On this page, we will show you how to create Namibia PayPal account which can receive and send. Yes, account which can receive. I know most of you have tried to create accounts but they can only send and this is because Namibia like many other African countries, it can only send.

The good news is having by enabling Paypal “Pay and Get Paid feature” in your Namibia Paypal Account, you can receive. PayPal’s “Pay and Get Paid” feature enables users to send payments and receive money from anywhere in the world, offering both flexibility and security. It’s used for personal, business, and international transactions, making it an ideal tool for both casual and professional users.

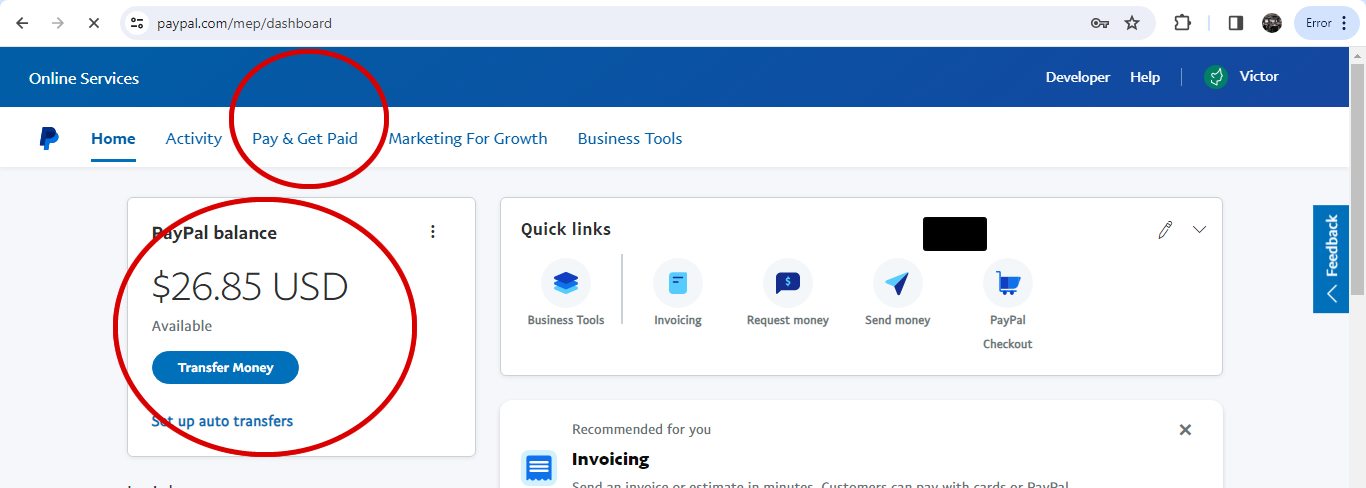

When the Namibia receiving Paypal account is set up successfully , its dashboard has to show two core things as shown below. PayPal Available balance section and “Pay and get paid” on menu. By default account balance is 0.00 USD

Feel free to contact us to assist you setup one: business@webvator.com

About the PayPal “Pay and get paid feature”

Sending Money (Pay)

With the “Pay” feature, PayPal users can send money to others for various reasons:

- Personal Transactions: You can send money to friends or family using their email address or mobile number, either from your PayPal balance, linked bank account, or credit/debit card.

- Business Payments: PayPal allows users to pay for goods and services securely from businesses online or in-store.

- International Transfers: You can send money internationally to users in different countries, with PayPal handling the currency conversion. Fees might apply depending on the region and payment method.

Receiving Money (Get Paid)

With the “Get Paid” feature, users can receive money from others for personal or business transactions:

- Personal Transfers: Individuals can send you money through PayPal using your email or phone number, making it easy to receive funds.

- Business Payments: If you run a business, PayPal enables you to accept payments online through websites, invoices, or links.

- PayPal Invoices: You can create and send professional invoices directly through PayPal to request payments from clients.

- PayPal.me: This is a personalized link you can share with others to receive payments quickly and easily.

- International Receipts: PayPal also makes it easy to get paid from abroad, supporting multiple currencies.

Paypal Use Cases in Namibia

- Freelancers: Receive payments from international clients or pay for software and services.

