Create a PayPal Account in Uganda, Receive and Withdraw

If you’re reading this page about creating a PayPal account in Uganda, chances are you’re either looking to set up an account to send payments or, more importantly, you want a PayPal account that allows you to both Pay and Get Paid online. Many people in Uganda face the challenge of PayPal restrictions, where the default account only supports sending money, making it difficult to receive payments from international clients, buyers, or even family members abroad.

In this guide, you’ll learn step by step how to set up a PayPal account in Uganda that will enable you to both pay and get paid online. We’ll start by walking through the process of creating a standard Uganda PayPal account that can be used for sending payments only (as this is what’s available by default in Uganda).

From there, we’ll explore how to upgrade your account to unlock the full “Pay & Get Paid” feature, giving you access to both sending and receiving capabilities.

Why Do Ugandans Use PayPal?

PayPal is one of the most popular online payment platforms worldwide, and Ugandans have found various practical uses for it. Despite limitations in certain features for Ugandan accounts, PayPal remains a vital tool for individuals and businesses alike. Here’s an overview of why Ugandans use PayPal:

1. Receiving Payments from Online Platforms

- PayPal Games: Many Ugandans participate in online games that pay through PayPal. These games often provide small but consistent earnings, which can accumulate over time.

- Freelancing Platforms: Platforms like Upwork, Fiverr, and Freelancer often use PayPal as a default payment option for freelancers. Ugandans use it to withdraw their earnings from writing, programming, design, and other online gigs.

- TikTok and Social Media Platforms: Creators on TikTok and other platforms receive payouts through PayPal for their content and monetization efforts.

2. Receiving Donations from Abroad

Organizations and individuals often rely on PayPal to receive donations from international supporters. This is particularly useful for NGOs, church ministries, and charity groups in Uganda.

3. Ecommerce and Digital Services

- Ecommerce Websites: PayPal enables Ugandan entrepreneurs to process payments for products and services on their online stores. This expands their market reach to international buyers.

- Membership Subscriptions: Websites offering memberships or premium content can use PayPal as a payment gateway for recurring subscriptions.

- Selling Digital Products: Writers, software developers, and other creators sell books, software, and digital assets using PayPal as a payment method.

4. Personal Transactions

- Receiving Money from Friends and Family Abroad: Ugandans with relatives overseas often use PayPal to receive money for personal needs.

- Convenient Withdrawals: Some users withdraw payments from PayPal accounts linked to their bank accounts or mobile money wallets in Uganda.

Why Create a “Pay and Get Paid” PayPal Account in Uganda?

A “Pay and Get Paid” PayPal account enables users to send and receive money, making it a versatile tool for both personal and business use. With this feature, Ugandans can:

- easily accept international payments.

- Avoid missing out on opportunities from platforms that exclusively use PayPal.

- Expand their businesses to a global audience.

When You Have No Choice

For some individuals and businesses, setting up a PayPal account isn’t just a preference—it’s a necessity. Many clients report that their payers or donors insist on PayPal as the only payment method.

If you’re in this situation and need assistance in creating a fully functional PayPal account in Uganda, we’re here to help. We offer guidance and support to set up a working PayPal account tailored to your needs.

Call us at: +256773168506 for professional advice and assistance.

Whether you’re a freelancer, business owner, or individual looking to transact globally, this guide will help you set up a functional PayPal account tailored to your needs in Uganda.

Step-by-Step Guide to Create a Uganda PayPal Account for Sending Payments

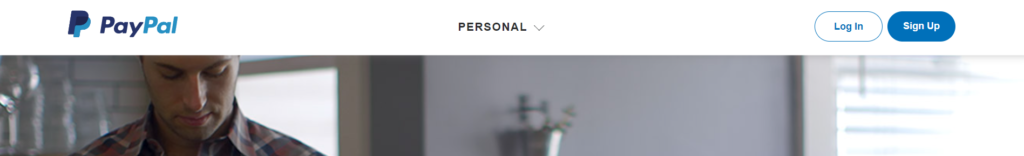

Step 1: Visit the Official PayPal Uganda Website

To get started, you need to go to the official PayPal website for Uganda. Visit this link: https://www.paypal.com/ug/. This ensures that you’re on the correct localized version of PayPal, specifically tailored for Ugandan users.

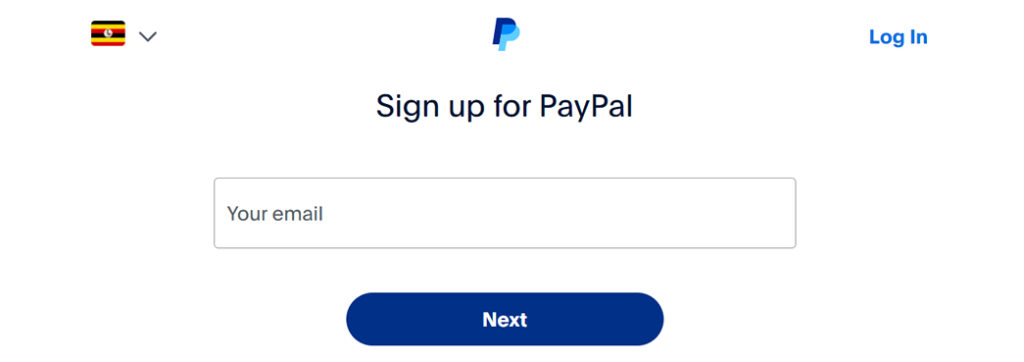

Step 2: Sign Up for a New Account

Once you’re on the PayPal Uganda homepage, click on the Sign Up button, which is usually found in the upper-right corner of the page..

Next, you’ll be asked to provide your email address. Make sure you enter a valid email that you have access to because PayPal will use this to verify your account and for all future communications.

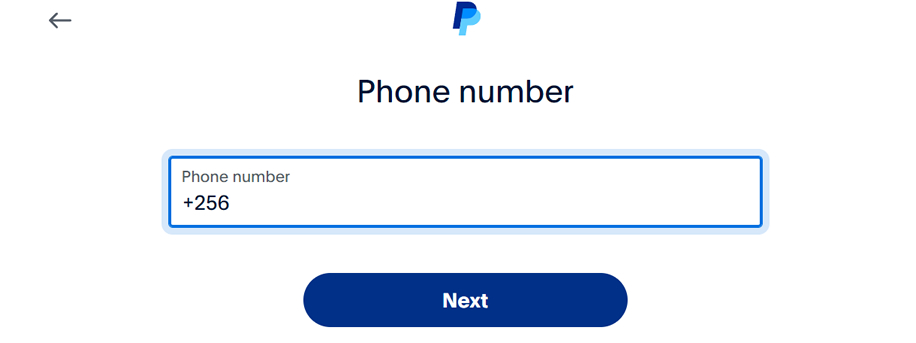

Step 3: Enter Your Phone Number

After entering your email, you will be asked to provide your phone number. Make sure you enter your current mobile number because PayPal will use this to verify your identity through SMS.

This step is important for account security. You’ll receive a confirmation code via text message, which you will need to input to proceed. Ensure that the phone number is linked to you personally, as PayPal may require this number for future security verifications.

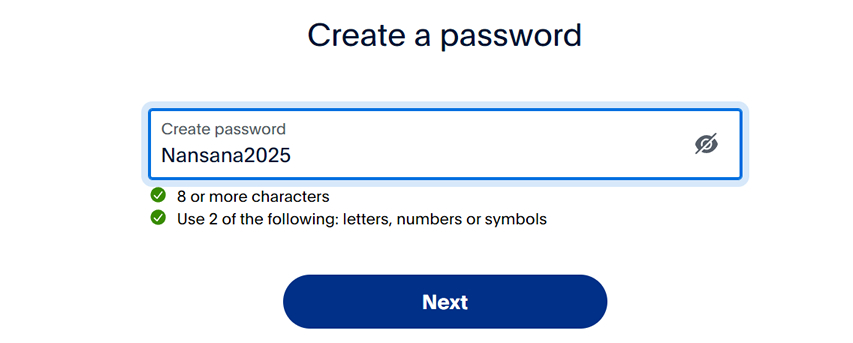

Step 4: Create a Strong Password

Now, it’s time to create a password for your PayPal account. Your password must be at least eight characters long and should include a combination of uppercase letters, lowercase letters, numbers, and special characters for added security. For example, a good password could be something like Nansana2025—a mix of letters and numbers that is easy for you to remember but difficult for others to guess.

Always ensure your PayPal password is unique and not used for other accounts to prevent unauthorized access.

