal Account in Uganda for business purposes

How To Create a Virtual PayPal Account in Uganda without bank details

A virtual PayPal account in normal terms is a Paypal account which is not linked to any bank account or ATM Card but can receive and send just as a normal PayPal account. The fact that its virtual means the money u receive in your PayPal account cant be put on bank account because account is not linked to any account.

How To Create a Virtual PayPal Account in Uganda and receive money

You may be wondering how to obtain a virtual PayPal account in Uganda, Tanzania, Rwanda, Ghana, Burundi, and efficiently receive money. The answer is straightforward: you can create a PayPal account using a country that allows both sending and receiving money, and provide the necessary documents as requested by PayPal.

While setting up a regular Ugandan PayPal account for sending purposes, PayPal might not require certain documents but when it comes to creating PayPal account capable of both receiving and sending funds, some documents and explanations have to carefully drafted starting from using a clean IP address during the setup. For this, we offer a service for a fee to assist in setting up a virtual PayPal account. This account can be utilized for receiving payments from friends and family, transactions related to game apps, survey apps, donations, or for personal reasons.

We set up the Virtual PayPal account in Uganda, Tanzania, Zambia and other countries in a safe & recommended way taking into consideration several factors;

![]() Virtual PayPal Account Uganda Setup with Safety in Mind.

Virtual PayPal Account Uganda Setup with Safety in Mind.

When setting up a virtual PayPal account, it’s crucial to prioritize safety. Use secure and unique passwords, and ensure that your login credentials are kept confidential.

![]() Understanding the Intended Use for the Virtual PayPal Account.

Understanding the Intended Use for the Virtual PayPal Account.

We clearly define the purpose of your Virtual PayPal account. Different accounts may have different features and limitations based on their intended use, whether it’s for charity donations, personal transactions, business-related payments, Gaming Apps, Surveys, Gogetfunding, TikTok or receiving funds for specific services.

![]() Selecting the Right Categories to use in your Virtual PayPal Account Uganda

Selecting the Right Categories to use in your Virtual PayPal Account Uganda

PayPal provides various categories to classify your account based on its purpose. For instance, you may choose between a personal or business account. If it’s for business, further categorize it based on the nature of your business (e.g., goods and services, nonprofit organization, freelance work). we ask you what your going to be using the account for so that we get you a right category

![]() Consideration of PayPal’s Requirements on your Account

Consideration of PayPal’s Requirements on your Account

We Understand that PayPal may request additional information based on the type of account and its intended usage. This might include identity verification documents, proof of address, and other relevant information. We Anticipate these requirements to streamline the account setup process.

![]() Providing Accurate Information in Virtual PayPal Account

Providing Accurate Information in Virtual PayPal Account

We ensure that all information provided during the account setup process is accurate and up-to-date. Inaccurate information can lead to complications, and PayPal may ask for clarification or additional documents to verify your account.

Common Virtual PayPal terms we use in Uganda ;

Virtual PayPal Account Uganda Sign-Up Link:

This is the link you provide for users in Uganda who wish to sign up for a virtual PayPal account. A virtual PayPal account enables users to send and receive payments online without having a physical presence. Although the links are not specifically tailored for individual users, the example you give (https://www.paypal.com/ug/bizsignup/#create/) leads directly to PayPal’s sign-up page, where users can create their accounts. This page is accessible from Uganda, and it offers an easy gateway for users looking to manage international payments or online transactions.

Virtual PayPal Email Address:

The “Virtual PayPal email address” refers to the email address that is used as the primary identifier for a PayPal account. This email address is essentially your virtual identity on PayPal, and all transactions, including receiving funds and communications, are tied to this address. It is crucial to keep this email secure because it is the main way to access your virtual PayPal account. Users in Uganda can link this email to their virtual accounts to send and receive money globally.

Virtual PayPal Uganda Restore Link:

This link (paypal.com/policy/icb) serves as a troubleshooting tool for users in Uganda who might face restrictions or limitations on their PayPal accounts. PayPal accounts can sometimes be restricted due to security concerns or policy violations, and users might not always receive an immediate notification or email explaining the issue. By using this restore link, Ugandan PayPal users can manually check their account status, review any restrictions, and follow the necessary steps to restore full functionality of their account.

Virtual PayPal Uganda Terms and Conditions Link:

The terms and conditions page for PayPal in Uganda (https://www.paypal.com/ug/webapps/mpp/paypal-fees) outlines the legal framework, rules, and guidelines that users must adhere to when using the PayPal service. This page explains important details, such as transaction fees, usage policies, and account limitations, specific to Ugandan users. It is essential for anyone signing up for a virtual PayPal account in Uganda to review these terms so that they understand their rights and obligations when using the service.

Virtual PayPal Uganda Login Link:

The login link (paypal.com) is the standard entry point for all PayPal users, including those in Uganda, to access their virtual PayPal accounts. After navigating to the PayPal website, users simply enter their email address and password to manage their account. This page allows users to send or receive payments, review transaction histories, and access other PayPal services. Ugandan users can use this link to easily log into their virtual PayPal accounts and manage their online financial activities.

Free Virtual PayPal Uganda:

This term refers to the fact that signing up for a virtual PayPal account is free for users in Uganda. There is no cost associated with opening an account, making it accessible to a wide range of individuals and businesses looking to manage payments online. Once signed up, users can start sending or receiving payments without having to pay any registration or initial account fees. However, there may be fees for specific transactions or services later on, which are outlined in PayPal’s terms and conditions.

What are Requirements to setup Virtual PayPal Account in Uganda

- Identity Card Photo:

- Provide a clear photo of your National ID, driving permit, or passport. You can use your camera to capture the front side of your ID. PayPal accepts these forms of identification for verification purposes.

- Email Address:

- Use a valid email address for your PayPal account. It can be a Gmail, Yahoo, or any other email, including a website email. Ensure that the email address belongs to you, and you have control over it, as it serves as your PayPal account. Do not use a friend’s or anyone else’s email.

- Mobile Money Number:

- Provide a mobile money number that you have access to and can receive verification codes on. This number is crucial in case PayPal needs to send a verification code for added security during the setup process.

- Setup Fee:

- Be prepared for a setup fee, which is negotiable but typically ranges between $45 and above. In Ugandan currency, the fixed cost for setting up a virtual PayPal account is in range of 150,000/= to 250,000/= ugx depending whether you need a verified PayPal account or not. Incase you need account which can transfer money from PayPal to debit card or mastercard in Uganda, we can guide u also in this

How long does it take to setup Virtual Paypal Account in Uganda?

PayPal Uganda virtual account Setup is done within 1 -4hrs, you can contact us on business@webvator.com or whats-app us on numbers on our website fro more details and if your from a restricted country and would like to also get this virtual PayPal account, please let us know and see how we can help you

Upon completion of the setup, your login details will be sent to you via email, allowing you to start utilizing the features of your PayPal account. This virtual account can be used for various purposes, including on fundraising platforms like GoGetFunding for NGOs seeking donors, on e-commerce websites during the checkout process, on gaming apps online, freelancing websites, and other platforms.

It’s essential to note that you have to reset the password to your password you prefer, but caution is advised against using VPN connections while logging into PayPal. Engaging in activities not allowed by PayPal is also discouraged to ensure the security and longevity of your account.

