Unlocking PayPal’s Sending and Receiving Capabilities in Jordan

Let’s delve into the current state of PayPal in Jordan. If you’re considering using PayPal in Jordan, whether it’s for receiving payments from overseas employees, TikTok cashouts, or any other purpose, this article aims to provide you with comprehensive insights into the world of PayPal in Jordan.

Learn how to set up your account, seamlessly receive payments, and efficiently withdraw funds to your Jordanian bank account. Explore the step-by-step process and gain a clear understanding of navigating PayPal for your financial needs in Jordan.

Jordanians ( أردنيون) opt for PayPal for its unparalleled ease of use. The simplicity lies in the straightforward sign-up process – all you need is an email address and a password to initiate transactions. With a PayPal account, you gain the flexibility to make payments on various online platforms worldwide.

Discover how to create a PayPal account in Jordan that empowers you to effortlessly receive and withdraw funds to your bank. Many Jordanians encounter difficulties when it comes to withdrawing money from PayPal, but we’re here to guide you on overcoming these challenges. Learn the essential steps to establish your PayPal account and navigate the withdrawal process seamlessly, ensuring a smooth and effective financial experience tailored to the Jordanian context.

How To Create a PayPal Account in Jordan which can receive and withdraw to bank:

Follow these steps:

1. Visit the Jordan Official PayPal Website:

Go to the official PayPal website by typing “https://www.paypal.com/jo/” into your web browser.

2. Click on “Sign Up:

Look for the “Sign Up” or “Create Account” button on the PayPal homepage and click on it.

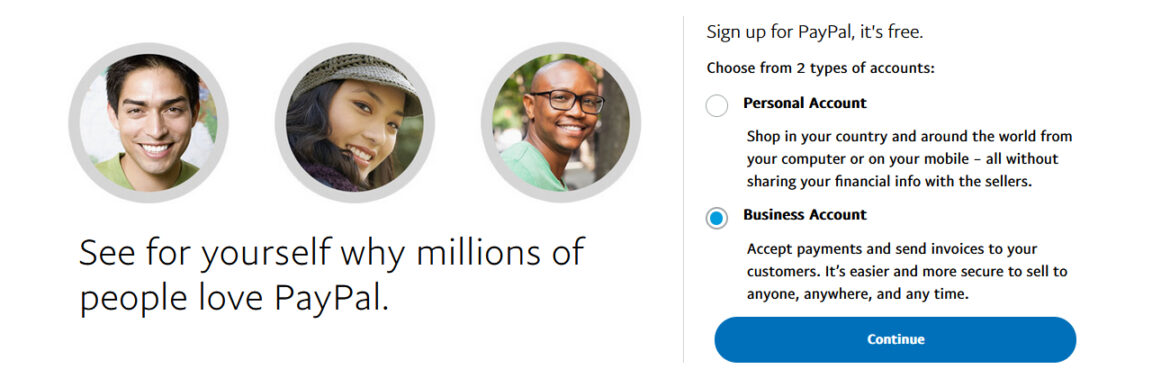

3. Choose Account Type:(Important)

Select Business instead of personal if you want to be withdrawing money from PayPal to Arab Bank in Jordan . If you choose personal account type, you will have issues withdrawing money to your Bank unless you use USA bank account which not everyone has access. Personal is OK if your going to be sending payments mainly can obtain a bank account abroad. Otherwise stick to business account setup to easily withdraw.

PayPal typically offers options for personal and business accounts.

So Select the Business type to continue

Note: When you reach part where you have to choose Type of business you own, choose individual/Sole Proprietor if you don’t have a legally registered business, don’t choose limited company when you don’t own one and also on part of business name, enter your full names as business name