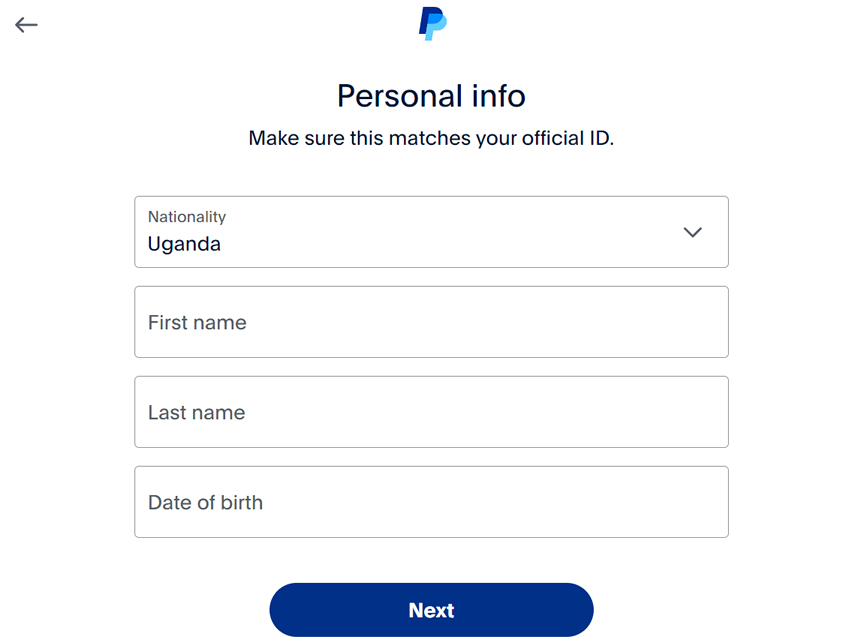

Step 5: Enter Your Personal Details

Next, you will be required to fill in your personal details. It’s essential that the information you provide matches exactly with your official identification documents, such as your National ID, Passport, or Driving License. This ensures smooth verification in case PayPal asks for identity confirmation in the future.

First Name: In Uganda, this refers to your local name. For instance, if your name is Nakamate Joan, Nakamate would be your first name.- Last Name: This is your English or family name, such as Joan in this case. Make sure this corresponds with how your names are written on official IDs.

- Date of Birth: Provide your correct date of birth as shown on your identification document.

- Country: The country should already be pre-selected as Uganda, but confirm it to ensure accuracy.

Accurate personal information is crucial to avoid any issues during future account verification or if PayPal needs to verify your identity for security reasons.

Step 6: Enter Your Address Information

After providing your personal details, you’ll be asked to enter your current residential address. This includes:

- Street Address: Enter the name of your street or village, such as Kikoni Road or Nansana Zone A.

- City: Enter your city or town, such as Kampala or Entebbe.

- Postal Code: For most Ugandan addresses, postal codes are not common. However, if you live in a city like Kampala, you can use a postal code like 00256. You can find a suitable code online or leave it blank if it’s optional.

- Phone Number: Confirm your phone number again in this section.

Ensure that your address information is accurate and current. This can be useful for future verifications, especially when linking your PayPal account to services such as mobile money or virtual cards.

Step 7: Agree to PayPal’s Terms and Conditions

Once you’ve entered all your information, you will need to agree to PayPal’s terms and conditions. Be sure to read through them to understand your rights and obligations as a PayPal user.

After checking the box to accept PayPal’s terms, click Agree and Create Account to finalize the setup process.

Step 8: Confirm Your Email Address

After submitting your information, PayPal will send a confirmation email to the address you provided earlier. Check your inbox for this email and click on the confirmation link to verify your email address. Without this step, your PayPal account won’t be fully active.

Make sure you complete this step promptly, as some PayPal features will remain unavailable until your email is confirmed.

Step 9: Link Your Payment Method (Optional but Recommended)

Once your account is created and verified, you may want to link a payment method, such as a credit or debit card, to fund your transactions. In Uganda, you can link cards from local banks or use virtual cards from services like Chipper Cash or Eversend. Linking a payment method is not mandatory for sending payments, but without adding a bank ATM card, you can not make your payments online, so adding a card is crucial if u want to be paying with PayPal in Uganda

To link a payment method:

- Go to your account settings.

- Select Link a Card or Bank Account.

- Enter your card details or follow the instructions to link your bank account.

Step 10: Start Sending Payments

Now that your PayPal account is fully set up and verified, you can start using it to send payments. Whether you’re paying for goods and services online, sending money to friends or family, or paying freelancers, your Uganda PayPal account will work efficiently for sending payments.

Below is video showing how i setup my Uganda PayPal account in 2Min

Tips for Using PayPal in Uganda

1: Verify Your Account: Fully verify your PayPal account by linking and confirming your debit card to lift any initial limits on transactions.

2: Currency Conversion: When paying for something in Dollars or in another currency, PayPal will do the conversion for you. Its ok linking your local Uganda shillings Bank account card to PayPal

What To Know About Using PayPal Uganda Services

Is PayPal Available in Uganda?: PayPal services are available to Ugandans just as it’s available to many other countries. If your from Uganda, you can create a PayPal account via the official PayPal Uganda website link: paypal.com/ug

By default a normal PayPal account created from Uganda can be used to send payments but not receiving, you can use the account to buy items from online, send money abroad, but softwares etc. This is possible by creating a Ugandan PayPal account and linking there a bank card(ATM bank card)

PayPal account in Uganda that can both receive and send: Since Uganda is among the African countries that can only send on PayPal but can’t receive, to create a PayPal account with both ability to send and receive, you need to create an account with “Pay & Get Paid” feature.

Receive money from Online in Uganda: This PayPal account helps you to receive payments from PayPal games, donations if you’re an organization, receive payments from friends and family abroad, you can use this PayPal account to withdraw from Tiktok, withdraw from games online, withdraw from freelancing websites such as Upwork, etc

Restricted Countries we do assist to create PayPal accounts which can receive: We not only help Ugandans to create PayPal accounts which can receive payments, but also countries like Namibia, Tanzania, Rwanda, Zambia, South Sudan and others. Feel free to contact us if we have not mentioned your country here. These PayPal accounts created for these restricted countries are meant to be used within those countries so you don’t need VPN when logging into PayPal.

How to Create a Pay & Get Paid PayPal Account in Uganda

If you’re in Uganda and have tried to use PayPal, you might have noticed something frustrating — the standard PayPal account only allows you to send money, not receive it. This is a major limitation for individuals and businesses in Uganda who need to accept payments from clients, especially internationally.

The reason for this limitation is due to PayPal’s regional restrictions. In countries like Uganda, Tanzania, and Namibia, PayPal accounts are restricted to sending only. To unlock the full functionality of PayPal, you need to enable the “Pay & Get Paid” feature, which allows you to both send and receive funds.

This feature comes automatically when you create a PayPal account in countries like South Africa, Kenya, Europe, and Canada. However, in countries like Uganda, this feature is not available by default. The good news is that with the right approach, you can set up a PayPal account in Uganda that allows you to both send and receive payments.

I will walk you through the steps to create a fully functional Pay & Get Paid PayPal account in Uganda.

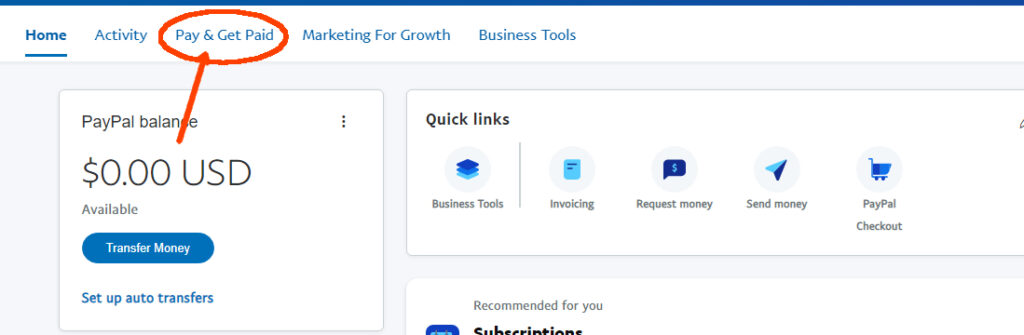

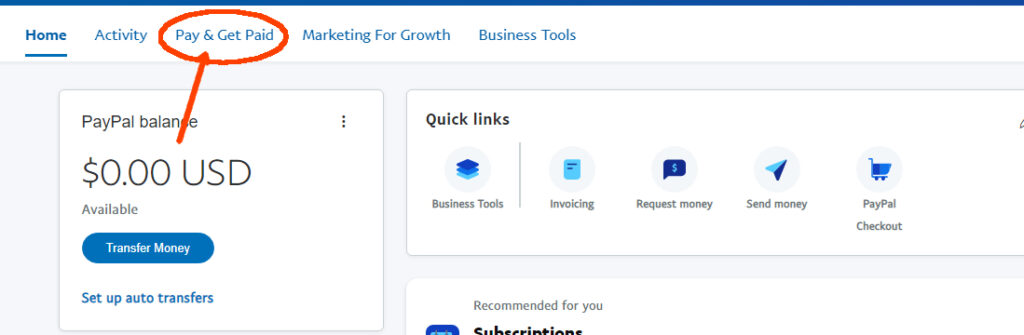

How to Tell if Your PayPal Account Can Only Send Money

Before we jump into the setup process, let’s first check your existing PayPal account.

- Log in to your PayPal account.

- Navigate to the menu and check for the option “Send” or “Pay & Get Paid.”