During the setup process, the recommendation is to configure a business account, even if the intention might be for personal use. While personal Virtual PayPal Uganda accounts are capable of receiving funds , they may come with limitations on certain features such as generating payment links or donation links. Opting for a business account provides versatility, allowing use for personal, business, and organizational purposes..

What is difference between a normal Uganda PayPal account and a Virtual PayPal account which can receive?

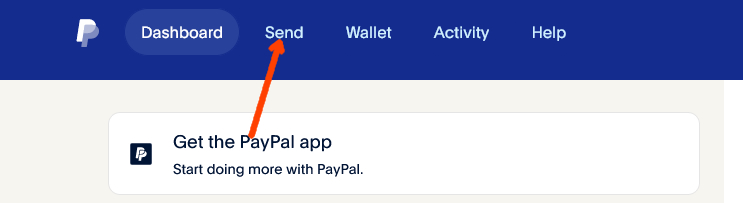

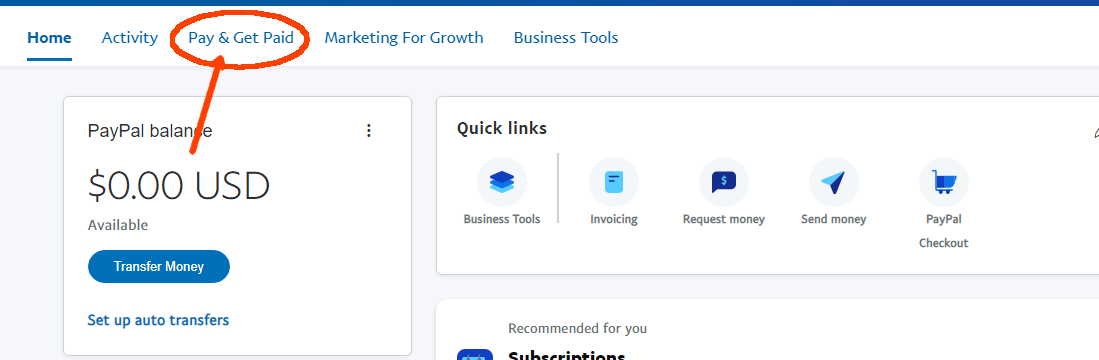

Normal PayPal Uganda account which can not receive but send. (Has only send on menu)

Virtual PayPal Uganda account which can RECEIVE AND SEND (Has both Pay & Get paid on menu)

Recent Virtual PayPal account News and Stories in Uganda 2024

![]() How to Restore a Restricted Virtual PayPal Account in Uganda.To speed up the restoration process, go directly to the PayPal Resolution Center using this link.(aypal.com/policy/icb). This is where you can see any outstanding actions required to resolve the issue. At times, notifications may not be obvious on the dashboard, and accessing this link will give you a clear view of what PayPal needs from you… Continue reading here…

How to Restore a Restricted Virtual PayPal Account in Uganda.To speed up the restoration process, go directly to the PayPal Resolution Center using this link.(aypal.com/policy/icb). This is where you can see any outstanding actions required to resolve the issue. At times, notifications may not be obvious on the dashboard, and accessing this link will give you a clear view of what PayPal needs from you… Continue reading here…

![]() What restrictions will you find in using Virtual PayPal accounts in Uganda. While virtual PayPal accounts can open up opportunities, they come with their own set of limitations and restrictions that users must be aware of to avoid issues such as frozen funds, account limitations, or failed transactions. Continue reading here…

What restrictions will you find in using Virtual PayPal accounts in Uganda. While virtual PayPal accounts can open up opportunities, they come with their own set of limitations and restrictions that users must be aware of to avoid issues such as frozen funds, account limitations, or failed transactions. Continue reading here…

![]() We created a virtual PayPal Account for an Organization to receive donations in Uganda.We managed to integrate a PayPal donate link on this organization in Uganda by creating a virtual PayPal account, enabling donations from anyone with a bank card, no matter their location. Continue reading here…

We created a virtual PayPal Account for an Organization to receive donations in Uganda.We managed to integrate a PayPal donate link on this organization in Uganda by creating a virtual PayPal account, enabling donations from anyone with a bank card, no matter their location. Continue reading here…

Things to consider when using virtual PayPal account

When using a Virtual PayPal account in Uganda for donations, it’s essential to be cautious to ensure a secure and transparent donation process. Here are some key considerations:

1. Clearly Communicate Purpose:

Clearly communicate the purpose of the donation to your audience. Be transparent about how the funds will be used and the impact they will have. This helps build trust with donors.

2. Use a Verified Virtual PayPal Account in Uganda:

Ensure that your Virtual PayPal account is verified. Verification adds an extra layer of security and credibility to your account. This process often involves confirming your bank account and linking a credit or debit card.

3. Check Transaction Fees:

Be aware of the transaction fees associated with receiving donations through Virtual PayPal. While creating a PayPal account is usually free, PayPal may charge a fee for each transaction. Communicate these fees to donors, and consider incorporating them into your fundraising strategy.

4. Regularly Monitor Your Uganda Virtual PayPal Account:

Keep a close eye on your PayPal account activity. Regularly monitor incoming donations, verify transaction details, and report any suspicious activity to PayPal immediately. This proactive approach helps maintain the security of your account.

5. Secure Your Virtual PayPal Account with Two-Factor Authentication:

Enable two-factor authentication for an extra layer of security. This typically involves receiving a verification code on your mobile device or through email, in addition to entering your password.

6. Update Contact Information in your Virtual PayPal Account:

Ensure that your contact information, including email and phone number, is up-to-date. This ensures that you receive important notifications and can be reached by PayPal if necessary.

7. Link a Business Account for Organizations:

If you’re representing an organization, consider using a Virtual PayPal Business account in Uganda. Business accounts provide additional features, including the ability to use your organization’s name for transactions and access to tools for invoicing and reporting.

8. Provide Donor Support:

Offer clear and accessible support to donors. Provide contact information or a support email where donors can reach out with questions or concerns related to their donations in your Paypal account.

9. Verify Tax-Exempt Status (for Nonprofits):

If your organization is a nonprofit and you wish to offer tax deductions to donors, ensure that your organization is tax-exempt. This might involve providing necessary documentation to PayPal and complying with relevant tax regulations.

10. Comply with PayPal Policies:

Familiarize yourself with PayPal’s policies, especially those related to donations. Adhering to PayPal’s terms of service ensures a smooth and compliant donation process.

11. Educate Donors:

Educate your donors about the Virtual PayPal Uganda account donation process, including any specific instructions for making donations. Provide a clear and user-friendly donation experience to encourage ongoing support.

By taking these precautions, you can create a secure and trustworthy environment for donors using your PayPal account for donations.

How To Create Virtual PayPal Account in Uganda for Organisations/NGOS/CBOs/Charity

If you represent or have a Non Government Organization (NGO), a Community Based Organizations (CBO) or charity and your organization wants to create a PayPal account which can be used for donations. You need to opt for Virtual PayPal Account in Uganda because a normal Ugandan PayPal account can not receive payments.

It’s possible to obtain the PayPal Account under organization’s name and this is what you need to create the virtual PayPal account for your organization in Uganda.