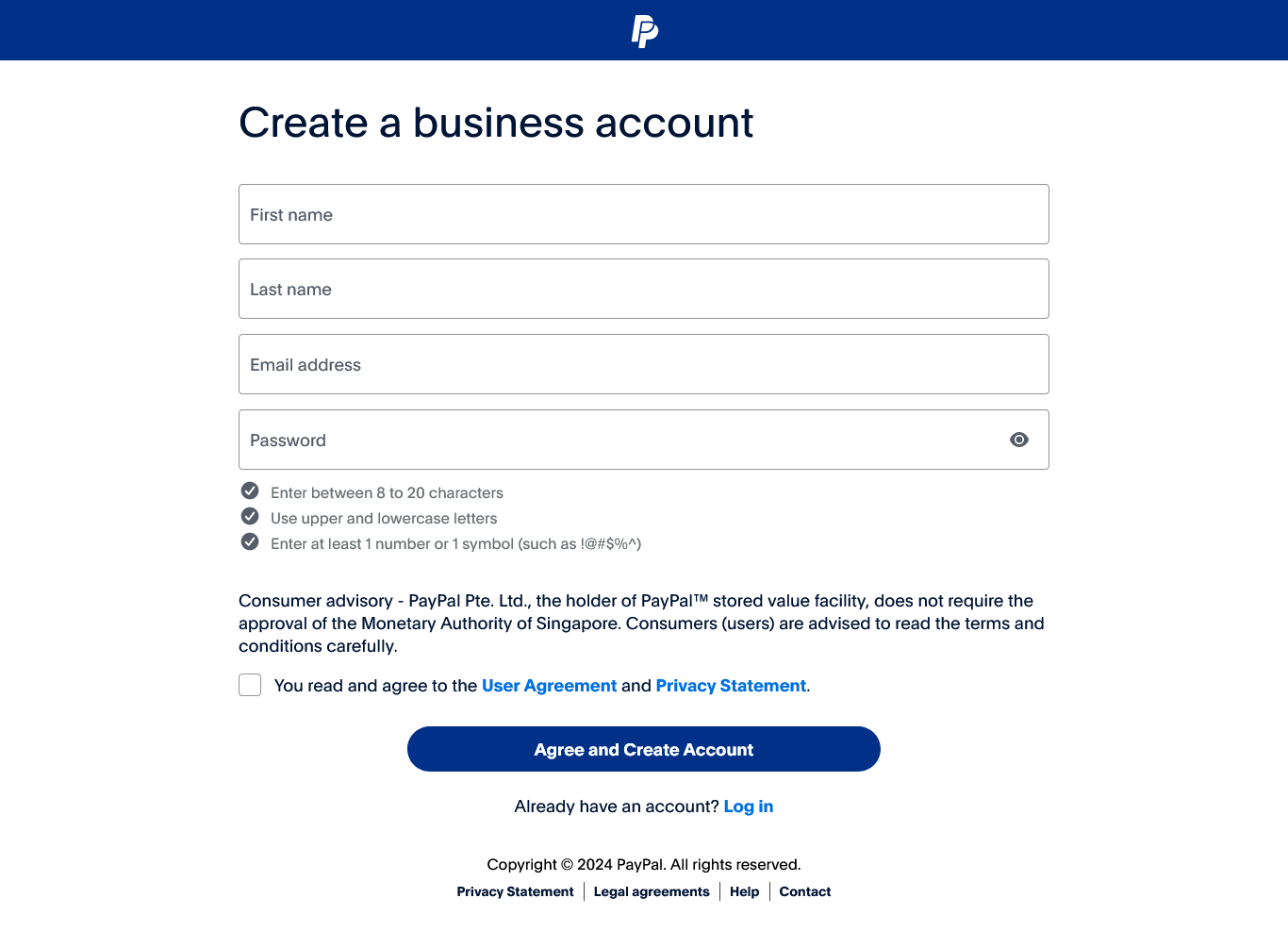

4. Provide Email Address:

Enter a valid email address that you want to associate with your PayPal account. This will also serve as your username for logging in.

5. Create a Password:

Choose a strong and secure password for your PayPal account. It should include a mix of uppercase and lowercase letters, numbers, and special characters.

6. Fill in Personal Information:

Complete the required fields with your personal information, including your name, address, and phone number.

7. Verify Your Email:

7. Verify Your Email:

– PayPal will send a verification email to the address you provided. Check your email inbox and follow the instructions to verify your email.

8. Link a Payment Method:

To fully utilize PayPal, link a payment method, such as a credit card or bank account. This allows you to fund your PayPal transactions.

In Jordan, You can directly link your Cairo Amman bank bank account to PayPal but if using Arab Bank, this might be not possible instead request shopping card from Arab Bank, link this card to PayPal and then withdraw money to your Arab Bank card. When money is on your Card, you can then transfer it to your bank account.

9. Confirm Identity (if required):

Depending on your location and other factors, PayPal may request additional identity verification steps.

