Is PayPal available in Qatar?

PayPal is available in Qatar, one can send and receive but when it comes to withdraw, you need to have QNB Bank account not just any bank in Qatar.

In Qatar, creating a PayPal account can be done on PayPal website, allowing individuals to link their existing cards or bank accounts from local institutions for online payments.

Once linked, users can utilize their PayPal account to make purchases or receive payments online seamlessly.

How to Withdraw Money from PayPal to Bank in Qatar

When it comes to withdrawing funds from a PayPal account in Qatar, there are specific requirements. Unlike in regions like the USA or the UK where PayPal withdrawals can be directly transferred to linked Visa or bank cards, in Qatar, withdrawals are channeled exclusively through Qatar National Bank (QNB). This process is facilitated through the QNB Internet Banking Portal system.

Qatar National Bank (QNB), being the largest financial institution in the Middle East, offers a reliable platform for PayPal users in Qatar to access their funds. By linking their PayPal account to a QNB bank account, users can efficiently withdraw their PayPal balance via the QNB Internet Banking Portal system.

While PayPal offers a convenient payment solution for online transactions in Qatar, the withdrawal process underscores the importance of a partnership with a local banking giant like QNB. This arrangement ensures smooth transactions and enhances the usability of PayPal services for individuals in Qatar.

The partnership between PayPal and QNB Bank enables users to link their QNB Bank account to their PayPal account, allowing for seamless withdrawal of funds. QNB in full is Qatar National Bank and, QNB Group is the largest financial institution in the Middle East established in 1964 as the country’s first Qatari-owned commercial bank, with an ownership structure split between the Qatar Investment Authority (50%) and the remaining (50%) held by members of the public.

How To Create a PayPal Account in Qatar

Follow these steps:

1. Visit the Qatar Official PayPal Website:

Go to the official PayPal website by typing “https://www.paypal.com/qa” into your web browser.