If you see “Send” only, that means your account is restricted to sending payments. If you see “Pay & Get Paid”, congratulations! Your account already supports both sending and receiving funds.

If your account shows only the “Send” option, or if you’re just starting to set up a PayPal account in Uganda, follow the steps below to unlock the full features of PayPal.

Step-by-Step Guide to Setting Up a Pay & Get Paid PayPal Account in Uganda

While setting up a PayPal account in Uganda directly won’t give you the ability to receive funds, there’s a workaround that allows you to enjoy full PayPal functionality. Follow these steps:

Step 1: Visit PayPal’s Website and Start the Signup Process

Go to PayPal’s official website using a browser. Once you’re on the website, click the Sign Up button, which is usually at the top-right corner of the page. This will begin the process of creating your new PayPal account.

Step 2: Choose a Personal PayPal Account

PayPal offers two types of accounts: Personal and Business. Select the Personal Account option. This is the right choice for individuals who want to send and receive money, whether for personal or freelance work. A business account is typically used for managing larger-scale transactions, but for most people in Uganda, a personal account is sufficient.

Step 3: Select a Country with No PayPal Restrictions

This step is crucial. PayPal limits its services in countries like Uganda, but there are no such restrictions in many other countries. During the signup process, PayPal will ask you to select your country. Instead of choosing Uganda, select a country that has no restrictions on PayPal usage. Canada is an excellent option for this purpose, but you can also choose any other.

Step 4: Complete the Rest of the Signup Process

After choosing a country, proceed with the rest of the registration process. You’ll need to fill in basic details such as your email address, password, and personal information like your name and address. For the address field, use a valid address from the country you selected (you can easily find a public address online). You’ll also be asked to confirm your email address by clicking on a link sent to your inbox.

Step 5: Link a Payment Method

Once your account is created, you’ll need to link a payment method to verify your PayPal account. There are two ways to do this:

- Link a Bank Account: If you have a bank account in a country where PayPal is fully supported (like South Africa or Kenya), you can link it to your PayPal account.

- Use a Virtual Card: If you don’t have a foreign bank account, you can use a virtual card service like Chipper Cash or Eversend to link to your PayPal account. These services offer virtual Visa or MasterCard options that are accepted by PayPal for verification purposes.

Step 6: Confirm Your Identity

PayPal will likely ask you to verify your identity by sending proof of identification, such as a passport or national ID card. Ensure that the name on your PayPal account matches the one on your identification documents to avoid any issues during verification.

Step 7: Activate the “Pay & Get Paid” Feature

Once your account is fully set up, the “Pay & Get Paid” feature will automatically be available on your account, since you registered it as a resident of a country with no PayPal restrictions. You can now send and receive payments without limitations.

Why This Works

By choosing a country without PayPal restrictions during the signup process, you bypass the limitations imposed on Ugandan accounts. PayPal recognizes your account as being from a country like Canada or South Africa, where full PayPal functionality is allowed, thus enabling the “Pay & Get Paid” feature.

Additional Considerations

- Compliance: It’s important to note that using a foreign address to create a PayPal account may violate PayPal’s terms of service, so use this method cautiously.

- Virtual Cards for Verification: Virtual cards like those from Chipper Cash or Eversend are a great solution if you don’t have access to a foreign bank account. Make sure to use a virtual card that is supported by PayPal to avoid verification issues.

- Withdrawing Funds: Once you’ve set up a PayPal account with the “Pay & Get Paid” feature, you can withdraw funds using services like Payoneer, which allows you to transfer PayPal balances to local bank accounts or use virtual cards for withdrawal.

Types of PayPal Accounts in Uganda

PayPal offers two main types of accounts: Personal Accounts and Business Accounts. These account types are universal across all countries, whether you’re in Uganda, Namibia, the USA, or any other part of the world—the options remain the same.

Personal Accounts

A Personal Account is designed for individuals who want to use PayPal for personal purposes. This type of account is ideal for everyday transactions, such as shopping online, sending or receiving money from friends and family, and managing small-scale payments. When you set up a Personal Account, it is linked to your personal details, including your name, making it perfect for private users who don’t need their account tied to a business entity.

Business Accounts

A Business Account, on the other hand, is tailored for businesses, organizations, and professionals who want their PayPal transactions associated with a company or brand rather than their personal identity. With this type of account, you can register your business name or organization name, enabling you to issue invoices, receive payments under your business name, and access tools designed for larger-scale financial management and e-commerce.

Both types of accounts offer a seamless way to conduct transactions, but the choice between a Personal and a Business Account ultimately depends on your needs. If you’re an individual user, a Personal Account is sufficient. However, if you represent a business or organization, opting for a Business Account ensures a professional representation of your transactions.

Since PayPal lists only two types of accounts—Personal and Business—many individuals representing organizations often feel uncertain about which option to choose during setup. For organizations, the correct choice is the Business Account.

When setting up a Business Account for an organization:

- Select “Business” as the Account Type: This ensures that the account is associated with the organization’s name rather than an individual’s personal details.

- Choose “Organization” as Your Business Type: During the registration process, PayPal will prompt you to specify the nature of your business. Select “Organization” to ensure your account reflects the nature of your work.

- Specify the Category of Programs You Offer: PayPal will also ask for additional details about your organization. Select the appropriate category that best describes your programs, services, or activities, such as “Nonprofit,” “Charitable Services,” or any other applicable designation.

How to Withdraw Funds from Your PayPal Account in Uganda

What if you want to withdraw money from PayPal to your bank or mobile money by yourself without passing through anyone?

Now we are going to talk about withdrawing that money , since you have got an account that can receive.

In countries where PayPal account is not restricted, Money in your paypal can be withdrawn and appear on your bank account within 1 – 3 days. But in Uganda and other restricted countries, you can withdraw money to your Mobile money number using Mpesa, virtual bank accounts or our service below and other platforms we will recommend you.

It is possible to withdraw funds from PayPal to a bank account if you have an account from a country that PayPal allows for withdrawals. For instance, if you are in Uganda, you may acquire a bank account in Kenya (specifically Equity Kenya) or obtain a Safaricom line for Mpesa mobile money transactions. However, this process involves traveling to Kenya to register Mpesa line or create Equity Bank account which some people find it hard, prompting many individuals to enlist the assistance of “PayPal agents” who can facilitate withdrawals to mobile money or a bank.

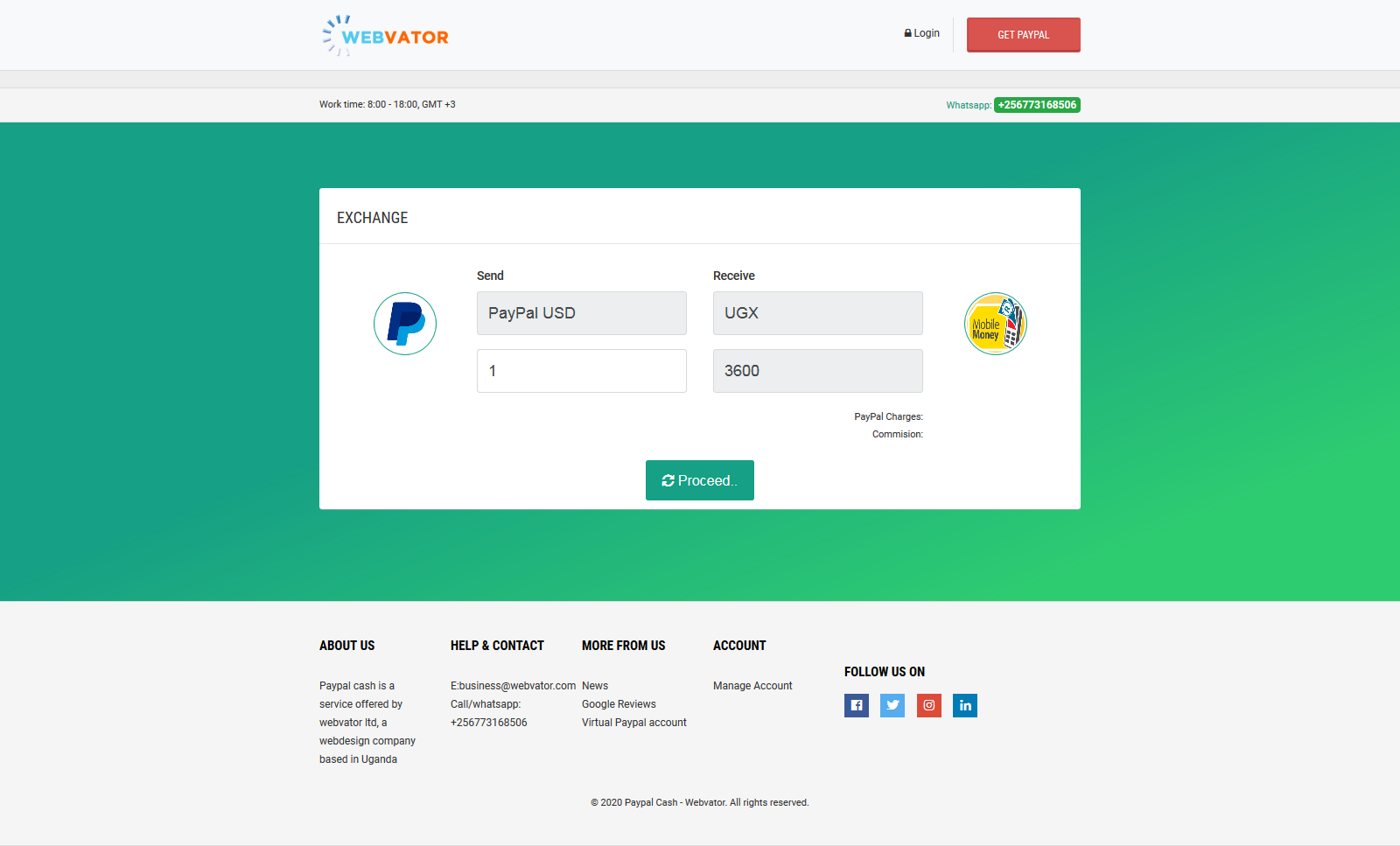

You can also use our PayPal Withdraw services, you can check rates on this link https://paypalcash.webvator.com

You might ask why are rates low when you use that link?