10. Complete the Setup:

Once you’ve filled in all the necessary information, your PayPal account should be set up. You can now log in and start using PayPal for online transactions.

How to withdraw money from PayPal in Jordan

To withdraw money from PayPal in Jordan, follow these general steps:

1. Link Your Bank Account:

– Ensure your PayPal account is set up and verified.

– Link your Jordanian bank account to your PayPal account. Navigate to “Wallet” in your PayPal account, click on “Link a Bank” or “Link a Card,” and follow the prompts to add your bank details.

2. Confirm Bank Account:

– PayPal may send a small amount to your bank account for verification purposes. Check your bank statement for this amount and confirm it in your PayPal account to complete the linking process.

3. Log In to Your PayPal Account:

– Visit the PayPal website and log in to your account using your credentials.

4. Navigate to Withdrawal Section:

– Locate the “Withdraw” or “Transfer” section on your PayPal dashboard.

5. Select Withdraw to Bank Account:

– Choose the option to withdraw funds to your linked bank account.

6. Enter Withdrawal Amount:

– Enter the amount you wish to withdraw.

7. Review and Confirm:

– Review the withdrawal details and confirm the transaction.

8. Wait for Processing:

– The withdrawal may take some time to process, usually a few business days.

9. Check Your Bank Account:

– Once the withdrawal is processed, check your Jordanian bank account for the credited funds.

Banking sector in Jordan

Jordan’s banking sector is characterized by a diverse mix of traditional and Islamic banking services. The Central Bank of Jordan (CBJ) plays a crucial role as the central monetary authority, overseeing and regulating banks to maintain the stability of the financial system. Major commercial banks, including Arab Bank and Cairo Amman Bank, offer a range of financial services, with a growing emphasis on digital transformation to enhance customer experiences through online and mobile banking platforms.

The presence of Islamic banking is notable, providing Sharia-compliant financial products alongside conventional offerings. The sector has embraced digital innovation, with banks investing in technology to provide convenient and secure online services. Efforts to promote financial inclusion, especially in rural areas, are evident, and mobile banking contributes to reaching previously unbanked populations. Despite facing challenges such as economic uncertainties and regulatory compliance, Jordan’s banking sector remains dynamic and responsive to evolving customer expectations in the digital age.

Foreign exchange services and remittances are significant aspects of Jordan’s banking landscape, facilitated by a sizable expatriate community. The regulatory environment, overseen by the CBJ, ensures adherence to guidelines that contribute to the sector’s integrity. Continuous adaptation to technological advancements, regulatory compliance, and economic factors are key considerations for the sector’s future resilience and growth. For the latest information, referencing official reports from the CBJ and individual banks is recommended.

Which Banks support PayPal in Jordan?

Banks in Jordan which work with PayPal transactions include:

1. Arab Bank

2. Cairo Amman Bank

3. Jordan Kuwait Bank

4. Bank of Jordan

5. Housing Bank for Trade and Finance

6. Jordan Islamic Bank

7. Standard Chartered Bank

8.CitiBank

How to Withdraw Money from PayPal with Payoneer in Jordan?

Here are the general steps to withdraw money from PayPal using Payoneer in Jordan:

1. Sign Up for Payoneer:

If you don’t have a Payoneer account, sign up for one on the Payoneer website.

2. Link Payoneer to PayPal:

In your PayPal account, link your Payoneer account. This may involve providing your Payoneer bank account details.

3. Verify Your Accounts:

Follow any verification steps required by both PayPal and Payoneer to ensure that the accounts are linked successfully.

4. Withdraw Funds:

Once linked, you should be able to select Payoneer as a withdrawal method in your PayPal account.

5. Confirm Withdrawal:

Enter the amount you want to withdraw and confirm the withdrawal transaction.

6. Wait for Processing:

The withdrawal process may take some time, typically 3-5 business days.

7. Check Your Payoneer Account:

After the withdrawal is processed, check your Payoneer account to ensure the funds have been received.

Note: Withdrawing money from PayPal to your Payoneer can cost you 14-16 USD

What are Alternatives to using PayPal in Jordan?

1. Wise

Wise is a UK-based foreign exchange financial technology company which specializes in cross-border payment transfers.

