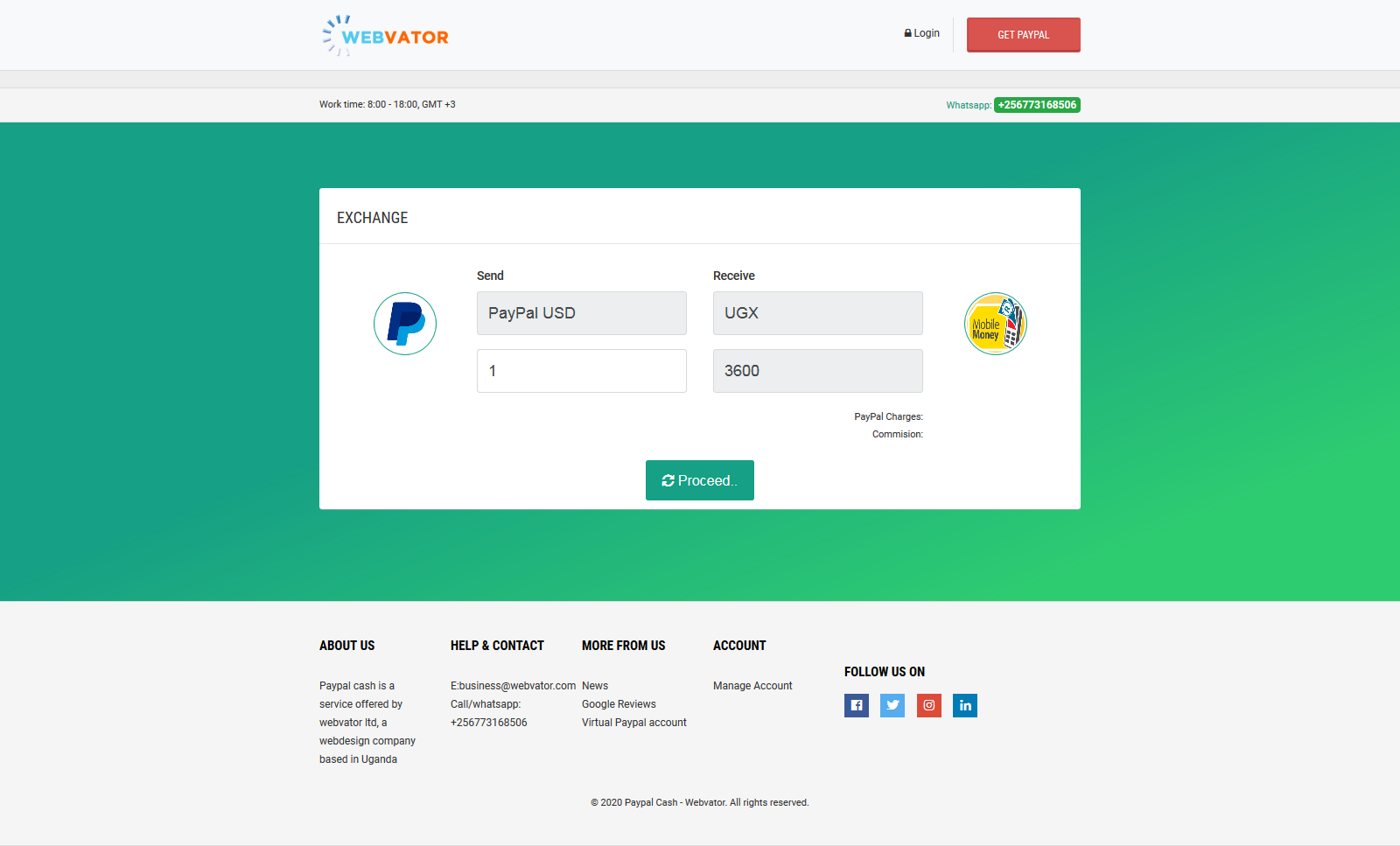

The only two ways to pay on Amazon website using PayPal Amazon does not accept PayPal payments directly, which can be inconvenient for users who prefer this widely used payment method. However, there are two reliable ways to use PayPal for your Amazon purchases. Let’s explore these options in detail and understand why Amazon doesn’t support PayPal directly. Option 1: Use a PayPal Debit/Mastercard Card The simplest way to use PayPal on Amazon is by obtaining a PayPal Business Debit…

How to Pay on Amazon with PayPal