The rates are low because the process of withdrawing money from PayPal involves several third parties, each of which charges a fee.

When you send money from your account to my PayPal account, PayPal charges a fee. I then cash out that money through M-Pesa, where M-Pesa converts the USD to Kenyan Shillings at their rate.

Once the money is on M-Pesa, I transfer it to MTN Uganda, where MTN converts the Kenyan Shillings to Ugandan Shillings at their rate. Finally, I send you the money minus my facilitation fee.

As a result, you receive slightly less money compared to the USD rates at banks or forex exchanges.

With 100$, you can expect 310,000 ugx if your to use withdraw services of PayPal agents n Kampala.

PayPal Uganda Consultants in Uganda

The PayPal Uganda consultants contact is 0773168506 0r 0706686059 and the address is Cornerstone Plaza, RM: MP-76 Third Floor.

PayPal Uganda office and contacts in Uganda: The PayPal main office is located in California, at North First Street campus.

PayPal Uganda Cash App – https://paypalcash.webvator.com

The Uganda PayPal App on paypalcash.webvator.com will transfer your money from PayPal to mtn Uganda, or PayPal airtel money Uganda on your phone, any amount is supported and money is sent your mobile money within minutes, if amount exceeds $3000, it can take upto 24Hrs.

Benefits of Using a receiving PayPal Account in Uganda

Knowing how to create a PayPal account in Uganda is crucial for anyone looking to participate in the global digital economy. Whether for personal use or business purposes, a PayPal account provides numerous benefits, including secure transactions, access to international markets, and financial convenience. By Opening up a PayPal account, you can take advantage of these opportunities and enhance your financial operations.

Understanding how to create a PayPal account in Uganda is essential due to the numerous benefits some of which have listed below:

- Facilitate International Transactions: Easily send and receive money globally from friends and relatives where other options such as western union and bank wire are harder or no option to them.

- Enhance Online Shopping Experience: Access a wider range of international products and services.

- Receive Payments for Freelance Work: Conveniently get paid by clients worldwide.

- Receive Payments from Games: Most online games pay to PayPal making it hard to ignore getting a receiving PayPal account tin Uganda.

- Tiktok Cashouts/Withdraws: If your using TikTok in Uganda and your eligible to get payments from your Lives and also Creator fund, PayPal is the easiest option available .

- Donations are Organizations:

In Uganda, there are very few payment gateways that support NGOs. While payment gateways like Pesapal cater to businesses, they do not offer adequate solutions for NGOs. Therefore, knowing how to create a PayPal account in Uganda for receiving donations can be a valuable option.Other gateways, such as Flutterwave, require extensive documentation, and even with the proper paperwork, many users report issues with card payments on the Flutterwave platform, including our clients. A PayPal account might be an excellent alternative for NGOs seeking online funding, offering a more reliable and accessible solution. - Cost-Effective Solution: Save on transfer fees and currency conversion rates.

- Build Financial Credibility: Enhance trust with international clients and partners.

- Convenience and Flexibility: Manage transactions on the go with PayPal’s user-friendly platform and mobile app.

- Participation in Global E-Commerce: Engage in the global market effectively.

- Secure Payment Method: Benefit from robust security features.

- Streamline Business Operations: Simplify the payment process for online sales and invoicing.

- Access to Business Tools: Utilize PayPal’s invoicing, payment tracking, and e-commerce integration tools. Etc

Creating a PayPal account in Uganda is a crucial step to take advantage of the global digital economy, offering secure, convenient, and efficient financial transactions.

Requirements to Create a receiving PayPal Account in Uganda

Before you start creating a PayPal account in Uganda, ensure you have a valid email address, personal information, identification documents, reliable internet access, a mobile phone, and meet the legal age requirement.

Here’s what you need in details when opening PayPal account in Uganda:

1. Valid Email Address

Ensure you have a valid email address that you can access. This will be used to create your PayPal account and for all future communications from PayPal.

2. Personal Information

You will need to provide basic personal information such as your full name, address, and phone number. Make sure this information matches your official identification documents.

3. Identification Documents

Although not always required immediately, having a valid form of identification, such as a National ID or passport, is important for verifying your account later on.

4. Credit or Debit Card, Virtual Cards(Optional)

You will need a valid credit or debit card to link to your PayPal account. This is necessary for verifying your account and for making online purchases. Make sure your card supports online transactions and is enabled for international use.

5. Internet Access

Reliable internet access is necessary to sign up and manage your PayPal account. Ensure you have a stable internet connection to avoid interruptions during the setup process.

6. Mobile Phone

A mobile phone is required to receive verification codes and for setting up two-factor authentication (2FA), which adds an extra layer of security to your account.

7. Legal Age Requirement

You must be at least 18 years old to create a PayPal account. Ensure you meet the age requirement as per PayPal’s user agreement.

8. Country of Residence

Verify that Uganda is listed in the country options when signing up on the PayPal website. This ensures that PayPal’s services are available and tailored to your region.

Pay & Get Paid PayPal Account in Uganda

What is Difference between an Ordinary Uganda PayPal account and a PayPal account with “Pay & Get Paid” feature

Distinguishing between an ordinary Ugandan PayPal account and a “Pay & Get Paid” PayPal account in Uganda involves understanding their respective functionalities. An “ordinary” Ugandan PayPal account is characterized by restrictions on receiving funds. Essentially, users with such accounts are limited to only making payments; they can pay for goods and services but cannot receive money.

On the other hand, a “Pay & Get Paid ” in Uganda possesses more comprehensive capabilities. Unlike its ordinary counterpart, this account allows users to both receive and send funds. This expanded functionality is particularly valuable for individuals or businesses engaging in a wide range of financial transactions, as it facilitates the receipt of payments for goods, services, or even donations.

The distinction, therefore, lies in the one-sided nature of an ordinary Ugandan PayPal account, which is primarily designed for outgoing payments. In contrast, a “Pay & Get Paid” PayPal account offers a two-way financial channel, enabling users to not only pay for products and services but also receive funds for their own offerings. This differentiation is crucial for users seeking a more versatile PayPal experience tailored to both sending and receiving money within the Ugandan context.

Brief overview of PayPal Uganda account with “Pay & Get Paid” Feature and its significance for Businesses.

PayPal is a widely used online payment platform that facilitates secure and convenient financial transactions. PayPal Accounts in Uganda serves as digital wallets, allowing users to send and receive money, make online purchases, and conduct various financial activities. PayPal’s significance for organizations lies in its ability to streamline and enhance financial operations in the following ways:

1. Global Reach: Receiving PayPal Uganda enables organizations to transact internationally, providing a platform for seamless cross-border transactions. This global reach is particularly beneficial for businesses with an international clientele.

2. Online Payment Processing: Organizations can integrate PayPal Uganda into their websites, allowing them to accept online payments for products, services, or donations. This enhances the efficiency of payment processing and expands the organization’s revenue channels.

3. Donation Collection: Nonprofit organizations can leverage PayPal Uganda for collecting donations online. The platform offers a secure and user-friendly way for supporters to contribute to causes, fostering increased engagement and financial support.

4. Secure Transactions: PayPal Uganda employs robust security measures, including encryption and fraud detection, ensuring that financial transactions are conducted in a secure environment. This is crucial for maintaining the trust of donors, customers, and partners.

5. Professional Image: Utilizing PayPal business account in the organization’s name adds a professional touch to financial transactions. It instills confidence in clients, customers, and donors, contributing to a positive perception of the organization.

6. Flexibility in Payment Methods: PayPal Uganda account supports various payment methods, including debit cards and bank transfers, offering flexibility for users. This versatility makes it easier for organizations to cater to the diverse preferences of their audience.

7. Ease of Use: The user-friendly interface of “Pay & Get Paid ” PayPal Uganda account makes it accessible to individuals and organizations alike. Setting up an account is relatively straightforward, and the platform offers tools and resources to simplify financial management.

What are Requirements to create a receiving PayPal account in Uganda with Pay & Get Paid feature

Incase you find it technical to create a receiving PayPal account, we can assit you and below are the requirements to come with;

- First and Last names as they appear on your National ID, Or Passport or Driving permit

- Date of Birth

- Email address and Telephone

- Business name or Organization if you have

- Consultancy fee

Should Organizations Use Personal or Business PayPal Accounts?

Organizations should always opt for Business Account setups rather than Personal Accounts. While Personal Accounts are designed for individual use and small-scale transactions, they come with significant limitations that make them unsuitable for organizational needs.

Why Business Accounts Are Essential for Organizations

- Access to Crucial Features

Business Accounts offer advanced features that are vital for organizations, such as the ability to create donation links. These links are essential for nonprofits, charities, and other organizations that rely on donations to fund their activities. Personal Accounts typically lack this functionality, making them inadequate for organizational purposes. - Professional Representation

A Business Account allows the organization’s name to appear on transactions instead of an individual’s name. This adds credibility and professionalism, which is crucial when dealing with donors, clients, or stakeholders. - Higher Transaction Limits

Personal Accounts are subject to more restrictive limits on transaction volume and amount, which could hinder an organization’s operations. Business Accounts, on the other hand, are designed to handle larger volumes of payments and withdrawals. - Customized Payment Options

With a Business Account, organizations can integrate customized payment solutions, such as invoicing tools, payment buttons, and checkout options for their website. These tools streamline donation and payment processes, making it easier for donors and clients to contribute or pay. - Regulatory Compliance

Business Accounts are structured to meet the regulatory requirements for organizations. This ensures smoother compliance with PayPal’s terms of service and reduces the risk of account freezes or disputes.

Why Not Use a Personal Account?

While a Personal Account may seem simpler to set up, its limitations can create unnecessary hurdles for organizations. The inability to enable donation links is a significant drawback, as is the lack of professional branding on transactions. Additionally, as the organization grows, a Personal Account may fail to handle the increased transaction volume, leading to disruptions in operations.

Frequently Asked Questions Concerning How to Create PayPal Account in Uganda

How to Create a PayPal Account in Uganda for both sending and receiving Purposes

To create a PayPal account in Uganda that allows you to receive payments, the key is to ensure that your account has the “Pay and Get Paid” feature enabled. This feature is crucial because it allows your PayPal account not only to send payments but also to receive funds from clients, customers, or anyone else globally. Without this feature, your PayPal account will be restricted to sending payments only, which is the default setup for Ugandan accounts.

The “Pay and Get Paid” feature is essentially what transforms your account into a fully functional tool for both paying and getting paid, allowing you to access the full range of PayPal’s services. Once this feature is enabled, you’ll be able to receive payments, withdraw funds, and manage international transactions efficiently.

How much does it cost to setup Paypal Uganda Account with Pay and Get Paid feature

Uganda PayPal account setup is free, in fact all PayPal accounts are free to set up, PayPal only deducts a fee when you receive ranging from 1.90% to 3.49%) plus a fixed fee per transaction.. For more details concerning Paypal Fees, click here

In-case you need our support in setting up your PayPal account and integrating it on website, we charge from 100,000 Ugx to 150,000/= Uganda shillings inclusive of payment integration on your website or social media.

Creating Uganda PayPal which can receive might not be that hard but documents involved and financial explanations to be drafted are reasons we charge a negotiable fee

How to Create PayPal Account in Uganda Using Mobile phone /App

Creating a PayPal account in Uganda using a mobile phone is a convenient way to set up your Paypal account in Uganda. Instead of using the website, you can conveniently set up your PayPal account directly from your mobile phone using the PayPal app and this guide will take you through the steps to set up a PayPal account using your mobile device.

Step-by-Step Guide

Step-by-Step Guide

- Download the PayPal App

- Open the App Store (iOS) or Google Play Store (Android) on your mobile phone.

- Search for “PayPal” and download the official PayPal app developed by PayPal Mobile.

- Install and Open the App

- Once the download is complete, install the app on your device.

- Open the PayPal app by tapping the icon on your home screen.

- Sign Up for a New Account

- Tap on “Sign Up” to begin the account creation process.

- Choose between a “Personal Account” and a “Business Account” based on your needs.

- For most individual users, a Personal Account is sufficient. Tap “Next” to continue.

- Enter Your Personal Information

- Fill in the required fields with your first and last name, email address, and a secure password.

- Tap “Next” to proceed.

- Provide Your Address and Contact Details

- Enter your address details, including street, city, and postal code.

- Provide your phone number. This is important for account verification and security purposes.

- Tap “Next” after filling in all the details.

- Agree to Terms and Conditions

- Review PayPal’s User Agreement and Privacy Policy.

- Tap “Agree and Create Account” to accept the terms and proceed.

- Link Your Bank Account or Mobile Money

- PayPal requires a funding source to verify your account. In Uganda, you can use your bank account or mobile money service.

- To link a bank account: Tap “Link a Bank” and follow the instructions to add your account details.

- To link mobile money: Select the option to link your mobile money account (such as MTN Mobile Money or Airtel Money) and follow the prompts.

- Verify Your Email Address

- PayPal will send a verification email to the address you provided. Open your email inbox, find the email from PayPal, and tap the verification link to confirm your email address.

- Start Using Your PayPal Account

- Once all the steps are completed, you can start using your PayPal account to send and receive payments.

- You can manage your account, view transactions, and access various features directly from the PayPal app on your mobile phone.

Step-by-Step Guide to Receiving Payments with Your PayPal Account in Uganda

Step 1: Ensure Your PayPal Account is Set Up

- Create and Verify Your Account

- If you haven’t already, follow the steps to create and verify your PayPal account. Ensure all personal and banking information is accurate and verified.

- Link Your Bank Account or Mobile Money

- Ensure your local bank account or mobile money service (e.g., MTN Mobile Money, Airtel Money) is linked to your PayPal account. This step is crucial for receiving funds and transferring them to your local account.

Step 2: Update Your PayPal Account Settings

- Log In to Your PayPal Account

- Open the PayPal app or website and log in with your credentials.

- Go to Settings

- Navigate to the “Settings” or “Profile” section of your account.

- Set Up Payment Receiving Preferences

- Ensure your account is set to receive payments. Go to “Payments” or “Payment Receiving Preferences” and configure your settings as needed.

Step 3: Share Your PayPal Email Address

- Provide Your PayPal Email

- Share your PayPal email address with clients or customers who need to send you payments. This is the email address associated with your PayPal account.

- Request Payments

- Ask clients to use the “Send Money” option in their PayPal account or app. They should enter your PayPal email address, the amount to be sent, and any other required details.

Step 4: Receiving Funds

- Check Your PayPal Account

- Regularly check your PayPal account for incoming payments. You will receive a notification email from PayPal when you receive a payment.

- Confirm Payment

- Log in to your PayPal account and confirm the payment in your “Activity” or “Transactions” section. Ensure that the payment status shows as “Completed” before proceeding with any service or product delivery.

Step 5: Transfer Funds to Local Account

- Link a Bank Account or Mobile Money

- Ensure your bank account or mobile money service is linked to your PayPal account for easy transfer of funds.

- Initiate a Transfer

- Go to the “Withdraw” or “Transfer” section of your PayPal account. Select the option to transfer funds to your local bank account or mobile money service.

- Follow Transfer Instructions

- Enter the transfer amount and confirm the transaction. It may take a few business days for the funds to appear in your local account.

Step 6: Manage Payments and Fees

- Understand Fees

- Familiarize yourself with PayPal’s fee structure for receiving payments. PayPal typically charges a fee for receiving money, especially for international transactions.

- Set Up Invoicing

- For recurring payments, consider setting up PayPal invoicing. This allows you to create and send invoices directly through your PayPal account, making it easier for clients to pay you.

- Monitor Transactions

- Regularly review your transaction history in the PayPal app or website to ensure all payments are accounted for and to track your earnings.

Tips for Efficient Payment Handling

- Communicate Clearly: Always provide clear instructions to your clients on how to send payments via PayPal.

- Security: Enable two-factor authentication (2FA) on your PayPal account to enhance security.

- Customer Support: Use PayPal’s customer support if you encounter any issues with receiving payments or transferring funds.

How to Create PayPal Account in Uganda: Common Mistakes to Avoid

Common Mistakes to Avoid

- Using a VPN During Setup

- Why It’s a Mistake: Using a VPN can trigger PayPal’s fraud detection systems, as it masks your real IP address, indicating you might be in a different country than Uganda.

- Consequence: This can lead to account lockout or suspension.

- Solution: Ensure your VPN is turned off during the account setup process to avoid discrepancies in location data.

- Providing Incorrect Information

- Why It’s a Mistake: Inaccurate personal details can cause verification issues.

- Consequence: This can result in delays or inability to verify your account, leading to restrictions.

- Solution: Double-check all personal information, including your name, address, and phone number, ensuring they match your official documents.

- Skipping Email Verification

- Why It’s a Mistake: Failing to verify your email can prevent you from fully activating your PayPal account.