2. 2Checkout (now Verifone):

2Checkout, now part of Verifone, is a global payment platform that provides online payment processing services.

Click here to view up-to 12 alternatives to PayPal in Jordan

How can I link my Jordan bank account to PayPal?

Here’s a general guide on how you can link Jordan bank account to PayPal

1. Log In to Your PayPal Account:

– Visit the official PayPal website and log in to your existing PayPal account. If you don’t have an account, you’ll need to sign up.

2. Navigate to “Wallet” or “Banks and Cards”:

– Once logged in, find the “Wallet” section on your PayPal account. In this section, you may see options like “Banks and Cards” or similar.

3. Add a Bank Account:

– Look for the option to add a bank account. This typically involves entering the required details, including your bank account number, branch details, and other relevant information.

4. Confirm Bank Account:

– PayPal may require you to confirm your bank account to ensure its validity. This often involves a small deposit or withdrawal that you’ll need to verify later.

5. Complete Verification Process:

– Check your bank statement for the small transaction made by PayPal. Once identified, log back into your PayPal account and confirm the amount to complete the verification process.

6. Linking Successful:

– After successful verification, your Oman bank account should be linked to your PayPal account. You can now use it for various PayPal transactions, including withdrawals and payments.

7. Withdrawal to Jordan Bank:

– If you intend to withdraw funds from your PayPal account to your Jordan bank account, ensure that the linked bank account details are accurate. You can initiate a withdrawal from your PayPal account.

Note: Jordanian personal PayPal accounts cannot add a Jordanian bank, only US banks. You can use US banks for withdrawing funds out of PayPal in Jordan.

Or make sure you setup PayPal account as a Business account to be able to withdraw to Jordanian banks

For those who prefer to create USA bank accounts in Jordan to use on Personal PayPal accounts, you can go to Citibank to get one though my research shows USA accounts at CITIBank were being created for companies not individuals

Is PayPal accepted in Jordan?

Yes, PayPal is generally accepted in Jordan. Users can create PayPal accounts and use them for various online transactions, including sending and receiving money.

How do I get a PayPal account in Jordan?

To get a PayPal account in Jordan, you can follow these general steps:

- Visit the PayPal website or download the PayPal mobile app.

- Click on “Sign Up” to create a new account.

- Provide the required information, including your email address and personal details.

- Link a credit card, debit card, or bank account to your PayPal account.

- Verify your account through the confirmation email sent by PayPal.

- Once verified, your PayPal account is ready to use.

How long does a PayPal payment take to show up in my bank account in Jordan?

The time it takes for a PayPal payment to show up in your bank account can vary based on several factors, including the type of transfer, your location, and your bank’s processing times. Here are some general guidelines:

1. **Standard Bank Transfer (Withdrawal):**

– Standard transfers from your PayPal account to your bank typically take 3 to 5 business days to process. This duration may vary based on weekends, holidays, and your bank’s processing times.

2. **Instant Transfer (if available):**

– PayPal offers an Instant Transfer option in some regions, allowing you to move funds to your linked bank account almost immediately for a fee. This is faster than the standard transfer option.

3. **eChecks or Unconfirmed Payments:**

– If the payment you received is through an eCheck or is unconfirmed, it may take several days for the funds to clear. PayPal waits for the eCheck to be cleared by the sender’s bank before making the funds available to you.

4. **Business Days vs. Weekends/Holidays:**

– Business days (Monday to Friday) are typically considered when estimating transfer times. If you initiate a transfer on a weekend or during a holiday, the processing may start on the next business day.

5. **Bank Processing Times:**

– The speed of the transfer also depends on how quickly your bank processes incoming payments. Some banks may credit your account faster than others.

It’s essential to note that PayPal provides estimated arrival times for transfers, but these are not guarantees. Delays can occur due to various reasons, including technical issues, verification processes, or unexpected circumstances.

To get the most accurate and up-to-date information about your specific transfer, you can log in to your PayPal account, go to your transaction history, and check the details of the transfer. Additionally, your bank statement will reflect the deposit when the funds are available in your bank account.

Is PayPal available in Jordan?

Yes, PayPal is available in Jordan, and individuals can use it for various online transactions, including purchasing goods and services, as well as sending and receiving money.

If this article has helped you in any way, leave us a comment below, you can also checkout and subscribe on our YouTube channel; http://www.youtube.com/webvator