- Ecommerce Businesses: Accept payments from customers worldwide.

- Individuals: Send or receive money from friends and family easily.

- Online Shopping: Make payments for goods and services on e-commerce platforms like eBay, Etsy, or Shopify.

- Subscription Services: Pay for recurring subscriptions like Netflix, Spotify, or Adobe Creative Cloud using PayPal.

- Donations to Charities: Easily send money to non-profit organizations and charities through PayPal’s donation feature.

- Crowdfunding: Receive contributions for personal projects or causes on platforms like GoFundMe or Kickstarter.

- Digital Products: Sell and receive payments for eBooks, courses, software, and other digital downloads.

- Event Ticket Sales: Pay for and receive payments for event tickets, whether it’s a concert, seminar, or webinar.

- Freelance Marketplace Payments: Use PayPal to receive payments from platforms like Upwork, Fiverr, and Freelancer.

- Social Media Sales: Receive payments for items sold through platforms like Instagram, Facebook Marketplace, or WhatsApp.

- Withdraw from TikTok in Namibia: You can use this PayPal to withdraw from TikTok.

- Payment for Services: Pay for professional services like web design, consulting, or graphic design.

- Group Gifts: Collect money from friends or family for group gifts, holidays, or events like weddings or birthdays.

- Loan Repayments: Send or receive personal loan repayments between friends and family members.

- International Education Fees: Pay for or receive payments for international school tuition, books, or other academic expenses.

- Mobile App Purchases: Pay for in-app purchases on mobile apps that accept PayPal as a payment method.

- Marketplace Rentals: Pay or receive funds for equipment, property, or vehicle rentals through peer-to-peer marketplaces.

How to withdraw Money from PayPal to Namibia Banks

Withdrawing funds from PayPal to a Namibia bank card is a convenient way to access your PayPal balance, especially if your local bank supports it. When a PayPal account is created with Pay and get get feature, you can easily withdraw to your Namibia Bank account.

Here’s a step-by-step guide on how to withdraw funds from PayPal to your bank card:

1. Link Your Bank Card to PayPal

Before you can withdraw money to your bank card, you need to ensure that your card is linked to your PayPal account. PayPal typically allows withdrawals to Visa and some Mastercard debit or credit cards.

- Steps to Link a Card:

- Log in to your PayPal account.

- Go to the Wallet section.

- Click on Link a card.

- Enter your card details (card number, expiration date, CVV, etc.).

- PayPal may charge a small verification fee (usually refunded later) to confirm the card.

2. Initiate a Withdrawal

Once your card is linked and verified, you can begin the withdrawal process.

- Steps to Withdraw:

- Log in to your PayPal account.

- Go to the Wallet section.

- Select the Transfer Funds option.

- Choose Withdraw to your card.

- Select the linked card you want to withdraw to.

- Enter the amount you wish to withdraw from your PayPal balance.

- Confirm the transaction.

3. Processing Time

- Instant Transfer: PayPal offers an “Instant Transfer” option to Visa debit or credit cards, which typically takes minutes to 30 minutes for the funds to arrive, but may charge a fee (usually around 1% of the withdrawal amount).

- Standard Transfer: The standard withdrawal may take 1 to 5 business days, depending on your bank’s processing time.

4. Fees for Card Withdrawals

- PayPal often charges a fee for withdrawing funds to a bank card. The fee may vary by region but is typically a fixed fee or a percentage of the transfer amount.

- For example, instant transfers may incur a fee of 1% of the amount, up to a certain limit.

- Standard transfers may have a lower fee or, in some cases, be free.

5. Check Your Card’s Eligibility

Not all cards are eligible for withdrawals. In most cases, Visa debit cards are widely accepted, but some Mastercards may also be eligible. You can check with PayPal or your bank to ensure your card is supported for withdrawals.

6. Check for Limits

There may be withdrawal limits depending on your PayPal account type and the card you’re withdrawing to. Ensure your account is verified to access higher limits for withdrawals.

7. Alternative Methods (if Bank Card Withdrawals Aren’t Available)

If withdrawing to a bank card is not available in your country, here are a few alternatives:

- Withdraw to a Bank Account: You can link a bank account and transfer funds directly to your account.