- Consequence: Unverified accounts may face limitations in usage.

- Solution: Promptly check your email and complete the verification process by clicking the link sent by PayPal.

- Linking Unsupported Banks or Services

- Why It’s a Mistake: Not all banks or mobile money services may be compatible with PayPal.

- Consequence: This can lead to issues with withdrawing funds or receiving payments.

- Solution: Ensure the bank or mobile money service you are linking is supported by PayPal in Uganda.

- Ignoring Account Security

- Why It’s a Mistake: Neglecting to set up security features can leave your account vulnerable to unauthorized access.

- Consequence: This can lead to potential fraud or account compromise.

- Solution: Enable two-factor authentication (2FA) and set up security questions to enhance the security of your account.

- Frequent Location Changes

- Why It’s a Mistake: Logging in from multiple locations within a short period can raise security concerns.

- Consequence: PayPal’s system might flag your account for unusual activity, leading to temporary holds or restrictions.

- Solution: Try to access your account from a consistent location and avoid frequent changes.

- Not Understanding Fees and Limits

- Why It’s a Mistake: Being unaware of PayPal’s fee structure and transaction limits can result in unexpected costs or transaction failures.

- Consequence: This can affect your ability to use your account effectively.

- Solution: Familiarize yourself with PayPal’s fees, transaction limits, and terms of service specific to Uganda.

Benefits of Knowing How to Create PayPal Account in Uganda

Benefits

Knowing how to create and use a PayPal account in Uganda offers numerous advantages, from accessing global markets and ensuring secure transactions to enhancing business capabilities and providing financial flexibility. Whether you are an individual looking to make online purchases or a business aiming to expand globally, PayPal provides a reliable and convenient solution.

Creating a PayPal account in Uganda comes with numerous benefits, especially as the world becomes increasingly digital. Understanding how to set up and use PayPal can provide significant advantages for both personal and business transactions. Here are some key benefits of knowing how to create a PayPal account in Uganda:

1. Access to Global E-commerce

Story:

John, an entrepreneur in Kampala, was struggling to purchase specialized equipment from international suppliers. Many of these suppliers only accepted PayPal payments. Once John learned how to set up a PayPal account, he could easily make purchases from around the world. This access to global e-commerce allowed him to source better products at competitive prices, significantly improving his business operations.

Benefit:

- Global Shopping: Enables users to shop from international online stores that accept PayPal.

- Business Expansion: Allows entrepreneurs to purchase supplies and tools from global markets, enhancing business opportunities.

2. Secure Online Transactions

Story:

Mary, a freelance graphic designer, often received payment requests from clients via various platforms. Before using PayPal, she faced issues with payment security and delays. After setting up her PayPal account, she enjoyed secure and prompt payments, boosting her confidence in dealing with international clients.

Benefit:

- Security: PayPal offers robust security features, protecting users’ financial information.

- Confidence: Users can transact with peace of mind, knowing their transactions are secure.

3. Ease of Use and Convenience

Story:

Pauline, a student in Uganda, wanted a simple way to manage her online subscriptions for educational platforms. With PayPal, she could easily pay for her subscriptions without the hassle of currency conversions or additional fees from local banks.

Benefit:

- User-Friendly: The PayPal app is intuitive and easy to use.

- Convenience: Allows for quick and seamless payments for online services and subscriptions.

4. Enhanced Business Capabilities

Story:

David, who runs a small online store, struggled with receiving payments from international customers. After setting up his PayPal account, he could accept payments from anywhere in the world, which increased his customer base and sales significantly.

Benefit:

- Increased Sales: Businesses can cater to international customers, boosting sales and revenue.

- Professionalism: Offers a professional payment method that instills trust in customers.

5. Access to Various Financial Services

Story:

Susan needed to send money to her friend in the United States. Traditional money transfer methods were costly and slow. With PayPal, she could transfer funds instantly and at a lower cost, making it an ideal solution for her needs.

Benefit:

- Money Transfers: Facilitates easy and cost-effective international money transfers.

- Financial Services: Provides access to various financial services like invoicing, refunds, and dispute resolution.

6. Integration with Online Marketplaces

Story:

James, an artist, wanted to sell his artwork on global platforms like Etsy and eBay. Setting up a PayPal account enabled him to receive payments directly from these platforms, simplifying the payment process and allowing him to focus more on his creativity.

Benefit:

- Marketplace Integration: Compatible with major online marketplaces, making it easier to receive payments.

- Streamlined Operations: Simplifies the process of managing sales and payments.

7. Flexibility in Payment Methods

Story:

Rebecca, a digital marketer, often faced issues when clients wanted to pay using different methods. By using PayPal, she provided clients with the flexibility to pay via credit cards, bank accounts, or PayPal balance, accommodating their preferences and ensuring timely payments.

Benefit:

- Payment Options: Supports multiple payment methods, including credit/debit cards and bank accounts.

- Client Satisfaction: Offers flexibility that enhances client satisfaction and trust.

How to Create PayPal Account in Uganda: Troubleshooting Common Issues

PayPal Uganda Common Issues

Using PayPal, while convenient, can sometimes come with various challenges. Here are some common issues PayPal users might encounter, along with tips on how to troubleshoot and resolve them:

1. Account Verification Problems

Issue: Difficulties verifying your PayPal account due to incorrect or incomplete information.

Solution:

- Ensure Accuracy: Double-check that all personal information entered matches your official documents.

- Upload Clear Documents: If required to submit documents, ensure they are clear and legible.

- Contact Support: Reach out to PayPal support for assistance if verification issues persist.

2. Account Limitations and Restrictions

Issue: PayPal may place limitations on your account, restricting certain activities such as sending or withdrawing money.

Solution:

- Complete Verification: Often, limitations are placed on accounts that haven’t been fully verified.

- Resolve Issues Promptly: Follow PayPal’s instructions to resolve any outstanding issues.

- Understand Reasons: Review the notification from PayPal to understand why the limitation was applied and address those issues.

3. Payment Holds and Delays

Issue: Payments received may be placed on hold, especially for new sellers.

Solution:

- Build Trust: Consistently deliver goods and services as promised to build a good track record.

- Provide Tracking Information: For tangible goods, upload tracking information to PayPal to expedite the release of funds.

- Customer Communication: Encourage buyers to confirm receipt of items or services through PayPal.

4. Transaction Denials and Payment Failures

Issue: Transactions are denied or payments fail unexpectedly.

Solution:

- Check Balance: Ensure you have sufficient funds in your PayPal account or linked bank account.

- Update Information: Verify that your linked bank accounts and credit cards are up-to-date and correctly entered.

- Review Account Status: Make sure your account isn’t limited or restricted.

5. Unauthorized Transactions

Issue: Unrecognized or unauthorized transactions appear in your account.

Solution:

- Report Immediately: Use PayPal’s Resolution Center to report unauthorized transactions.

- Change Passwords: Update your PayPal password and enable two-factor authentication (2FA).

- Monitor Account: Regularly review your account activity for any suspicious transactions.

6. Currency Conversion Fees

Issue: High fees incurred during currency conversions.

Solution:

- Understand Fees: Familiarize yourself with PayPal’s currency conversion fees.

- Use Local Currency: Whenever possible, transact in your local currency to avoid unnecessary conversion fees.

- Alternative Methods: Consider other payment methods or services that might offer better exchange rates.

7. Linking Bank Accounts or Cards

Issue: Difficulties linking bank accounts or credit/debit cards to your PayPal account.

Solution:

- Check Compatibility: Ensure that the bank or card is supported by PayPal.

- Correct Information: Verify that the information entered matches your bank or card details.

- Contact Bank: Sometimes, banks may block online linking for security reasons; contacting them can resolve the issue.

8. Disputes and Chargebacks

Issue: Handling disputes and chargebacks from buyers.

Solution:

- Provide Documentation: Keep thorough records of all transactions, communications, and shipping details.

- Respond Promptly: Address disputes quickly and provide all requested information to PayPal.

- Customer Service: Maintain good customer service practices to reduce the likelihood of disputes.

9. Email Phishing Scams

Issue: Receiving fraudulent emails pretending to be from PayPal.

Solution:

- Verify Emails: Always check the sender’s email address and look for signs of phishing.

- Don’t Click Links: Avoid clicking on links in suspicious emails; instead, log in directly to PayPal’s website.

- Report Scams: Forward phishing emails to spoof@paypal.com for PayPal to investigate.

10. Account Closure and Inactivity

Issue: Accounts closed due to inactivity or policy violations.

Solution:

- Stay Active: Regularly log in and use your PayPal account to keep it active.

- Follow Policies: Adhere to PayPal’s user agreement and policies to avoid violations.

- Appeal Closures: If your account is closed, contact PayPal support to understand the reason and appeal the decision if necessary.

why are some countries limited by paypal when it comes to receiving on paypal

Media speculation suggests common reasons could include insufficient regulation and security in a country’s banking system, failure of a country to comply with U.S. tax law, or a U.S. trade ban affecting a country.

Can i get a paypal account using a Ugandan bank like centenary bank , Equity or ABSA?