2. Click on “Sign Up:

Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

3. Choose Account Type:(Important)

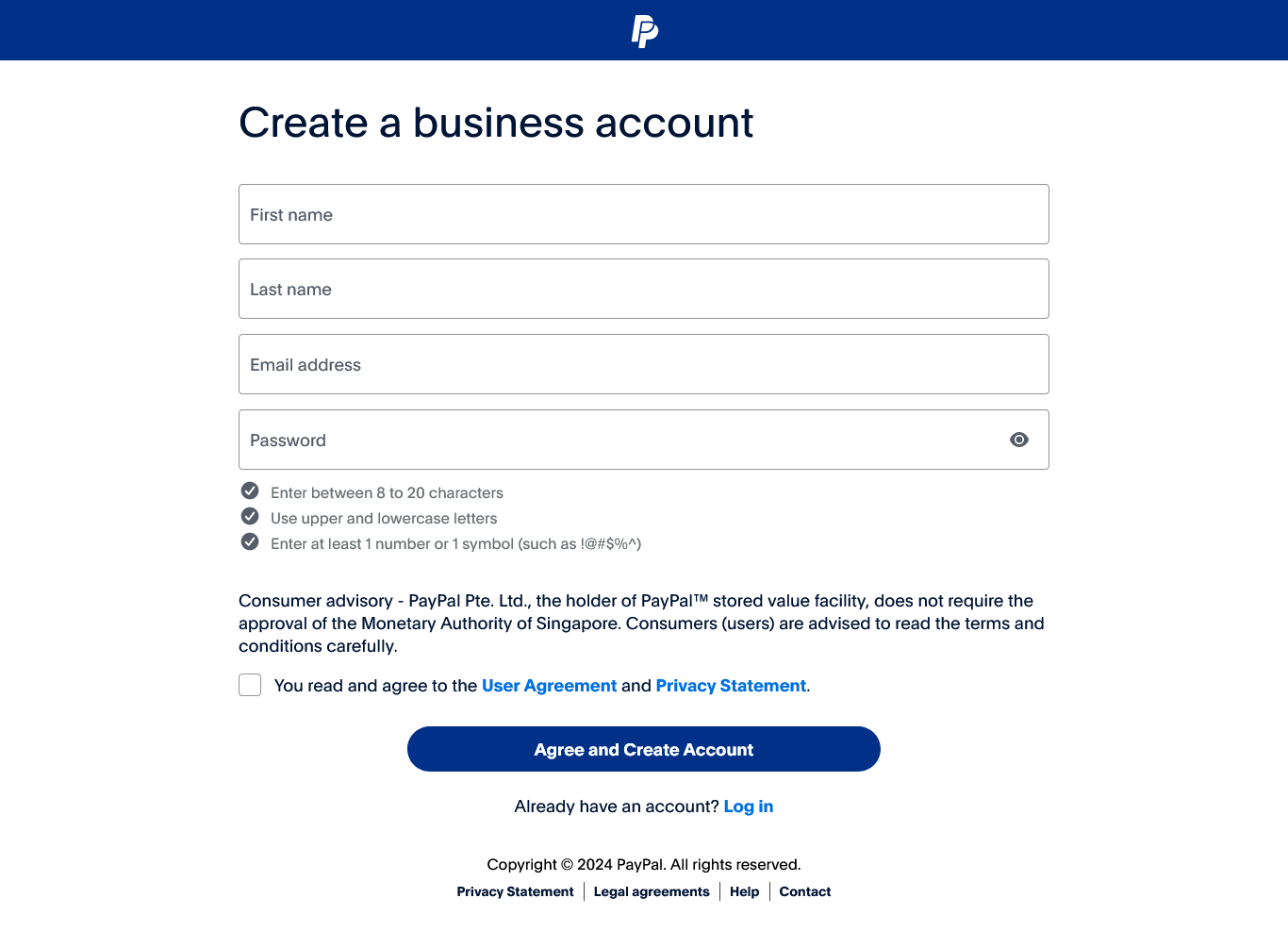

4. Provide Email Address:

Enter a valid email address that you want to associate with your PayPal account. This will also serve as your username for logging in.

5. Create a Password:

Choose a strong and secure password for your PayPal account. It should include a mix of uppercase and lowercase letters, numbers, and special characters.

6. Fill in Personal Information:

Complete the required fields with your personal information, including your name, address, and phone number.

7. Verify Your Email:

7. Verify Your Email:

– PayPal will send a verification email to the address you provided. Check your email inbox and follow the instructions to verify your email.

8. Link a Payment Method:

To fully utilize PayPal, link a payment method, such as a credit card or bank account. This allows you to fund your PayPal transactions.

9. Confirm Identity (if required):

Depending on your location and other factors, PayPal may request additional identity verification steps.

10. Complete the Setup:

Once you’ve filled in all the necessary information, your PayPal account should be set up. You can now log in and start using PayPal for online transactions.

How to withdraw money from PayPal in Qatar using QNB Internet banking portal

To withdraw money from PayPal in Qatar, follow these general steps:

Whether you are an individual or a corporate customer, register for QNB Internet Banking and enjoy the new feature by following the below steps:

To Register or login into QNB Internet Banking Portal, CLICK HERE

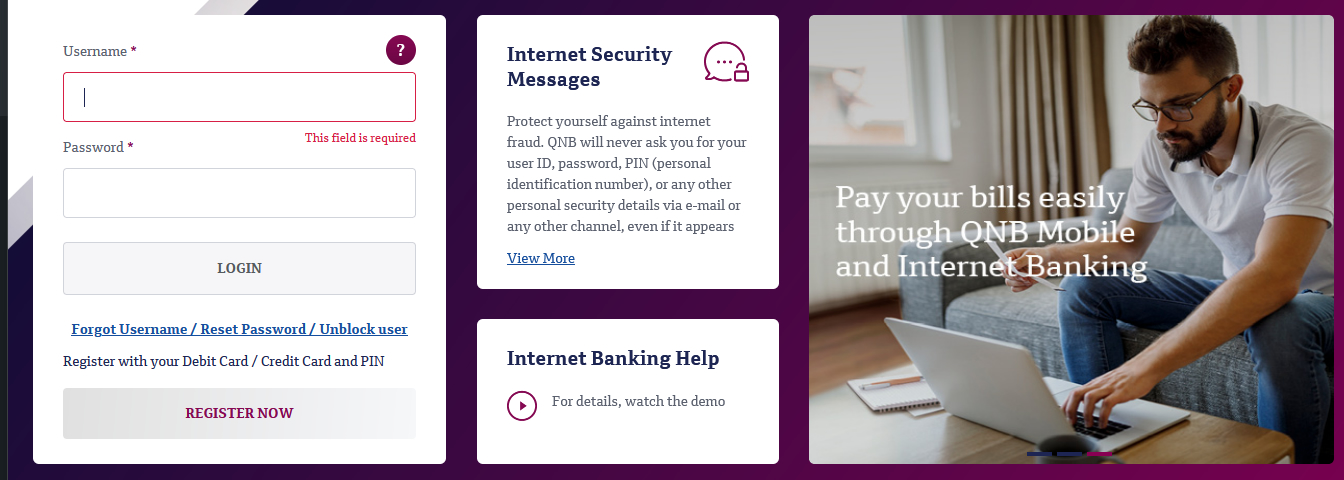

1. Login to QNB Internet Banking (https://ib.qnb.com/identity/login)

2.After Login, Click on “PayPal”

3. Click on “Withdrawal Setup”

4. Type your PayPal account ID and click “Submit”

5. Click on “Click here to Activate the PayPal Withdrawal Service”

6. A PayPal mini-browser will appear on the top of the withdrawal set-up page to link your PayPal account with QNB account

7. Enter your PayPal account password and then click “Authorize to Continue ”

8. Click on “Close and Continue” button

9. After completing the account verification, close the pop-up window and go back to PayPal on QNB Internet Banking page

10. Click on “Continue” to complete the Withdrawal set-up

11. Once you click on “Activate”, an OTP SMS will be sent to the registered mobile number

12. Enter the OTP and click on “Confirm”

After completing the steps outlined earlier, users in Qatar will experience some enhancements within their PayPal account interface:

New Withdrawal Options: Upon successful setup, additional withdrawal options will become available within the PayPal menu. This includes the ability to transfer funds from your PayPal balance directly to your linked QNB bank account.

Standing Orders Configuration: Users will also have the option to configure standing orders for automated withdrawals. This feature enables users to set up recurring withdrawals at predetermined intervals, providing greater flexibility and convenience in managing their funds.

Single Account Linkage: It’s important to note that users can only link one PayPal account to their QNB bank account at any given time. If there is a need to change the linked PayPal account, the current association must be removed first. Subsequently, the new PayPal account can be set up and linked to the QNB bank account.

These added functionalities streamline the process of managing PayPal funds for users in Qatar, offering greater control and customization options for their financial transactions.

Banking sector in Qatar

The banking sector in Qatar is a vital component of the country’s economy, playing a significant role in facilitating economic growth and development. Here are some key aspects of the banking sector in Qatar:

1. Qatar Central Bank (QCB): The Qatar Central Bank is the country’s central monetary authority responsible for formulating and implementing monetary policy. It regulates and supervises financial institutions operating in Qatar to ensure stability and integrity in the banking sector.

2. Major Banks: Qatar is home to several major banks, including Qatar National Bank (QNB), Commercial Bank of Qatar (CBQ), Doha Bank, Qatar Islamic Bank (QIB), and others. These banks offer a wide range of financial services to individuals, businesses, and government entities.

3. Islamic Banking: Islamic banking plays a significant role in Qatar’s financial landscape. Islamic banks, such as Qatar Islamic Bank (QIB), Masraf Al Rayan, and Barwa Bank, offer Sharia-compliant financial products and services, adhering to Islamic principles and practices.

4. Foreign Banks: Qatar also hosts branches of several international banks, contributing to the diversity and competitiveness of the banking sector. These foreign banks provide specialized services and expertise to multinational corporations, expatriates, and international investors operating in Qatar.

5. Financial Infrastructure: The banking sector in Qatar benefits from robust financial infrastructure, including advanced technology platforms, secure payment systems, and sophisticated risk management frameworks. These infrastructure elements support efficient and secure financial transactions, both domestically and internationally.

6. Government Support: The Qatari government plays an active role in supporting the banking sector through regulatory oversight, policy formulation, and strategic initiatives. Government-owned entities like Qatar Investment Authority (QIA) also play a significant role in the banking sector through investments and financial contributions.

7. Strategic Vision: Qatar’s banking sector operates within the broader framework of the country’s economic diversification and development strategies. The sector aligns with Qatar National Vision 2030, focusing on sustainable growth, innovation, and financial inclusion to achieve long-term socioeconomic objectives.

Overall, the banking sector in Qatar is dynamic, well-regulated, and integral to the country’s economic stability and prosperity. With a mix of local, regional, and international players, Qatar’s banking sector continues to evolve to meet the changing needs of its diverse clientele and global market dynamics.