- Use a Virtual Card: Services like Payoneer provide virtual bank accounts and debit cards that can be linked to PayPal for withdrawals.

To withdraw PayPal funds to a Namibia bank card, ensure your Visa or eligible Mastercard is linked to your account, and follow the steps to initiate a transfer.

Banks that Accept PayPal payment in Namibia

These are the banks in Namibia you can easily use to withdraw funds from paypal with if you managed to create an account with “Pay and Get Paid” feature. If you need assistance in creating an account which can receive and send, reach us on the whatsapp (+256773168506) or send as an email business@webvator.com

1: First National Bank (FNB) South Africa: FNB South Africa offers PayPal withdrawal services, and Namibians can open an account with FNB in South Africa to take advantage of this. You can:

-

- Open an FNB South Africa account (this can be done online or physically).

- Link your PayPal account to FNB via the FNB PayPal service.

- Withdraw your PayPal funds to your FNB South Africa account, and then transfer them to a Namibian account if needed. for some citizens who created FNB accounts from south Africa, you can withdraw from PayPal to bank using this link; https://www.fnbwithdraw.com/ppaweb/

2: Bank Windhoek and Nedbank Namibia:

While these banks do not directly support PayPal, they do facilitate international transfers. Namibians can explore linking virtual bank accounts (such as Payoneer or Wise) to their PayPal accounts and then withdraw to their local banks like Bank Windhoek or Nedbank Namibia.

Other Namibia Banks that can be used on Paypal include; Standard Bank Namibia, Nedbank Namibia, Letshego Bank Namibia, Trustco Bank Namibia, Development Bank of Namibia (DBN), Agribank (Agricultural Bank of Namibia).

Alternative Methods to Access PayPal Funds in Namibia

- Payoneer:

- Payoneer provides a virtual US bank account that can be linked to PayPal. Namibians can:

- Sign up for a Payoneer account and receive virtual banking details.

- Link Payoneer to PayPal for withdrawals.

- Transfer funds from Payoneer to Namibian banks (using international wire transfers) or withdraw from ATMs using a Payoneer Mastercard.

- Payoneer provides a virtual US bank account that can be linked to PayPal. Namibians can:

- Wise (formerly TransferWise):

- Wise offers multi-currency accounts that can receive PayPal payments. Once you’ve withdrawn your PayPal balance to Wise, you can transfer it to a Namibian bank account at competitive exchange rates.

- Friends or Family in Supported Countries:

- If you have trusted contacts in countries where PayPal fully operates (e.g., South Africa), you can send them the funds via PayPal, and they can help you transfer the money back to your Namibian bank account through a direct bank transfer or other means.

For other options on how to withdraw money from Paypal to Namibia, click here

How to get this Namibia PayPal account with “Pay and Get paid” feature?

Setting up a PayPal account in Namibia that has the “Pay and Get Paid” feature can be challenging due to the strict documentation requirements PayPal imposes. While creating a PayPal account is relatively straightforward, the real difficulty lies in submitting the necessary documents that allow you to receive payments.

We simplify the process for you by handling everything needed to unlock the full “Pay and Get Paid” feature. Here’s how it works:

- Provide Your Details: You will send us the name, email, and telephone number that you wish to use for your PayPal account.

- We Handle the Setup: Using this information, we take care of the rest. This involves generating and submitting the required documents that PayPal requests during the setup process. These documents are crucial for PayPal to verify your account for receiving payments.

- Quick Turnaround Time: The entire process typically takes between 1 to 4 hours. Once we’ve set everything up, we will send you the login details.

- Security and Control: Upon receiving your PayPal credentials, we strongly advise you to immediately change the password to ensure your account’s security.

- Start Using PayPal: Once your account is set up, you can start enjoying all the benefits PayPal offers, including the ability to both send and receive payments seamlessly.

By entrusting us with the setup, you bypass the complications and ensure your Namibia PayPal account is fully functional with the “Pay and Get Paid” feature, allowing you to receive payments globally without hassle.

If you be interested also in How to Use PayPal For Donation in Namibia with or without Bank, click here

Do we charge for our work?

Yes, We charge a small fee for consultancy services

Receiving Funds into your Namibia PayPal: