Setting Up Cash App in Uganda: A Guide for Ugandans from webvator

Introduction:

In the ever-evolving world of online transactions, navigating the challenges of sending and receiving payments, especially in Uganda, can be a daunting task. Today, we aim to explore the possibilities of setting up a Cash App account in Uganda, a country not currently supported by this popular mobile banking application.

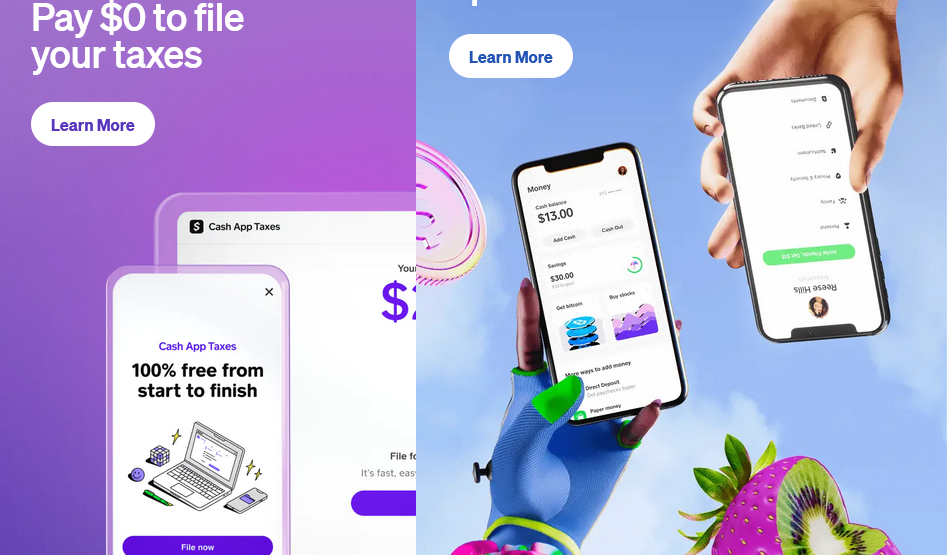

Understanding Cash App:

Cash App, distinct from its counterpart CashApp, is a widely used mobile banking app in the United States. Renowned for its ease of use, speed, and security, Cash App has gained popularity globally, particularly among freelancers seeking a convenient platform for sending, receiving, and spending funds. It even allows users to invest in cryptocurrency, setting it apart from traditional options like PayPal.

Key Functions of Cash App:

Cash App serves various purposes, making it a versatile tool for financial transactions. Users can send, receive, and spend money effortlessly. Additionally, the app enables users to invest and even purchase cryptocurrency directly from their Cash App accounts, offering a range of financial services in one platform.

Downloading and Installing Cash App in Uganda:

While Cash App is not officially available in Uganda, there are ways to access it. By using a VPN to mimic a United States location, users can download the app from the official website (https://cash.app/). It’s crucial to avoid searching for “Cash App” directly on app stores, as this may lead to misleading or unrelated applications.

If your to search for it in Play store, Look out for Cash app by Square, Inc, Category: Finance.

Avoid being scammed while trying to get a Verified Cash App in Uganda

Desperation to access Cash App in Uganda might make individuals susceptible to scams. It’s essential to exercise caution, as scammers often pose as helpers in setting up Cash App accounts. Verifying the online presence of those offering assistance, checking reviews, or visiting individuals with actual office scan help, Webvator office is on Cornerstone Plaza, RM: MP-76 near Usafi Taxi Park, Avoid people who meet you outside out offices

Cash App as a Reliable International Payment Method in Uganda:

Despite not being officially supported in Uganda, Cash App has become increasingly popular for international transactions. Many individuals and businesses prefer Cash App over other options, such as PayPal, citing reliability and ease of use. However, obtaining a fully functional Cash App account in Uganda may come with a cost ranging from 200,000 to 400,000/= Uganda shillings

List of some countries not supported by Cash App at the moment.

Cash App is actively working to expand its global presence, yet as of the time of composing this article, several countries, including but not limited to Uganda , continue to face the challenge of not being supported by Cash App. The list of such countries includes Namibia, Algeria, Nigeria, Kenya, South Africa, Ghana, Kenya, Togo, Rwanda, Iceland, Morocco, UAE, Lesotho, Portugal, germany and several others.

How do I set up Cash App in Uganda and other Non-Supported Countries:

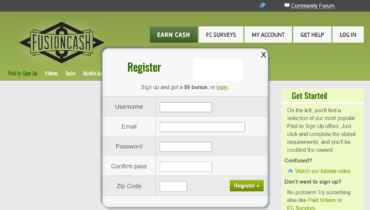

1. Download and Create Account:

– Use a VPN with a United States location.

– Download the Cash App from the official website.

– Sign up using either a phone number or email address.

2. Account Verification:

– Cash App places limits on unverified accounts.

– Verification requires personal details, including name, date of birth, and address.

– A real US-based debit card is needed to lift transaction limits.

3. Bitcoin Withdrawal:

– Non-US residents can’t link local cards; hence, Bitcoin withdrawal is an alternative.