Which Banks support PayPal in Qatar, Doha ?

All Bank Cards from several banks shown below in Qatar can work with PayPal transactions but when it comes to withdraw, its only possible with QNB bank leaving other banks to be used for sending purposes only on PayPal. Banks include:

1. Qatar National Bank (QNB) – The largest bank in Qatar and one of the largest in the Middle East.

2. Commercial Bank of Qatar (CBQ) – A leading private sector bank in Qatar.

3. Doha Bank – One of the oldest commercial banks in Qatar.

4. Qatar Islamic Bank (QIB) – The first Islamic bank in Qatar, offering Sharia-compliant banking services.

5. Masraf Al Rayan – A prominent Islamic bank in Qatar, known for its innovative Islamic financial products.

6. Barwa Bank – Another significant Islamic bank in Qatar, offering a range of Sharia-compliant banking solutions.

7. Ahli Bank Qatar (Ahlibank) – A well-established bank offering a variety of banking and financial services.

8. International Bank of Qatar (IBQ) – A private bank providing a range of banking services to individuals and businesses.

9. Qatar Development Bank (QDB) – A government-owned development bank focused on supporting economic growth and diversification in Qatar.

10. Qatar Credit Bank – A government-owned bank providing loans and financial assistance to Qatari nationals.

How to Withdraw Money from PayPal in Qatar without a Bank account

To withdraw money from PayPal without bank in Qatar, you can use Payoneer and below are steps you can use to do it;

Here are the general steps to withdraw money from PayPal using Payoneer in Qatar:

1. Sign Up for Payoneer:

If you don’t have a Payoneer account, sign up for one on the Payoneer website.

2. Link Payoneer to PayPal:

In your PayPal account, link your Payoneer account. This may involve providing your Payoneer bank account details.

3. Verify Your Accounts:

Follow any verification steps required by both PayPal and Payoneer to ensure that the accounts are linked successfully.

4. Withdraw Funds:

Once linked, you should be able to select Payoneer as a withdrawal method in your PayPal account.

5. Confirm Withdrawal:

Enter the amount you want to withdraw and confirm the withdrawal transaction.

6. Wait for Processing:

The withdrawal process may take some time, typically 3-5 business days.

7. Check Your Payoneer Account:

After the withdrawal is processed, check your Payoneer account to ensure the funds have been received.

Note: Withdrawing money from PayPal to your Payoneer can cost you 14-16 USD

What are Alternatives to using PayPal in Doha, Qatar?

Qatar offers a range of reputable companies that provide instant money transfer services to facilitate swift and secure transactions both domestically and internationally.

Here are some of the most popular and reliable options:

1. Western Union: Western Union is a globally recognized leader in instant money transfer services, with a widespread network of locations across Qatar. Customers can send and receive funds quickly and conveniently through Western Union’s established platform.

2. MoneyGram: MoneyGram is another well-known provider of instant money transfer services in Qatar. With numerous agent locations throughout the country, MoneyGram offers reliable and efficient money transfer solutions to customers.

3. Xpress Money: Xpress Money is a trusted global money transfer company that operates in Qatar, offering fast and secure transfer services to various destinations worldwide. Their services are known for their speed, reliability, and competitive exchange rates.

4. Al Fardan Exchange: Al Fardan Exchange is a reputable exchange house in Qatar, providing instant money transfer services to numerous destinations across the globe. With a focus on customer satisfaction and security, Al Fardan Exchange is a popular choice for individuals needing to send or receive money quickly.

5. UAE Exchange: UAE Exchange is another prominent player in the money transfer industry in Qatar, offering convenient and efficient transfer services to customers. With a strong presence in the region, UAE Exchange provides reliable solutions for both domestic and international money transfers.

6. Wise: Wise is a UK-based foreign exchange financial technology company which specializes in cross-border payment transfers.

These companies offer various options for sending and receiving funds, including cash pickup, bank transfers, and mobile wallet transfers, catering to the diverse needs of customers in Qatar. Additionally, they prioritize security and customer satisfaction, ensuring that transactions are processed swiftly and securely.

Click here to view up-to 12 alternatives to PayPal in Jordan

Can I link a Qatar bank account with PayPal?

Yes, you can link your Qatari debit or credit card to your PayPal account for making payments and purchases. However, it’s essential to ensure that your card is eligible for online transactions and compatible with PayPal’s requirements.