Creating a PayPal account with Ugandan banks debit cards is possible, to create a PayPal account using your bank in Uganda, click here

But unfortunately Uganda is among third world countries which cant receive money on Paypal but can you can pay or send. Not receiving money means u cant get paid or someone cant send you money on your PayPal. That’s where webvator comes in by helping you get an account which can receive.

What countries are eligible or ineligible to receive and send on Paypal?

Most african countries can send but CANNOT receive on paypal

- Here are countries that cannot receive but can send on Paypal

- Here are countries that can receive and send on PayPal

Probably if your from third world countries like Uganda, Rwanda, Sudan etc you cant receive unless u make a virtual paypal account as discussed on this page above.

African countries that can receive Paypal include South Africa, Kenya, Bostwana and still also for them you can only withdraw to limited banks .

In South Africa, FNB Bank is ok. It provides a ‘Withdraw’ service that allows you to transfer (withdraw) funds from your PayPal™ account into your South African bank account.

In Kenya: Equity Bank.

Botswana: PayPal partnered with First National Bank (FNB) in Botswana to allow you to withdraw money from your PayPal account to your Individual or Business FNB bank. Your need a verified PayPal account and a FNB account to be able to withdraw.

How To Withdraw Paypal in Uganda

If you want to withdraw money in your paypal in Uganda, we provide the services here,

https://paypalcash.webvator.com

We can process Money within minutes for amount less than 1,500 Dollars, more than that, it can be processed within 24 hours

How to Manage PayPal Account Settings in Uganda

Managing your PayPal account settings in Uganda is essential for ensuring smooth transactions, enhanced security, and personalized account preferences. Here’s a comprehensive guide on how to manage your PayPal account settings effectively:

1. Accessing Account Settings

- Log In to Your PayPal Account:

- Open the PayPal app on your mobile device or go to the PayPal website (www.paypal.com).

- Enter your email address and password, then click “Log In.”

- Navigate to Account Settings:

- On the website, click on the gear icon (⚙️) located at the top right corner of the page to access the settings menu.

- On the mobile app, tap the profile icon and then select “Settings.”

2. Updating Personal Information

- Personal Info:

- Under the “Account” tab, you can update your name, email address, phone number, and physical address.

- Ensure all details are accurate to avoid verification issues.

- Email Address:

- Add or remove email addresses associated with your PayPal account. Ensure your primary email is up-to-date and verified for receiving notifications and payment confirmations.

- Phone Number:

- Update your phone number for account recovery and security verification purposes.

3. Security Settings

- Password:

- Regularly update your password for enhanced security. Choose a strong password combining letters, numbers, and special characters.

- Two-Factor Authentication (2FA):

- Enable 2FA to add an extra layer of security. This will require you to enter a code sent to your phone or generated by an authenticator app whenever you log in.

- Security Questions:

- Set up security questions and answers for additional account recovery options.

- Review Devices and Sessions:

- Check the devices that have accessed your account and end any suspicious sessions.

4. Payment Settings

- Linked Accounts:

- Link your bank account, credit/debit cards, or mobile money services (e.g., MTN Mobile Money, Airtel Money). This will allow you to fund your PayPal account and withdraw funds easily.

- Preferred Payment Method:

- Set your preferred payment method for online purchases and automatic payments. This could be your linked bank account, card, or PayPal balance.

5. Notification Preferences

- Email Notifications:

- Customize your email notification settings to receive alerts for payments, account activity, promotions, and updates.

- Mobile Notifications:

- Enable or disable push notifications on your mobile device for real-time updates on transactions and account activity.

6. Currency Settings

- Primary Currency:

- Set your primary currency for transactions. This can help avoid conversion fees and simplify transactions.

- Adding Currencies:

- If you frequently deal with multiple currencies, you can add and manage different currencies in your account.

7. Privacy Settings

- Manage Data Sharing:

- Control how your data is shared with PayPal partners and third-party services.

- Marketing Preferences:

- Opt in or out of marketing communications from PayPal and its partners.

8. Account Restrictions and Limitations

- Resolve Limitations:

- If your account has limitations, follow the steps provided by PayPal to resolve them. This typically involves verifying your identity and providing additional information.

- Account Status:

- Regularly check your account status to ensure there are no restrictions or issues that need attention.

9. Business Account Settings (if applicable)

- Business Information:

- Update your business name, address, and contact information.

- Invoice Settings:

- Customize your invoice templates and payment terms for easier billing and payments.

- Sales Preferences:

- Set up sales tax rates, shipping methods, and other preferences relevant to your business.

10. Troubleshooting Common Issues

- Login Problems:

- If you encounter login issues, use the “Forgot your email or password?” link to recover your account.

- Unrecognized Transactions:

- Report any unrecognized transactions immediately through the Resolution Center.

- Customer Support:

- Contact PayPal customer support for assistance with any unresolved issues or queries.

How to Create PayPal Account in Uganda Without Bank Card (Debit/credit card)

Is it possible to create a PayPal account without a bank account or ATM card?

Creating a PayPal account in Uganda without a credit card is entirely possible by using alternative methods such as using mobile money services, or obtaining a virtual card.

Here’s a detailed guide on how to do it.

Step-by-Step Guide

- Visit the PayPal Website

- Open your web browser and go to the PayPal website at www.paypal.com.

- Sign Up for a New Account

- Click on the “Sign Up” button located at the top right corner of the homepage.

- You will be prompted to choose between a “Personal Account” and a “Business Account.” Select the account type that suits your needs and click “Next.”

- Enter Your Details

- Fill in the required information, including your first and last name, email address, and a secure password.

- Click “Next” to proceed.

- Complete Your Profile

- Enter your address details, phone number, and date of birth.

- Ensure all information is accurate and up-to-date.

- Link Your Bank Account

- Instead of linking a credit card, you can link your virtual card or just skip this part. Virtual cards can be provided through mobile money services provided by telecom companies like MTN and Airtel or use Chipper cash or eversend

- Select the option to link a bank account and follow the instructions to add your account details.

- Verify Your Email Address

- PayPal will send a verification email to the address you provided. Open the email and click on the verification link to confirm your email address.

- Set Up Mobile Money Account

- If you don’t have a bank account, you can use mobile money services as an alternative. Ensure you have an active mobile money account with providers like MTN Mobile Money or Airtel Money.

- Visit the “Link a Card” or “Bank” section on PayPal and select “Mobile Money.”

- Follow the prompts to link your mobile money account to your PayPal account.

- Use PayPal’s Virtual Card Option

- Some financial institutions in Uganda offer virtual cards that can be used for online transactions. These virtual cards can be linked to your PayPal account.

- Obtain a virtual card from your bank or financial institution and enter the card details when prompted by PayPal.

- Start Using Your PayPal Account

- Once all the steps are completed, you can start using your PayPal account for online transactions.

- You can receive payments, make purchases, and withdraw funds to your linked bank or mobile money account.

Can I have a PayPal business account without a business?

Yes. You can have business paypal account without a business.

But u will have a transaction limit u cannt exceed if you don’t verify the business account

Do Games that Pay to Paypal really work or its a lie?

Exploring PayPal Games: Do They Really Pay to PayPal?

In recent years, the gaming industry has witnessed a surge in the popularity of mobile games that claim to reward players with real money through platforms like PayPal. These games often promise lucrative prizes and cash payouts in exchange for completing tasks, reaching certain milestones, or winning competitions. However, the question remains: do PayPal games actually pay out real money to players’ PayPal accounts, or are they simply too good to be true?

Understanding PayPal Games:

PayPal games, also known as “pay-to-play” or “cash-out” games, typically operate on a simple premise: players engage in various activities within the game in exchange for the chance to earn real cash rewards. These activities may include playing mini-games, completing surveys, watching advertisements, or participating in tournaments.

The allure of PayPal games lies in their promise of financial gain while indulging in leisure activities. For many players, the prospect of earning money from gaming represents an enticing opportunity to monetize their hobby and potentially supplement their income.

Separating Fact from Fiction:

While the concept of earning money while playing games sounds appealing, it’s essential to approach PayPal games with a critical eye and manage expectations accordingly. While some games may indeed offer legitimate opportunities to earn money, others may fall short of delivering on their promises.

Before diving into PayPal games, it’s crucial to conduct thorough research to assess their credibility and reputation. Reading reviews from other players, investigating the developer’s track record, and verifying payment proof can help determine whether a PayPal game is legitimate or potentially fraudulent.

Furthermore, it’s essential to familiarize oneself with the game’s terms and conditions, including payout thresholds, withdrawal methods, and any associated fees or restrictions. Some PayPal games may impose minimum withdrawal limits or charge transaction fees, which can impact the overall profitability of participating.

Practical Considerations:

Even in the case of legitimate PayPal games, it’s essential to approach them with realistic expectations. While it’s possible to earn money from playing these games, the payouts are often modest, and the process may require a significant time investment.

Additionally, the competitive nature of PayPal games means that not all players will earn substantial rewards. Success in these games often depends on skill, luck, and persistence, and not everyone will achieve the same level of financial success.

Moreover, participating in PayPal games should be viewed as a form of entertainment rather than a reliable source of income. Treating gaming as a means to earn money can lead to frustration and disappointment if expectations are not met.

PayPal games offer players the opportunity to earn real money through gaming activities. While some games may deliver on their promises and provide legitimate avenues for cash rewards, others may fall short of expectations or even operate as scams.To maximize the potential benefits of PayPal games, it’s essential to approach them with caution, conduct thorough research, and manage expectations accordingly. By doing so, players can enjoy the thrill of gaming while also exploring the possibility of earning money through platforms like PayPal.

Watch video below where we show you how to spot legit and fake games online

Read here also about if Do these game apps really pay you?

How can I withdraw my money in PayPal without a bank account or debit card?

Yes. If your in Uganda, you can use a website ,www.paypalcash.webvator.com to withdraw money to your MTN, AIRTEL Mobile money

If your outside Uganda, please write to us and we will get you the right website to use

How to open paypal account?

How do i get a PayPal account in unsupported countries?

Use a virtual PayPal account, we charge consultancy fee to take you through the procedure. Virtual accounts can work for any country as long as you don’t plan to use them for crime.

In this way you can use PayPal from any unsupported country. You will be able to get Paypal account in a country that Paypal don’t accept to operate with?

When using PayPal without a bank account and a credit card linked to it and you receive a payment, where is the "real" money stored?

The money is stored by PayPal – in a special account which PayPal holds with the financial institution of their choice, linked to your PayPal account – and is disbursed upon your confirmation.

It is same as a trust account which attorneys hold on behalf of their clients – money which has been received and is being held in someone else’s name as the money does not belong to the attorney/company.

That special account has a detailed sub-ledger containing breakdown of transactions and client accounts – instead of creating one account per each client/customer.

How to Link Your Debit or Credit Card to PayPal Account in Uganda

How to Link a Card

Linking your debit or credit card to your PayPal account in Uganda enhances your ability to make online transactions securely and conveniently. By following the steps outlined below and troubleshooting any common issues, you can ensure a smooth and successful linking process.

Step-by-Step Guide to Link Your Debit or Credit Card to PayPal

1. Log In to Your PayPal Account

- Open the PayPal App or Website:

- On your mobile device, open the PayPal app.

- On a computer, go to the PayPal website (www.paypal.com).

- Enter Your Credentials:

- Enter your email address and password, then click “Log In.”

2. Access Wallet or Payment Methods

- On the PayPal Website:

- Click on the “Wallet” tab at the top of the page.

- On the PayPal App:

- Tap the profile icon or menu button, then select “Wallet” or “Payment Methods.”

3. Link a New Card

- Click/Tap on “Link a Card” or “Add Card”:

- This option can usually be found in the “Wallet” section.

- Enter Card Details:

- Card Number: Enter your debit or credit card number.

- Expiry Date: Select the card’s expiration date.

- Security Code (CVV): Enter the three-digit security code found on the back of your card.

- Billing Address: Ensure the billing address matches the one associated with your card.

- Save Card Information:

- After entering all the necessary details, click “Save” or “Link Card.”

4. Confirm Your Card

- Verification Process:

- PayPal may charge a small temporary fee to your card to verify it. This charge will appear on your card statement with a unique code.

- Log in to your online banking or check your card statement to find the PayPal charge.

- Enter the Code:

- Go back to your PayPal account and enter the unique code to confirm your card.

5. Card Successfully Linked

- Completion:

- Once the code is verified, the temporary charge will be refunded, and your card will be successfully linked to your PayPal account.

Troubleshooting Common Issues

1. Card Not Accepted

Issue: Your card might be declined by PayPal for several reasons.

Solution:

- Check Card Type: Ensure that your card is a Visa, MasterCard, American Express, or Discover, as these are generally accepted by PayPal.

- Sufficient Funds: Ensure your card has sufficient funds to cover the temporary verification charge.

- Correct Details: Double-check that you have entered the correct card details and billing address.

- Contact Bank: Sometimes, your bank may block online transactions for security reasons. Contact your bank to ensure there are no restrictions on your card.

2. Verification Code Not Found

Issue: You cannot find the verification code on your card statement.

Solution:

- Check Statements: Look carefully at your online bank statement or physical statement for a charge from PayPal with a four-digit code.

- Wait for Processing: It may take a few days for the charge to appear on your statement. Be patient and check back later.

- Resend Code: If the code does not appear, you can request PayPal to resend it.

3. Card Already Linked to Another Account

Issue: The card is already linked to another PayPal account.

Solution:

- Contact Support: Reach out to PayPal customer support to resolve this issue and unlink the card from the other account.

- Use a Different Card: If you have another card, try linking it instead.

Benefits of Linking Your Card to PayPal

- Convenience: Make quick and easy payments online without entering card details each time.

- Security: PayPal provides an extra layer of security by not sharing your card details with merchants.

- Global Access: PayPal is widely accepted internationally, allowing you to shop from global retailers.

- Backup Payment Option: If your PayPal balance is insufficient, linked cards can be used as a backup payment method.

- Transaction Tracking: Easily track and manage all your transactions in one place through PayPal.

How to Receive Payments with Your PayPal Account in Uganda

How to Receive on PayPal Uganda

Receiving payments through PayPal in Uganda is a convenient and secure way to handle transactions for your business, freelance work, or personal needs. Here’s a detailed guide on how to set up your PayPal account to receive payments in Uganda:

Step 1: Create Your PayPal Account

- Visit PayPal’s Website:

- Open your web browser and go to PayPal’s official website.

- Click on the “Sign Up” button located at the top right corner of the homepage.

- Choose Your Account Type:

- Select “Business Account” if you are receiving payments for your business, or “Personal Account” for individual needs.

- Click “Next” to proceed.

- Enter Your Details:

- Fill in your email address, create a strong password, and provide your personal or business information as required.

- Agree to PayPal’s terms and conditions and click “Agree and Create Account.”

Step 2: Verify Your PayPal Account

- Email Verification:

- Check your email inbox for a verification email from PayPal.

- Click on the verification link to confirm your email address.

- Link Your Bank Account and Card:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Link your Ugandan bank account by entering your bank details. Note that not all Ugandan banks support PayPal withdrawals, so you might need to use a bank that does.

- Link a credit or debit card (Visa or Mastercard) by entering the card details.

- Verify Your Card:

- PayPal will make a small charge to your card (which will be refunded). Check your card statement for the PayPal code and enter it on PayPal to complete the verification.

Step 3: Set Up to Receive Payments

- Enable Payment Options:

- In your PayPal account settings, ensure that your account is set up to receive payments. This is typically enabled by default.

- Provide Your PayPal Email Address:

- Share your PayPal email address with the sender. This is the email address associated with your PayPal account where you will receive payments.

Step 4: Invoice Clients (For Business Accounts)

- Create an Invoice:

- Log in to your PayPal account and go to the “Tools” section.

- Click on “Invoicing” and then “Create Invoice.”

- Fill in the invoice details, including the recipient’s email address, the amount, and a description of the goods or services.

- Send the Invoice:

- Review the invoice and send it to your client’s email address.

- The client will receive the invoice and can pay it using their PayPal account or credit/debit card.

Step 5: Receive Payments

- Notification of Payment:

- Once a payment is made, you will receive an email notification from PayPal.

- Log in to your PayPal account to view the transaction details.

- Check Your Balance:

- Go to the “Wallet” section to see your PayPal balance.

- Payments received will appear in your account balance.

Step 6: Withdraw Funds

- Withdraw to Your Bank Account:

- Go to the “Wallet” section and click “Transfer Money.”

- Choose to transfer funds to your linked bank account. Note that withdrawals to Ugandan banks might incur additional fees and take a few business days.

- Use a Third-Party Service:

- If your bank does not support PayPal withdrawals, consider using a third-party service like Xoom (a PayPal service) to transfer funds from PayPal to your bank account or mobile money account.

PAGE TAGS;

paypal account create create paypal account in Uganda [how to create paypal Uganda [how to open paypal account] [How to open a Uganda Paypal account] [get donations via paypal Uganda] [create paypal account for NGO in Uganda] [create paypal business account in Uganda]- [create paypal individual account][create paypal personal account] [create paypal to mobile money] [create paypal Uganda] [paypal uganda vs pioneer Uganda] [paypal xoom] [personal paypal account Uganda] [send money online]

[set up a paypal merchant account in Uganda] [signup paypal uganda]

[uganda paypal business account] [xoom paypal Uganda]

[foreign paypal account] [How to open a paypal account in Uganda]

[how to receive online payments in Uganda] [how to register on paypal Uganda] [how to use paypal in Uganda] [join paypal Uganda][open paypal account free] [paypal account of charity NGO organization] [paypal account Uganda] [paypal account verification in uganda] [paypal donation in Uganda] [paypal login] [paypal mobile app Uganda] [paypal mtn Uganda][paypal offices Uganda][paypal online] [paypal phone number] [paypal to airtel money] [paypal uganda account registration] [paypal uganda login] [paypal uganda signup] [how to open verified PayPal account in Uganda] [How to open CBO paypal account]