How to create the Virtual PayPal account in Uganda for a registered Organization?

To open up the PayPal account, you’ll need to have a valid certificate or license for your Uganda Organization, ID of one of the directors, Email account, Uganda mobile number and a fee of 150,000/= Uganda shillings.

The setup duration for a virtual PayPal account of an organizational is remarkably swift, typically taking only 1 to 4 hours.

This streamlined process allows organizations to quickly integrate PayPal into their financial operations, enabling them to receive donations seamlessly via there websites or using the PayPal donate link. The use of Uganda virtual PayPal accounts in the name of the organization provides a professional and efficient means of conducting online transactions.

It’s important to ensure that names used on your virtual PayPal account match the names on your real ID because PayPal will ask to verify your identity when you start receiving funds into your virtual PayPal account

PayPal does it to promote a secure and reliable financial environment for your organization’s online transactions. If you have any specific inquiries or wish to initiate the setup process, you can reach out to the provided contact information for more details and assistance.

How to create the Virtual PayPal account in Uganda for a NON-registered Organization?

If you are operating a charity without a valid license, you still have the option to establish a virtual PayPal account in Uganda for receiving donations. Collecting donations can be conducted at an individual level, as exemplified on platforms like GoGetFunding and other crowdfunding platforms, where individuals can create campaigns and receive contributions.

When using PayPal, we will meticulously select a category that aligns with your specific situation to mitigate scrutiny from PayPal regarding the reception of donations when formal registration is not in place.

To open up the virtual PayPal account for a non registered charity, you’ll need to suggest Organization name to use , Get an ID, Email account, Uganda mobile number and a fee of 150,000/= Uganda shillings.

The Identity can be a Uganda National ID, Driving permit or Passport.

Steps followed when creating PayPal account in Uganda for charity ;

1. Visit the PayPal website: Go to www.paypal.com.

2. Click on “Sign Up” or “Create Account”: Look for the button to sign up.

3. Select “Personal Account”: Choose the option for a personal account.

4. Fill in your email and create a password:

5. Provide basic information: Enter your legal name, address, and phone number. when asked about Category, make sure you choose NGO

6. Link a payment method: Add a bank account, credit card, or debit card.

7. Confirm your email address: Check your email and click on the confirmation link.

When you’re considering setting up a virtual PayPal account in Uganda for individual fundraising or personal causes not officially registered as a charity, it’s crucial to be transparent and ethical. Webvator knows how such setup should be done and avoid the mistake of using unprofessional people who have no idea of how this should be handled.

Below are some considerations to consider when creating a Virtual PayPal account for Organizations which are not legally registered :

Individual Fundraising: You can set up virtual PayPal account to initiate campaigns for personal causes, such as medical expenses, PET rescue donations, educational needs, etc. When setting up PayPal account, we clearly communicate the purpose of your PayPal account. Don’t forget to speak to us about the reason for opening for you the PayPal account

Category Selection on PayPal: When creating a virtual PayPal account in Uganda, carefully select a category that aligns with your individual fundraising needs. While this may help avoid unnecessary scrutiny, providing false information can violate PayPal’s terms and may lead to consequences.

Be aware that PayPal may conduct reviews to ensure compliance with its policies. If flagged, your activities may undergo scrutiny, and misleading information could result in penalties or account suspension.

While individuals can seek financial support for personal causes, it is vital to approach fundraising ethically, transparently, and within legal boundaries. If uncertain about legal requirements or platform usage, consider seeking advice from us to ensure compliance. Always prioritize honesty and transparency when communicating with donors and using online fundraising platforms.

How To Create Virtual PayPal Account in Uganda for Personal Use

If you’re considering the creation of a virtual PayPal account in Uganda for personal use, there are several important aspects to be aware of. Utilizing PayPal for individual purposes involves considerations tailored to personal needs. Let’s show you how to create a personal PayPal account in Uganda and also how to use a virtual PayPal account for personal purposes.

How to Create Virtual PayPal account in Uganda for Personal use and requirements

For Personal PayPal account, you need to have a valid up-to date National Identity, Telephone number (U might need to use one from a supported country), and email address. Most cases when we’re creating a virtual PayPal account for an individual, we usually use virtual telephone numbers of a specific supported country.

Our PayPal Uganda Consultancy fee rages from 100,000/= to 150,000/= Uganda shillings to create a virtual Personal PayPal account

Here’s how to create personal PayPal account in Uganda ;

1. Visit the PayPal website: Go to www.paypal.com.

2. Click on “Sign Up” or “Create Account”: Look for the button to sign up.

3. Select “Personal Account”: Choose the option for a personal account.

4. Fill in your email and create a password:

5. Provide basic information: Enter your legal name, address, and phone number.

6. Link a payment method: Add a bank account, credit card, or debit card.

7. Confirm your email address: Check your email and click on the confirmation link.

8. Optional: Verify your account: Confirm your bank account or provide additional identification details.

9. Explore account settings: Customize your preferences, add a profile picture, and review security settings.

Congratulations! Your personal PayPal account is now ready for use.

Here’s a breakdown of what you need to know about personal PayPal accounts in Uganda:

![]() PayPal Account Creation:

PayPal Account Creation:

Initiating a virtual PayPal account is the first step. Ensure accurate personal information is provided during the account setup process.

![]() Linking Payment Methods on PayPal:

Linking Payment Methods on PayPal:

Connect your PayPal account to your preferred payment methods, such as a bank account or credit/debit card, to facilitate seamless transactions.

![]() Security Measures:

Security Measures:

Implement recommended security measures for your account, including a strong password and enabling two-factor authentication, to safeguard your financial information.

![]() Transaction Types:

Transaction Types:

PayPal supports various transaction types for personal use, including sending money to friends and family, making online purchases, and receiving funds for personal causes.

![]() Currency Considerations:

Currency Considerations:

Be aware of the currency options available on PayPal and choose the one that aligns with your needs, especially if dealing with international transactions.

![]() Fee Structure:

Fee Structure:

Familiarize yourself with PayPal’s fee structure for personal transactions, ensuring transparency in financial dealings and understanding any potential charges.

![]() Personal Fundraising:

Personal Fundraising:

Individuals can leverage PayPal for personal fundraising endeavors, such as medical expenses, educational pursuits, or other personal causes, by setting up campaigns to receive donations.

![]() Legal Compliance:

Legal Compliance:

Abide by PayPal’s terms of service and comply with any local laws and regulations related to personal financial transactions to ensure a smooth and lawful experience.

How To Create a PayPal Account In Uganda for Online Games & Tiktok

We recently made a YouTube Video about Paying cash Games which pay to paypal and i strongly advise you to watch it before you try out these games that brand themselves as “Play Games For legit”, “games that pay real money instantly”, “paypal games that pay real money fast”, “free $100 paypal games”, ” slot games that pay instantly to paypal”, “android apps that pay instantly to paypal”, ” paypal games that pay real money ios”, ” free games that pay real money instantly”, “paypal game download”.. etc

Below is the video;

To setup Virtual PayPal account which you can use to receive PayPal from Games, visit the official website of PayPal, choose supported country and follow the setup process below;

Our PayPal Uganda Consultancy fee rages from 100,000/= to 150,000/= Uganda shillings to create a virtual PayPal account in Uganda you can use on Gaming Apps, you need also ID, Email address and Telephone number

Creating a PayPal account for use in games and Tiktok is not rocket science, but please note the steps below can differ on country your coming from

Below are the steps to create a PayPal account specifically for gaming purposes:

1. **Visit the PayPal Website:**

– Go to the official PayPal website by typing “www.paypal.com” in your web browser.

2. **Click on “Sign Up” or “Create Account”:**

– Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. **Select “Personal Account”:**

– Choose the option for a “Personal Account” as this is appropriate for individual use, including gaming, Titok payments and other online platforms.

4. **Fill in Your Email and Create a Password:**

– Enter your email address and create a secure password for your account.

5. **Provide Basic Information:**

– Enter your legal first and last name, address, and phone number. Make sure the information is accurate and matches your identification documents.

6. **Create a PayPal PIN (Optional):**

– You may have the option to create a 4-digit PIN for added security. This can be useful when contacting PayPal customer service.

7. **Link a Payment Method:**

– Link your preferred payment method to your PayPal account. This can be a bank account, credit card, or debit card. Linking a payment method allows you to make purchases within games.

8. **Confirm Your Email Address:**

– Check your email inbox for a confirmation email from PayPal. Click on the provided link to confirm your email address.

9. **Explore Account Settings:**

– Once your account is set up, you can explore your account settings. You may want to customize preferences, add a profile picture, and review security settings.

10. **Link PayPal to Games:**

– In the games or platforms where you want to use PayPal, navigate to the payment or account settings and link your PayPal account. This may involve providing your PayPal email address.

Now, your PayPal account is ready to be used for gaming purposes. You can make in-game purchases, receive payments, and use your PayPal account across various gaming platforms. Always ensure the security of your account by keeping your login credentials confidential and monitoring your transactions regularly.

You can use this Virtual PayPal account in Uganda on several games

1. Real Money :

PayPal serves as a secure and widely-used platform for receiving from real money games that pay to Paypal. It is commonly employed for various online transactions, making it easy for users to send and receive funds securely.

2. Win Gift Cards:

Some online platforms and games offer users the opportunity to win gift cards as prizes. These gift cards can be conveniently utilized through PayPal for online purchases or other transactions.

3. Win Rewards in Games:

Online games often feature reward systems where players can earn virtual or real-world rewards. PayPal provides a convenient way to receive tangible rewards earned within gaming environments.

4. Cash Paying Games:

Certain games offer cash rewards or payouts to players. PayPal is a preferred method for receiving these cash rewards due to its ease of use and broad acceptance.

5. Earn Free Money:

Various online platforms and apps offer opportunities to earn free money through activities like surveys, tasks, or promotions. PayPal is a common payout method for these earnings.

6. Earn Gift Cards:

Similar to winning gift cards, users can earn gift cards through online activities or promotions. PayPal becomes a useful intermediary for converting these gift card values into usable funds.

7. Games to Earn Money:

Some games are designed explicitly for users to earn money or rewards. PayPal serves as a reliable and secure channel for receiving these earnings.

8. Make Money by Playing Games:

Certain gaming platforms or apps allow users to make money by engaging in gameplay. PayPal is often the preferred method for cashing out these earnings.

9. Games that Give You Money:

PayPal facilitates transactions for games that provide monetary rewards to players. It ensures a seamless and secure transfer of funds.

10. Get Paid to Play Games:

Some platforms pay users for their time and skill in playing games. PayPal acts as a convenient means for receiving these payments.

11. Free Games for Money:

There are platforms that offer free-to-play games where users can earn money through various in-game activities. PayPal enables easy withdrawal of these earnings.

12. Game Rewards:

PayPal is often integrated into gaming reward systems, allowing players to redeem their in-game achievements or points for real-world monetary rewards.

PayPal plays a crucial role in facilitating secure transactions, withdrawals, and conversions of various rewards and earnings obtained through online gaming and other activities, feel fee to ask webvator.com regarding the authenticity of game your playing .

How to Create Virtual PayPal Account in Uganda for TikTok money Withdraw

When it comes to Tiktok, you can use a personal or business PayPal account to withdraw money from Tiktok, steps on opening up Paypal account for Tiktok withdraw are same as ones described above.

Our PayPal Uganda Consultancy fee for creating virtual Paypal account in Uganda which you can use to withdraw funds from Tiktok rages from 100,000/= to 150,000/= Ugx. You can use PayPal account on Gaming Apps, you need also ID, Email address and Telephone number

Several considerations come into play when creating a Virtual PayPal account for an E-commerce website. PayPal offers a variety of categories to select from during the account setup, and choosing the right category for your E-commerce website is vital.

For instance, if your E-commerce platform specializes in selling E-books, it is advisable to choose the ‘E-books’ category. Similarly, for websites dealing with digital products like software, Home appliances, drop shipping, medical drugs, and other specific niches, selecting the appropriate category during the virtual PayPal account setup is crucial. This proactive step helps in avoiding potential scrutiny from PayPal in the future.”

Creating PayPal account in Uganda for E-commerce websites

Creating a PayPal account in Uganda for use with E-commerce websites is a common thing, below are the steps to create a PayPal account for E-commerce purposes:

1. Visit the PayPal Website:

– Go to the official PayPal website by typing “www.paypal.com” in your web browser.

2. Click on “Sign Up” or “Create Account”:

– Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Select “Business Account”:

– Choose the option for a “Business Account” as this is appropriate for E-commerce transactions. We at Webvator.com advises not to use personal accounts when creating virtual accounts for eCommerce use

4. Fill in Your Email and Create a Password:

– Enter your email address and create a secure password for your account.

5. Provide Basic Business Information:

– Fill in the requested business information, including the business name, address, and phone number. Ensure that the information is accurate and matches your business details.

6. Add Business Details:

– You may be asked to provide additional business details such as the type of business, business structure, and other relevant information.

7. Link a Payment Method:

– Link your preferred payment method to your PayPal business account. This can be a business bank account, credit card, or debit card. This allows you to receive payments from customers.

8. Confirm Your Email Address:

– Check your email inbox for a confirmation email from PayPal. Click on the provided link to confirm your email address.

9. Provide Documentation (if required):

– Depending on your location and the nature of your business, PayPal may request additional documentation for verification purposes. This can include business licenses, tax IDs, or other relevant documents.

10. Explore Business Tools:

– Once your business account is set up, explore the business tools and features offered by PayPal. This may include invoicing, reporting, and integration options for E-commerce platforms.

11. Integrate PayPal with Your E-commerce Website:

– If you have an existing E-commerce website, integrate PayPal as a payment option. This involves configuring the payment settings on your website to accept PayPal payments. Many E-commerce platforms have built-in PayPal integrations.

Now, your PayPal business account is ready to be used for E-commerce transactions. Customers can make payments on your website, and you can manage your business finances through the PayPal business tools.

Before you create virtual PayPal account for your ecommerce website, PayPal generally prohibits certain types of businesses and activities due to legal or ethical considerations. Below are some examples of businesses or activities that PayPal may restrict or prohibit:

1. High-Risk Industries:

– Some high-risk industries, such as online gambling, adult content, or illegal activities, may face restrictions or limitations.

2. Weapons and Firearms:

– Selling weapons, firearms, or ammunition may be restricted or prohibited.

3. Drugs and Controlled Substances:

– Businesses dealing with illegal drugs or substances may not be supported.

4. Cryptocurrency Exchanges:

– PayPal may have restrictions on transactions related to certain cryptocurrency activities.

5. Hate Speech and Discrimination:

– Businesses promoting hate speech, discrimination, or illegal activities may face restrictions.

6. Ponzi Schemes and Pyramid Schemes:

– PayPal typically prohibits involvement in fraudulent investment schemes.

7. Counterfeit Goods:

– Selling counterfeit or unauthorized replicas of branded products may violate PayPal’s policies.

8. Money Services:

– Unlicensed money services, such as unregistered remittance or currency exchange, may not be supported. This affects also those offering PayPal to Mobile money withdraws in Uganda, Kenya, Ghana, Nigeria, Tanzania and Rwanda..

9. Multilevel Marketing (MLM):

– Some MLM or network marketing activities may be subject to restrictions.

10. Unregulated Gambling:

– Certain forms of online gambling or betting without proper licensing may be restricted.

If your not sure about the case with your business, please contact us and we advise for free.

Below are Uganda Virtual PayPal buttons or payment links you can integrate on your website

PayPal Uganda provides several types of buttons that can be integrated into E-commerce websites to facilitate various types of transactions.

Here are some commonly used PayPal buttons for E-commerce websites:

1. Paypal Buy Now Button:

– The “Buy Now” button allows customers to make instant purchases of a single item with a specified price. It’s suitable for straightforward transactions where customers want to buy a single product quickly.

2. PayPal Add to Cart Button:

– The “Add to Cart” button enables customers to add items to a shopping cart before proceeding to checkout. It’s ideal for E-commerce websites with multiple products and a shopping cart system.

3. PayPal Subscribe Button:

– The “Subscribe” button is used for subscription-based services or products. Customers can sign up for recurring payments, making it suitable for subscription boxes, memberships, or services with regular billing.

4. PayPal Donate Button:

– The “Donate” button is designed for non-profit organizations or websites seeking contributions. Users can make one-time or recurring donations with this button.

5. PayPal Automatic Billing Button:

– This button is useful for businesses that want to set up automatic billing plans. It allows customers to sign up for recurring payments with a specified frequency and amount.

6. PayPal Installment Plan Button:

– The “Installment Plan” button lets customers pay for a product or service in installments. It’s suitable for high-ticket items that customers may prefer to pay for over time.

7. PayPal QR Code Payments:

– PayPal also supports QR code payments, allowing customers to scan a QR code with their mobile devices to make a payment. This can be handy for in-person transactions or specific marketing materials.

8. PayPal Smart Payment Buttons:

– Smart Payment Buttons dynamically display the most relevant payment options based on the customer’s location and device. It includes PayPal, credit/debit cards, and other local payment methods.

9. PayPal Express Checkout Button:

– The “Express Checkout” button streamlines the checkout process, allowing customers to skip entering shipping and payment details on your site. It’s a faster checkout option.

10. PayPal Credit Card Buttons:

– PayPal allows businesses to add credit card buttons to accept payments directly without requiring customers to have a PayPal account.

These buttons can be easily generated and customized through the PayPal Merchant Services or PayPal Checkout integration, depending on your website’s needs and the specific type of transaction you want to facilitate.

If you require virtual PayPal account in Uganda integration for your Shopify, WordPress, or any other platform your website utilizes, feel free to reach out to us. We also specialize in the development of E-commerce websites.

Our PayPal Uganda Consultancy fee for creating virtual PayPal account in Uganda for eCommerce use rages from 150,000/= ugx to 200,000/= Ugx. You need Ecommerce Business Name , ID, Email address and Telephone number

PayPal is a versatile platform that supports a wide range of businesses across various industries.

Here are some examples of businesses that commonly use Virtual PayPal account in Uganda.

E-commerce Stores:

Virtual PayPal account in Uganda can be setup for E-commerce stores, ranging from small businesses to large retailers, widely adopt PayPal as a secure online transaction platform. It serves as a trusted payment method for customers making purchases on various online platforms.

Freelancers and Independent Contractors:

Virtual PayPal account in Uganda can be setup for Freelancers and independent contractors across diverse fields find PayPal invaluable for invoicing and receiving payments. Its ease of use and global acceptance make it a preferred choice for professionals offering services remotely.

Digital Goods Providers:

Virtual PayPal account in Uganda can be setup for Businesses involved in the sale of digital goods, such as software, e-books, and online courses, often leverage PayPal to facilitate seamless digital transactions. The platform’s secure infrastructure supports the digital economy.

Subscription-Based Services:

Virtual PayPal account in Uganda can be setup for Companies offering subscription services, including streaming platforms and membership sites, frequently utilize PayPal for managing recurring payments. Its subscription-based payment solutions provide a convenient and reliable option for ongoing services.

Charities and Non-profit Organizations:

Charities and non-profit organizations leverage virtual PayPal accounts in Uganda to collect online donations efficiently. The platform streamlines the donation process, offering a secure and user-friendly experience for supporters contributing to various causes.

Travel and Accommodation Services:

Within the travel and accommodation sector, PayPal is utilized by travel agencies, tour operators, and accommodation providers to accept payments for bookings and reservations. Its widespread acceptance contributes to a smoother booking experience for customers.

Online Marketplaces:

You can open virtual PayPal account in Uganda for Online marketplaces, exemplified by platforms like Etsy or eBay, integrate PayPal for secure payment transactions. This integration enhances trust and facilitates seamless financial transactions between buyers and sellers.

Consulting and Advisory Services:

You can open virtual PayPal account in Uganda for Businesses offering consulting, coaching, or advisory services find PayPal beneficial for invoicing clients and receiving payments. Its flexibility accommodates various billing structures, supporting professionals in client-focused industries.

Event Management:

You can open virtual PayPal account in Uganda for Event organizers employ PayPal to sell tickets, manage registrations, and handle payments for conferences, concerts, and other events. The platform’s versatility facilitates efficient event management and payment processing.

Gaming and Entertainment:

You can open virtual PayPal account in Uganda In the realm of gaming and entertainment, online gaming platforms, content creators, and entertainment services rely on PayPal for transactions related to in-game purchases, subscriptions, or digital content. It offers a secure and widely accepted payment method in the digital entertainment space.

Food and Beverage Services:

You can open virtual PayPal account in Uganda for Restaurants, cafes, and food delivery services often utilize PayPal for online orders and payments. The platform’s integration with various ordering systems enhances the efficiency of digital transactions in the food industry.

Health and Wellness Professionals:

You can open virtual PayPal account in Uganda for Health and wellness professionals, including fitness trainers, nutritionists, and therapists, leverage PayPal for appointment bookings and online consultations. Its ease of use and secure payment processing contribute to a seamless client experience in the health and wellness sector.

Education Institutions:

You can open virtual PayPal account in Uganda for Schools, colleges, and educational platforms utilize PayPal for accepting tuition payments and fees. Its secure and reliable payment infrastructure supports the financial aspects of academic institutions.

Technology and Software Sales:

You can open virtual PayPal account in Uganda for Technology companies and software developers often choose PayPal to sell software licenses, digital products, and services. Its global reach and reputation make it a preferred payment solution in the tech industry.