Can I receive payments in different currencies with PayPal in Qatar?

Yes, PayPal supports transactions in multiple currencies, allowing users in Qatar to send and receive payments in various currencies. However, currency conversion fees may apply when converting funds between different currencies.

Can I use PayPal for online shopping in Qatar?

Yes, PayPal can be used for online shopping in Qatar. Many online retailers accept PayPal as a payment method, allowing users to make purchases securely without sharing their financial information.

How long does a PayPal payment take to show up in my bank account in Qatar?

The time it takes for a PayPal payment to show up in your bank account can vary based on several factors, including the type of transfer, your location, and your bank’s processing times. Here are some general guidelines:

1. Standard Bank Transfer (Withdrawal):

– Standard transfers from your PayPal account to your bank typically take 3 to 5 business days to process. This duration may vary based on weekends, holidays, and your bank’s processing times.

2. Instant Transfer (if available):

– PayPal offers an Instant Transfer option in some regions, allowing you to move funds to your linked bank account almost immediately for a fee. This is faster than the standard transfer option though a percentage might be charge like 1% or lower

3. eChecks or Unconfirmed Payments:

– If the payment you received is through an eCheck or is unconfirmed, it may take several days for the funds to clear. PayPal waits for the eCheck to be cleared by the sender’s bank before making the funds available to you.

4. Business Days vs. Weekends/Holidays:

– Business days (Monday to Friday) are typically considered when estimating transfer times. If you initiate a transfer on a weekend or during a holiday, the processing may start on the next business day.

5. Bank Processing Times:

The speed of the transfer also depends on how quickly your bank processes incoming payments. Some banks may credit your account faster than others.

It’s essential to note that PayPal provides estimated arrival times for transfers, but these are not guarantees. Delays can occur due to various reasons, including technical issues, verification processes, or unexpected circumstances.

To get the most accurate and up-to-date information about your specific transfer, you can log in to your PayPal account, go to your transaction history, and check the details of the transfer. Additionally, your bank statement will reflect the deposit when the funds are available in your bank account.

What are the withdrawal options for PayPal in Qatar?

In Qatar, PayPal users can typically withdraw funds to their linked QNB bank account. This can be done through the QNB Internet Banking Portal system

Can I use PayPal for international transactions from Qatar?

Yes, PayPal allows users in Qatar to send and receive payments internationally. Whether you’re conducting business transactions, sending money to family or friends abroad, or making purchases from international vendors, PayPal offers a convenient and secure platform for cross-border transactions.

Are there any limits on the amount of money I can send or receive through PayPal in Qatar?

PayPal may impose certain limits on the amount of money you can send, receive, or withdraw from your account, depending on factors such as your account status, verification level, and transaction history. These limits are in place to help prevent fraud and ensure compliance with regulatory requirements. You can view your account limits by logging into your PayPal account and reviewing your account settings.

Can I use PayPal for business transactions in Qatar?

Yes, PayPal offers business accounts tailored to the needs of merchants and businesses in Qatar. Business accounts come with additional features and tools designed to facilitate online sales, manage invoices, accept payments on websites or mobile apps, and more. Business owners can sign up for a PayPal Business account to access these features and expand their reach to customers locally and globally.

If you need integration on eCommerce or Apps, you can contact us for integration, webvator.com designs websites and Applications. we have a very good team knowledgeable in integrating different payment gateways on websites

How secure is PayPal for transactions in Qatar?

PayPal employs advanced security measures to protect users’ personal and financial information and ensure the security of transactions conducted through its platform. These measures include encryption, fraud detection, buyer and seller protection programs, and two-factor authentication.

Additionally, PayPal is subject to regulatory oversight and compliance requirements to safeguard users’ interests and maintain the integrity of its services

Can I use PayPal for recurring payments or subscriptions in Qatar?

Yes, PayPal offers features for setting up recurring payments, subscriptions, and automated billing arrangements for businesses and customers in Qatar. This feature is particularly useful for subscription-based services, membership fees, monthly donations, and other recurring expenses. Users can authorize automatic payments from their PayPal account on a scheduled basis, providing convenience and flexibility for both parties involved.

If this article has helped you in any way, leave us a comment below, you can also checkout and subscribe on our YouTube channel; http://www.youtube.com/webvator . You can read more about how to create PayPal account in Uganda