Receiving payments online has become essential for businesses, freelancers, and entrepreneurs worldwide. PayPal is one of the most popular payment platforms, but what if you don’t have or don’t want a PayPal account? Fortunately, there are ways to accept PayPal payments without directly having an account, and one of the most efficient methods is through Paddle.

This guide explains how Paddle works and how you can set it up to receive payments without needing a PayPal account.

Why Avoid a PayPal Account?

Before diving into the solution, let’s consider why someone might prefer not to have a PayPal account:

- Country Restrictions: PayPal is not available in certain countries, and creating an account might not be straightforward.

- Complex Verification Processes: Verifying a PayPal account can sometimes be challenging due to the need for linking specific bank accounts or credit cards.

- Fees: PayPal’s transaction fees might not align with your business or personal financial goals.

- Preferences: Some users might simply prefer other platforms or wish to avoid PayPal due to policy concerns.

Introducing Paddle

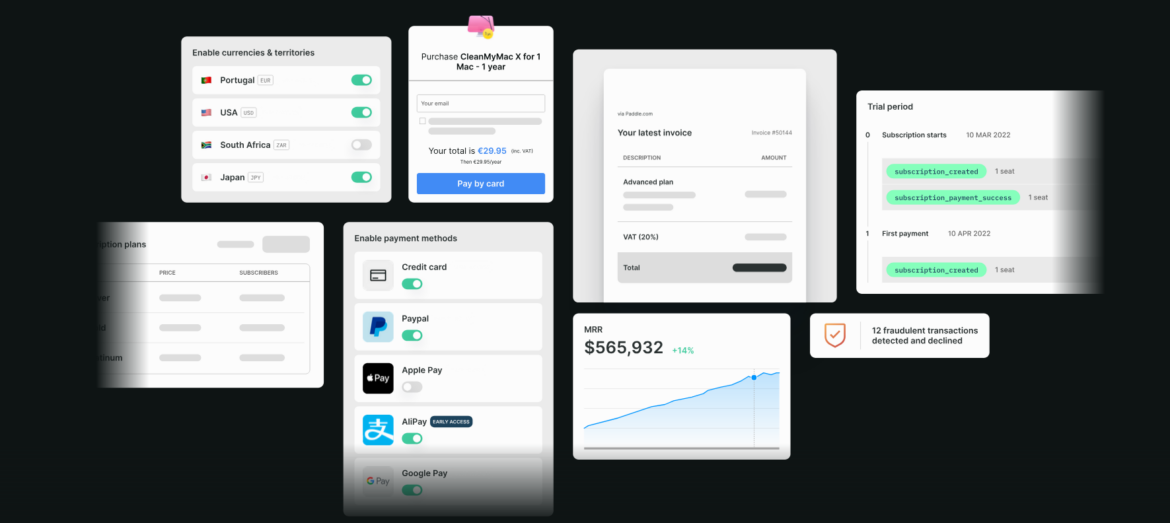

Paddle is a comprehensive payment processing platform designed primarily for software and SaaS (Software as a Service) businesses. What makes Paddle unique is its ability to handle all aspects of payment processing, including PayPal transactions, without requiring you to create a PayPal account.

How Paddle Works

Paddle acts as the Merchant of Record (MoR) for your transactions. This means:

- Paddle manages the entire payment process, including handling taxes, compliance, and fraud protection.

- Customers can pay through various options, including credit/debit cards, bank transfers, and PayPal.

- You only need a Paddle account, not a PayPal account, to receive payments from customers choosing PayPal.

READ ALSO;

👉 Make Passive Income in Uganda Through Affiliate Marketing

👉 Make Passive Income in South Africa Through Affiliate Marketing | How to make money online

👉 How to Become an Amazon Affiliate in South Africa Online

Steps to Receive PayPal Payments Through Paddle

1. Sign Up for a Paddle Account

To get started, create an account on Paddle’s platform:

- Visit the official website: Paddle.com.

- Click on the “Sign Up” button and fill out the required information.

- Complete any necessary verifications and set up your account.

2. Set Up Your Payment Options

After creating your account, configure your payment settings:

- Navigate to the Payment Settings section.

- Ensure that PayPal is enabled as a payment option. Paddle automatically integrates PayPal into its system, allowing your customers to choose it during checkout.

3. Integrate Paddle with Your Website or Platform

Paddle offers various integration options to suit different needs:

- Checkout Links: Generate simple payment links for your products or services.

- APIs: Use Paddle’s API for seamless integration into your custom website or app.

- Plugins: If you’re using platforms like WordPress, Shopify, or WooCommerce, Paddle offers easy-to-install plugins.

4. Share the Payment Link

Once your integration is set up:

- Share the payment link with your clients or customers.

- During checkout, customers can select PayPal as their preferred payment method.

5. Receive Your Payments

Paddle collects the payment from the customer, handles the PayPal transaction, and transfers the funds to your Paddle account. From there, you can withdraw the money to your bank account or other payment options supported by Paddle.

Advantages of Using Paddle Over PayPal

- Global Reach: Paddle supports payments in multiple currencies and offers diverse payment options, making it ideal for international transactions.

- Tax Compliance: Paddle manages tax calculations and remittance, helping you stay compliant with local regulations.

- Unified Dashboard: View all transactions, analytics, and payout details in a single interface.

- Simplified Process: Customers can pay via PayPal, but you don’t need to deal with the complexities of maintaining a PayPal account.

Alternative Methods to Receive Payments Without a PayPal Account

While Paddle is an excellent solution, other platforms also allow you to receive PayPal payments indirectly:

- Payoneer

- Some platforms, like Fiverr or Upwork, offer Payoneer as a payout option for earnings collected via PayPal.

- Stripe

- Stripe allows businesses to accept payments, including PayPal, via third-party integrations like PayPal for Stripe.

- Third-Party Marketplaces

- Platforms like Gumroad or Selz enable customers to pay with PayPal, even if the seller doesn’t have a PayPal account.

Final Thoughts

Receiving PayPal payments without a PayPal account is not only possible but can be highly efficient with the right tools like Paddle. This approach is particularly beneficial for individuals and businesses in countries where PayPal has restrictions or for those who prefer not to deal with PayPal directly.

By leveraging Paddle, you can expand your payment options, reach a broader audience, and simplify the process of receiving online payments.

So, whether you’re a freelancer, small business owner, or SaaS entrepreneur, consider Paddle to streamline your payment processes and eliminate the need for a PayPal account entirely.

Have you tried Paddle or another method to accept PayPal payments without an account? Share your experiences in the comments below!