Real Estate Transactions:

You can open virtual PayPal account in Uganda for Real estate agents and property management companies may use PayPal for rental payments and property transactions. The platform’s secure transactions contribute to the efficiency of financial dealings in the real estate sector.

In summary, PayPal’s adaptability and secure payment solutions make it a versatile choice for businesses across various industries, enhancing the efficiency of financial transactions and contributing to a seamless customer experience.

How to Open up Business Virtual PayPal account in Uganda

Opening a virtual PayPal account for business purposes in Uganda involves several steps. below we detail the process

1. Visit the PayPal Website:

– Go to the official PayPal website by typing “www.paypal.com” in your web browser.

2. Click on “Sign Up” or “Create Account”:

– Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Select “Business Account:

– Choose the option for a “Business Account” as this is suitable for business purposes.

4. Fill in Your Email and Create a Password:

– Enter your email address and create a secure password for your business account.

5. Provide Basic Business Information:

– Fill in the requested business information, including the business name, address, and phone number. Ensure that the information is accurate and matches your business details.

6. Add Business Details:

– You may be asked to provide additional business details such as the type of business, business structure, and other relevant information.

7. Link a Payment Method:

– Link your preferred payment method to your PayPal business account. This can be a business bank account, credit card, or debit card. This allows you to receive payments from customers.

8. Confirm Your Email Address:

– Check your email inbox for a confirmation email from PayPal. Click on the provided link to confirm your email address.

9. Provide Documentation (if required):

– Depending on your location and the nature of your business, PayPal may request additional documentation for verification purposes. This can include business licenses, tax IDs, or other relevant documents.

10. Explore Business Tools

– Once your business account is set up, explore the business tools and features offered by PayPal. This may include invoicing, reporting, and integration options for E-commerce platforms.

Our PayPal Uganda Consultancy fee for creating virtual business PayPal account in Uganda which you can use for business purposes rages from 150,000/= ugx to 250,000/= Ugx. You need Business Name, ID, Email address and Telephone number for your business

How to create PayPal account for freelancing use

Creating a virtual PayPal account in Uganda for freelancing work is done not so differently as creating any other virtual PayPal account . It’s important to note that the availability of certain features or the process may change, so it’s essential to to always check updates from PayPal.

Here’s a general guide on creating the PayPal account for a freelancer

1. Visit the PayPal Website:

– Go to the official PayPal website by typing “www.paypal.com” in your web browser.

2. Click on “Sign Up” or “Create Account:

– Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Select “Personal Account:

– Choose the option for a “Personal Account” as this is suitable for individual freelancers.

4. Fill in Your Email and Create a Password:

– Enter your email address and create a secure password for your PayPal account.

5. Provide Personal Information:

– Fill in your legal first and last name, address, and phone number. Ensure that the information is accurate and matches your identification documents.

6. Link a Payment Method:

– Link your preferred payment method to your PayPal account. This can be a bank account, credit card, or debit card. Linking a payment method allows you to withdraw funds.

7. Confirm Your Email Address:

– Check your email inbox for a confirmation email from PayPal. Click on the provided link to confirm your email address.

8. Complete Identity Verification (if required)

– Depending on your location and PayPal’s policies, you may be required to complete additional identity verification steps. This can include providing a photo ID or other documentation.

9. Integrate with Freelancing Platforms:

– If you are freelancing on platforms like Upwork, Freelancer, or Fiverr, you can link your PayPal account to receive payments. Follow the platform’s instructions for linking your PayPal account.

11. Use for Freelance Transactions:

– Start using your PayPal account for receiving payments from clients. Provide your PayPal email address to clients when invoicing or receiving payments.

12. Withdraw Funds (if necessary):

– If you receive funds in your PayPal account, you can withdraw them to your linked bank account. Ensure that your bank account is properly linked for withdrawal.

Freelancers who open virtual PayPal accounts in Uganda usually come from the following sectors:

- Writing and Content Creation freelancers:

- PayPal accounts are used by Freelance writers, bloggers, copywriters, and content creators offer their writing services for articles, blog posts, website content, and marketing materials.

- Graphic Design Freelancers:

- PayPal accounts are used by Freelance graphic designers provide services for creating logos, branding materials, website graphics, and other design-related projects.

- Web Development and Design Freelancers:

- PayPal accounts are used by Freelance web developers and designers offer services for building and designing websites, including coding, UI/UX design, and customization.

- Programming and Software Development Freelancers:

- Freelance programmers and software developers work on coding projects, software development, and app creation.

- Digital Marketing Freelancers:

- PayPal accounts are used by Freelancers in digital marketing provide services such as social media management, SEO (Search Engine Optimization), content marketing, and online advertising.

- Video Editing and Production Freelancers:

- PayPal accounts are used by Freelance video editors and producers work on video editing, production, and post-production tasks for clients in the film, television, or online video industries.

- Photography Freelancers:

- Freelance photographers offer their services for events, portraits, product photography, and other photographic needs.

- Marketing and Public Relations:

- Freelance marketers and public relations professionals provide services in strategic planning, campaign management, and public relations efforts.

- Consulting and Business Services:

- Freelance consultants offer expertise in various fields such as business, finance, human resources, and management.

- Translation and Language Services:

- Freelance translators and interpreters provide language services for clients who require translation of written content or interpretation services.

- Virtual Assistance:

- Freelance virtual assistants provide administrative support services to businesses and entrepreneurs remotely.

- Illustration and Animation:

- Freelance illustrators and animators offer their artistic services for illustrations, animations, and other visual content.

- E-learning and Online Education:

- Freelance educators, course creators, and instructional designers contribute to the development of online courses and educational content.

- Data Entry and Administration:

- Freelancers in data entry and administration offer support in tasks such as data input, organization, and administrative assistance.

- Event Planning:

- Freelance event planners assist in organizing and coordinating events, conferences, weddings, and other special occasions.

Freelancers can be found in almost every industry, and the nature of their work allows them to collaborate with clients globally. The rise of online platforms has facilitated the connection between freelancers and clients, making it easier for businesses to find the specific skills they need for various projects.

Our PayPal Uganda Consultancy fee for creating virtual PayPal account in Uganda for Freelancing use rages from 100k Uganda shillings to 150k/= Ugx. You need ID, Email address and Telephone number

While PayPal is a versatile platform, there are certain activities and transactions that violate PayPal’s policies and terms of service. Users should refrain from using their PayPal accounts for the following:

1. Illegal Activities:

– Any transactions or activities that are illegal or involve the sale of illegal goods or services are strictly prohibited.

2. Fraudulent Actions:

– Engaging in fraudulent activities, including scams, phishing, or any form of deception, is against PayPal’s policies.

3. Gambling and Gaming:

– Using PayPal for online gambling, betting, or gaming activities that violate local laws or regulations is not allowed.

4. Adult Content:

– Transactions related to the sale or distribution of adult content, including explicit material, are prohibited.

5. Counterfeit Goods:

– Selling or purchasing counterfeit or unauthorized replicas of branded products is not allowed.

6. Ponzi Schemes:

– Involvement in fraudulent investment schemes, including Ponzi or pyramid schemes, is against PayPal’s policies.

7. Hate Speech and Discrimination:

– Using PayPal for activities that promote hate speech, discrimination, or violence is not allowed.

8. Drugs and Controlled Substances:

– Any transactions related to the sale of illegal drugs or controlled substances are strictly prohibited.

9. Weapons and Firearms:

– PayPal should not be used for transactions related to the sale or purchase of weapons, firearms, or ammunition.

10. Unregulated Money Services:

– Engaging in unlicensed or unauthorized money services, such as remittance or currency exchange, is not allowed.

11. Multi-level Marketing (MLM):

– Some forms of multi-level marketing or pyramid schemes may be restricted by PayPal.

12. High-Risk Investments:

– Transactions involving high-risk investments or speculative activities may be subject to scrutiny.

13. Unapproved Charities:

– Using PayPal for fundraising for unregistered or unauthorized charities may violate policies.

14. Cryptocurrency Transactions:

– While PayPal has introduced support for certain cryptocurrencies, engaging in certain cryptocurrency-related activities may be restricted.

15. Infringement of Intellectual Property:

– Engaging in transactions that involve the infringement of intellectual property rights, including copyright and trademark violations, is not allowed.

It’s essential for users to review and comply with PayPal’s Acceptable Use Policy and User Agreement to understand the specific activities that are prohibited. Violating PayPal’s policies can result in the suspension or closure of the account, and in some cases, legal action. Users should stay informed about any updates to PayPal’s policies and guidelines to ensure they are in compliance.

To avoid PayPal from suspending your account, it’s crucial to adhere to PayPal’s policies and guidelines. Here are some tips to help you maintain a compliant and secure PayPal account:

1. Provide Accurate Information:

– Ensure that all the information you provide during the account setup process is accurate and matches your identification documents. This includes your legal name, address, and contact information.

2. Verify Your Account:

– Complete any identity verification steps that PayPal may request. This may include providing additional documentation to confirm your identity.

3. Use a Valid Email Address:

– Use a valid and regularly monitored email address for your PayPal account. Ensure that you have access to the email address associated with your PayPal account for account notifications and communication.

4. Link a Verified Payment Method:

– Link a verified and legitimate payment method, such as a bank account or credit card, to your PayPal account. This not only enables you to make transactions but also adds a layer of security.

5. Regularly Update Your Information:

– Keep your account information up to date. If there are changes to your name, address, or contact information, update them in your PayPal account settings.

6. Understand and Comply with PayPal Policies:

– Familiarize yourself with PayPal’s Acceptable Use Policy, User Agreement, and other policies. Ensure that your activities on the platform align with these policies to avoid violations.

7. Use PayPal for Legitimate Transactions:

– Conduct only legitimate and lawful transactions using PayPal. Avoid engaging in activities that violate PayPal’s policies, such as illegal transactions, fraud, or the sale of prohibited items.

8. Secure Your Account:

– Use strong, unique passwords for your PayPal account. Enable two-factor authentication if available. Regularly review and update your security settings.

9. Monitor Your Account Activity:

– Regularly review your account activity and transactions. Report any suspicious or unauthorized activities to PayPal immediately.

10. Avoid High-Risk Transactions:

– Be cautious when engaging in high-risk transactions, as these may trigger account reviews. High-risk transactions include certain types of investments, online gambling, or transactions involving prohibited items.

11. Communicate with PayPal:

– If you have any questions or concerns about your account, contact PayPal’s customer support. Communicating with PayPal can help address issues proactively.

12. Comply with Regional Laws and Regulations:

– Ensure that your activities on PayPal comply with the laws and regulations of your region. Different regions may have specific requirements and restrictions.

13. Be Cautious with Cryptocurrency Transactions:

– If you’re involved in cryptocurrency transactions, ensure that you follow PayPal’s guidelines for such transactions to avoid any issues.

14. Regularly Check for Policy Updates:

– Stay informed about any updates or changes to PayPal’s policies. Regularly check the PayPal website or official communications for policy updates.

A Comparative Analysis of PayPal, Cash App, and Stripe in Uganda

In today’s digital age, the availability of multiple online payment platforms has provided individuals and businesses with convenient and efficient ways to manage financial transactions. Three prominent platforms, namely PayPal, Cash App, and Stripe, have gained popularity for their unique features and capabilities. This essay delves into a comparative analysis of these platforms, considering their strengths, weaknesses, and suitability for various users.

Virtual PayPal Account:

PayPal stands out as a global giant in the online payment industry. Renowned for its widespread acceptance and versatility, PayPal caters to both personal and business transactions. Its extensive user base and support for multiple currencies make it an ideal choice for those engaging in international transactions. PayPal offers a comprehensive suite of services, including invoicing, buyer and seller protection, and various integrations.

However, the platform’s transaction fees can be comparatively higher, and there’s a risk of account suspension if policies are violated. Despite these drawbacks, PayPal remains a go-to solution for individuals and businesses with diverse transaction needs.

To create Virtual Paypal account in Uganda, email business@webvator.com

Cash App :

Cash App can be created only via VPN in Uganda since its only supported in USA and UK only. Cash App with its user-friendly interface and simplicity, has carved a niche in the market for quick and easy peer-to-peer transactions. Primarily popular within the United States, Cash App is favored for its straightforward mobile payment capabilities. While it lacks some of the business-oriented features present in PayPal, its Cash Card facilitates physical purchases, adding a layer of convenience.

However, Cash App has limitations in terms of international functionality, making it more suitable for those seeking simplicity in domestic transactions.

To Open up a Cash App account in Uganda, email business@webvator.com

Stripe in Uganda:

Targeting a different market segment, Stripe has positioned itself as a robust platform for online businesses, especially in the e-commerce space. Recognized for its powerful features, extensive developer tools, and APIs for customization, Stripe caters to businesses with specific needs. It excels in supporting subscription-based models and recurring billing, making it a preferred choice for enterprises with complex payment structures.

Despite its robust capabilities, Stripe may have a steeper learning curve for non-developers and is not as well-known for peer-to-peer transactions.

To create Stripe in Uganda, email business@webvator.com

Choosing the Right Platform:

The choice between PayPal, Cash App, and Stripe ultimately hinges on the user’s specific needs and preferences. For personal transactions, both PayPal and Cash App offer viable options, with the decision dependent on individual preferences and desired features. In the realm of business transactions, Stripe shines with its tailored features for e-commerce, while PayPal remains a versatile choice. Cash App’s simplicity makes it an attractive option for casual or small-scale peer-to-peer transactions.

Consideration of factors such as transaction fees, international functionality, and the nature of transactions plays a crucial role in determining the most suitable platform. Users are encouraged to stay informed about updates and changes in these platforms’ services, as the fintech industry continues to evolve rapidly. In conclusion, the dynamic landscape of online payment platforms provides users with an array of choices, each catering to different needs and preferences in the ever-expanding digital financial ecosystem.

PayPal is available in a large number of countries around the world. However, the availability of specific features, services, and the ability to send or receive payments may vary depending on the country. PayPal continually expands its services to new regions, so it’s recommended to check the official PayPal website for the most up-to-date information.

Here is a general overview:

Countries where PayPal is Widely Available:

1. United States

2. United Kingdom

3. Canada

4. Australia

5. European Union countries (varies by specific services)

Countries with Limited PayPal Access:

1. Some countries in Asia, Africa, and South America may have limited access to certain PayPal services.

Countries with No PayPal Access:

1. Some countries, particularly those with strict financial regulations, may not have access to PayPal like Syria, russia, Somalia

It’s important to note that PayPal’s availability and the services offered can change, and new countries may be added to the list over time. To determine if you can set up a PayPal account in a specific country and what features are available, please visit the official PayPal website or contact PayPal customer support for the latest and most accurate information.

Creating a PayPal account in Uganda without a bank account is indeed possible and we will explain not only how to create PayPal Uganda account without Bank details but also things to put into consideration:

1. During setup, Skip Bank Details: When you’re setting up your PayPal account, you’ll typically be asked to link a bank account or a credit/debit card. However, these details are often optional. Simply skip the part where PayPal asks for bank details, and proceed with completing the rest of the account setup process.

2. Choose a right Category: During the setup, it’s crucial to select the appropriate category for your account. If your account will primarily be used for donations or charity purposes, ensure you choose a category that aligns with these activities. This helps PayPal understand the nature of your transactions and reduces the likelihood of any issues arising.

To create a PayPal account in Uganda without a bank account, you can follow these steps:

1. Visit the PayPal website: Go to the PayPal website and click on the “Sign Up” or “Sign Up for Free” button.

2. Choose account type: Select the type of account you want to create. You can choose between a Personal account or a Business account, depending on your needs.

3. Enter personal information: Fill out the required fields with your personal information such as your name, email address, and password. Make sure to use accurate information as this will be used to verify your account.

4. Skip bank details: When prompted to enter bank details, simply skip this step. PayPal allows you to skip adding a bank account during the signup process. However, keep in mind that not linking a bank account may limit some features and may raise suspicion with PayPal.

5. Verify your email address: After completing the signup process, PayPal will send a verification email to the email address you provided. Click on the verification link in the email to confirm your email address.

6. Confirm identity (if prompted): Depending on PayPal’s verification process, you may be asked to confirm your identity. Follow the instructions provided by PayPal to complete this step. This may involve providing additional personal information or verifying your phone number.

7. Start using your PayPal account: Once your account is set up and verified, you can start using your PayPal account to send and receive payments. You can use it for online shopping, sending money to friends and family, or receiving payments for goods and services.

8. Be aware of limitations: Keep in mind that not linking a bank account may have limitations on your PayPal account. For example, you may not be able to withdraw funds to a bank account or receive certain types of payments. Be sure to review PayPal’s terms and conditions for more information on account limitations.

By following these steps, you can create a PayPal account in Uganda without a bank account. However, it’s essential to be aware of any limitations and to consider linking a bank account in the future for added functionality and flexibility.

Considerations and Challenges when using PayPal Uganda account without bank details:

PayPal Holds: It’s common for PayPal to place holds on funds, especially for new accounts or transactions. These holds can last anywhere from 24 hours to Maximum 21 days. To learn how to mitigate these holds, you may refer to my Youtube video below that provide tips and strategies to get money from hold to available balance

Increased Scrutiny: PayPal may subject accounts without linked bank details to increased scrutiny. They may ask more questions or request additional verification steps to ensure the security and legitimacy of the account. Being prepared to provide necessary information can help streamline this process. To Link your bank card and verify your PayPal account, refer to this YouTube video

Transaction Size: It’s advisable to avoid conducting large transactions, especially when your PayPal account is new and doesn’t have linked bank details. Large transactions may trigger suspicion and prompt PayPal to request further documentation or verification. Starting with smaller transactions can help establish trust and credibility with PayPal.

By considering these factors and following the steps outlined above, you can successfully create a PayPal account in Uganda without linking a bank account. However, it’s essential to stay informed about PayPal’s policies and guidelines, as well as to be prepared to address any potential challenges that may arise during the account setup and usage process.

You can also watch video how to create a PayPal account in Uganda without bank details

Creating a PayPal account is generally free, but certain features or services may have associated fees. PayPal account creation involves the following steps.

Steps to Create a PayPal Account in Uganda:

1. Visit the PayPal Website:

– Go to the official PayPal website by typing “www.paypal.com” in your web browser.

2. Click on “Sign Up” or “Create Account

– Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Select “Personal Account” or “Business Account.

– Choose the type of account you want to create. For personal use, select “Personal Account.”

4. Fill in Your Email Address and Create a Password:

– Enter a valid email address that you regularly use, and create a secure password for your PayPal account.

5. Provide Your Personal Information:

– Enter your legal first and last name, address, and phone number. Make sure the information matches your identification documents.

6. Link a Payment Method:

– Link a payment method to your PayPal account. This can be a bank account, credit card, or debit card. This step is necessary for making transactions.

7. Verify Your Email Address:

– Check your email inbox for a confirmation email from PayPal. Click on the provided link to confirm your email address.

8. Complete Identity Verification (if required):

– Depending on your location or PayPal’s policies, you might be required to complete additional identity verification steps. This may include providing a photo ID or other documentation.

9. Explore Account Settings:

– Once your account is set up, you can explore your account settings, add additional email addresses, and set up security features.

10. Start Using Your PayPal Account:

– You can now use your PayPal account for making online transactions. If you intend to receive money, ensure that you share your PayPal email address with the person or platform sending the funds.

Our PayPal Uganda Consultancy are negotiable when it comes to students, don’t hesitate to talk to us if you want a free virtual PayPal account help. You need ID, Email address and Telephone number

Step-by-Step Guide to Withdrawing Upwork Earnings Using PayPal in Uganda

1. Set Up Your Upwork Account for PayPal Withdrawals:

- Log in to your Upwork account.

- Click on your profile picture in the top right corner and select “Settings.”

- In the “Settings” menu, navigate to “Get Paid.”

- Click on “Add Method” to add a new payment method.

2. Add PayPal as a Payment Method:

- Select “PayPal” from the list of available payment methods.

- Enter the email address associated with your PayPal account.

- Follow the prompts to complete the setup and link your PayPal account to Upwork.

3. Verify Your PayPal Account:

- Upwork may require you to verify your PayPal account. This usually involves confirming a small test deposit that Upwork sends to your PayPal account.

- Log in to your PayPal account, check for the test deposit, and verify the amount in Upwork to complete the verification process.

4. Initiate a Withdrawal from Upwork:

- Go to the “Get Paid” section in your Upwork account.

- Choose PayPal as your payment method.

- Enter the amount you wish to withdraw from your Upwork earnings.

- Confirm the withdrawal, and Upwork will process your request. This usually takes a few hours to a couple of days.

5. Transfer Funds from PayPal to Your Local Bank:

- Once the funds are in your PayPal account, you need to transfer them to your local bank account in Uganda. Unfortunately, direct bank transfers from PayPal to Ugandan banks are not supported directly.

- Use a third-party service that facilitates PayPal to bank transfers. Some options include:

- Payoneer: You can link your PayPal account to Payoneer and then withdraw the funds from Payoneer to your local bank account.

- Local Forex Bureaus: Some local forex bureaus in Uganda offer services to withdraw PayPal funds. Research and choose a reputable provider.

- Online webvator Paypl withdrawal services: Use online payment services that support PayPal withdrawals