– Withdrawal limits via Bitcoin are $2,000 per day and $5,000 per week.

4. Account Verification Alternatives:

– Verifying Cash App for non-US citizens can be challenging.

– Seeking help from a trusted individual in the United States or exploring verified Cash App account services may be an option.

Understanding Cash App Transaction Limits:

When you create a Cash App account, it is automatically set up without full verification, resulting in certain transaction limits imposed by Cash App for security reasons. These limits remain in place until your account undergoes the verification process.

Here’s a breakdown of the initial transaction limits on Cash App:

- Sending Limit: Initially, you can send up to £250 within any given 7-day period.

- Receiving Limit: Similarly, the receiving limit is set at £500 within any 7-day period.

If you attempt to send or receive amounts exceeding these limits, Cash App will prompt you to complete the verification process. Verification involves providing your full name, date of birth, and address to enhance the security of your Cash App account.

Even without additional verification, you can continue to use Cash App within the initial limits, allowing you to send £250 and receive up to £500 within any 7-day period for free.

It’s important to note that Bitcoin withdrawal is restricted unless your Cash App account is fully verified. The verification process not only ensures compliance with security standards but also opens up the possibility of withdrawing funds, making it a crucial step in maximizing the functionality of your Cash App account.

Ultimately, while receiving payments is essential, the ability to withdraw those earnings adds a crucial layer of utility to your Cash App experience. Therefore, understanding and completing the verification process becomes paramount for users looking to make the most of their Cash App transactions.

Withdrawing Funds from Cash App in Uganda and Non-Supported Countries:

In regions like Uganda, where Cash App is not officially supported, the process of withdrawing funds involves alternative methods, particularly Bitcoin withdrawal, as adding a local card is limited to US-based cards.

Here’s a step-by-step guide on how to withdraw funds from Cash App in Uganda and similar non-supported countries:

- Bitcoin Withdrawal:

- As a workaround for users in non-supported countries, Bitcoin withdrawal is a viable alternative.

- This method allows users to withdraw up to $2,000 per day and $5,000 per week as the threshold limit for Cash App Bitcoin withdrawal.

- US-Based Card Cashout:

- For those using a US-based card with Cash App, higher withdrawal limits are possible, reaching up to $25,000 per week.

- Verification Process:

- Before initiating a Bitcoin withdrawal, Cash App will prompt users to provide certain details for verification.

- Pay careful attention to the verification process, especially in the following areas:

- Photo ID: Acceptable forms include a driver’s license, international passport, or work ID.

- Scanning Documents: Ensure clear and accurate scans or snaps of your ID are submitted, as Cash App is sensitive to the quality of the provided information.

- Phone Number: During verification, you’ll be asked to provide a phone number. Virtual numbers can be obtained online, and services like “NextPlus” may be useful.

- Social Security Number (SSN): This is a crucial piece of information that Cash App may request during the verification process.

- Caution and Accuracy:

- Exercise caution and accuracy when providing details during the verification process, as this is a critical step in lifting account limits.

- Be mindful of the sensitivity of the information you share and ensure that all required details are provided correctly.

By following these steps and providing accurate information during the verification process, Ugandans can navigate the challenges and access the full functionality of their Cash App accounts, including the ability to withdraw funds through Bitcoin or, for those with US-based cards, higher cashout limits.

Alternative Methods for Cash App Verification:

Verifying Cash App accounts for non-US citizens can be challenging, but there are alternatives to ease the process. If you encounter difficulties, consider the following options:

1. Contact Us for Assistance:

– If you find the Cash App verification process challenging, don’t hesitate to reach out to us for assistance.

– We can provide guidance and support regarding the verification requirements and steps, making the process more manageable for non-US citizens.

2. Open Cash App Account with a Trusted Contact in the United States:

– If you have a trustworthy contact in the United States, you can request their assistance in opening a Cash App account.

– Ask them to use their details during the registration process, and afterward, collect their ID and documents for verification purposes to ensure alignment with the provided details.

3. Buy Verified Cash App Account in Uganda

– For those looking to bypass the stress of verification entirely, the option to buy a verified Cash App account is available.

– If you choose this route, let us know, and we can offer advice on finding a reliable source or guide you on selecting a trustworthy person in your country who can assist with the process.

These alternative methods aim to provide solutions for non-US citizens facing challenges with Cash App verification. Whether seeking guidance, leveraging the assistance of a trusted contact in the United States, or exploring the option to purchase a verified account, there are avenues to navigate the verification process more smoothly.

Conclusion:

While Cash App is not officially supported in Uganda , resourceful individuals can navigate the challenges and set up accounts using the outlined steps. It’s crucial to remain vigilant, avoid scams, and understand the verification processes to fully utilize the benefits of Cash App in Uganda, Cash App in Tanzania, Cash App in Rwanda, Cash App in Kenya, Cash App in Namibia, Cash App in Algeria,…

I will like to use the account to receive money from games

Hi Samuel, can u send me a whatsapp message on +256773168506